PNC leans into branch staff with hospitality industry roots

PNC is revving up its branch expansion plans even as customer traffic at branches industry-wide continues to decline, so the lender is prizing hospitality at its physical locations to make customers feel welcome and entice them to stay.

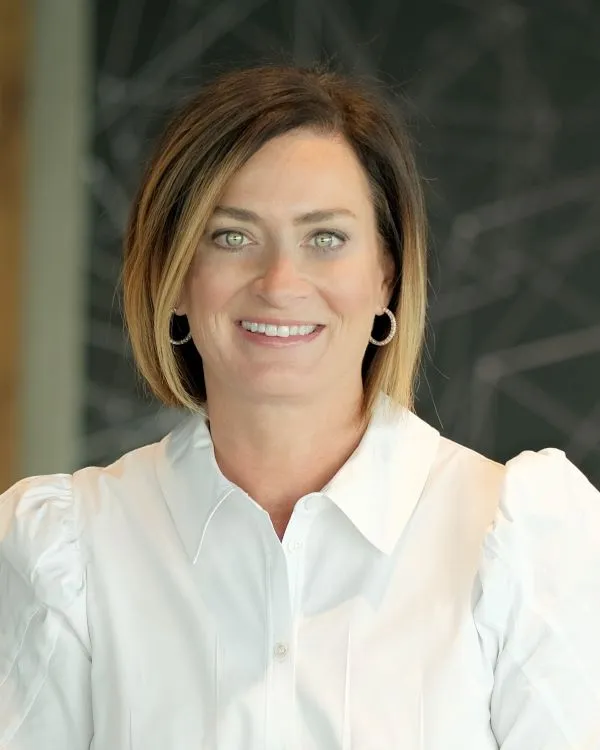

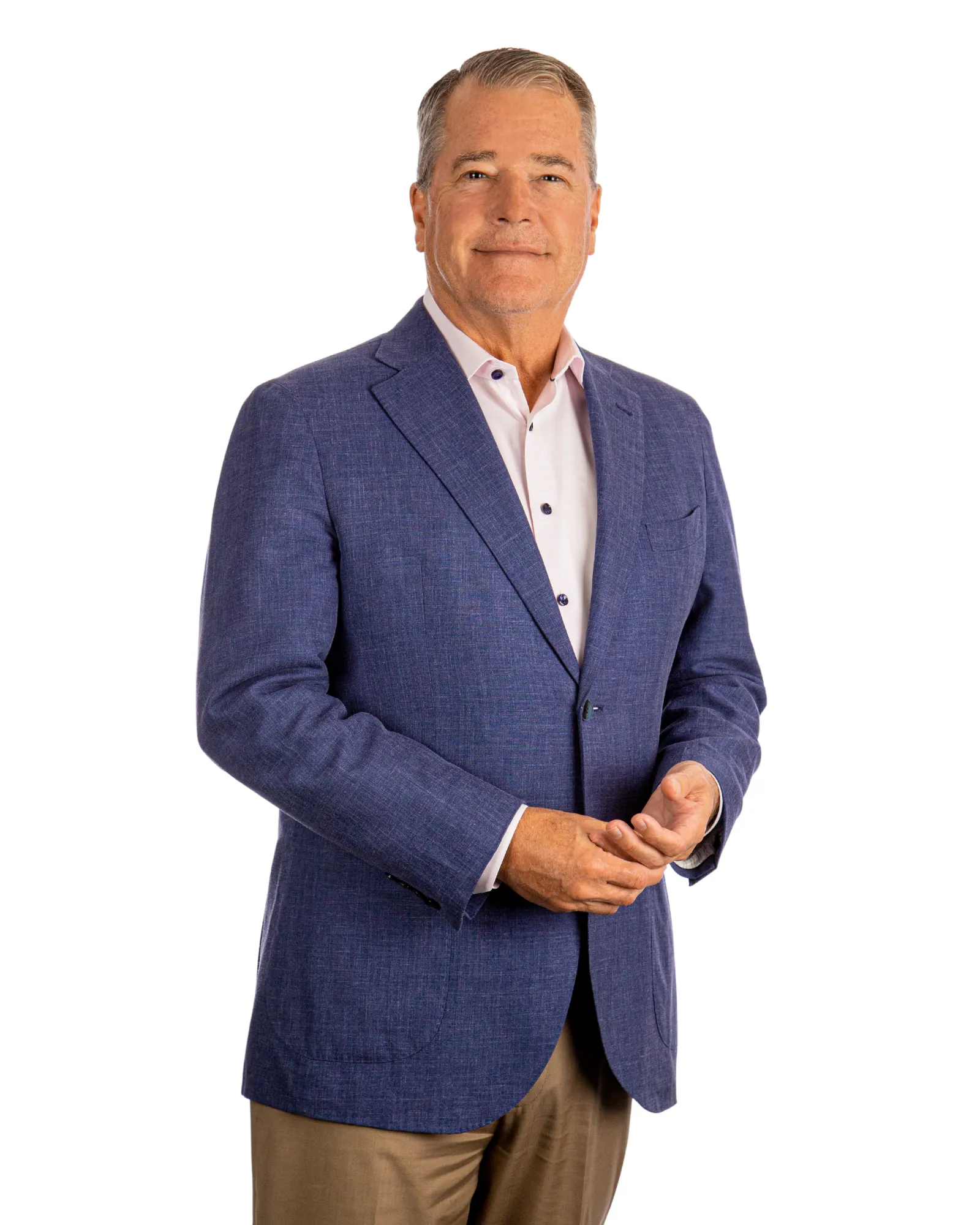

To that end, Pittsburgh-based PNC is pulling many new branch hires from the hospitality industry and finding that experience beneficial, said Jeff Martinez, an executive vice president and the super-regional’s head of branch banking. He pointed to a highly valued branch manager who had previously managed a location of the Brazilian steakhouse Fogo de Chao.

“There’s definitely a need for some industry knowledge, but it’s a mindset,” Martinez said during a recent interview. “We want people that are client advocates, that can drive the hospitable environment that we’re looking for, but also have the intellect, the curiosity to help” with banking specifics.

PNC in November said it has increased its physical expansion plans across the country, allocating an additional $500 million to open and renovate more bank branches, to bring its total investment in its retail presence to $1.5 billion. The bank plans to open about 200 new branches in 12 U.S. cities and renovate 1,400 existing branches by 2029.

“It’s a doubling down in [metropolitan statistical areas] that we’re in; it is not necessarily going to new and unknown areas,” Martinez said.

Along the way, the bank is taking what it’s learned in a market such as Miami, where it’s seen encouraging growth with households and small businesses, to inform its trajectory in Dallas or Houston, for example, he said.

PNC strives to get these markets to at least a 7% branch market share, and generate profitability from branches in four years or less, Martinez said. “If you really nurture a new build and get it right pre-opening and the first three years, you kind of understand the legacy trajectory that’ll build for five to 10 years to come,” he said.

Where other banks may be new to a market such as the Southeast, PNC is focused on growing its established presence in the region, he said. “We’re not picking a new fight,” Martinez said. “We’re finishing the fights that we’ve already picked years ago.”

Editor’s note: This interview has been edited for clarity and brevity.

BANKING DIVE: How does PNC identify the right locations for new or additional branches?

JEFF MARTINEZ: One aspect is, how do you build on an existing franchise that has incorporated growth in communities? In Atlanta, we stopped de novoing around 2012, 2014, so that’s 10 years in a major city that’s grown. The relevance that we’ve seen in existing locations, we want to make sure we keep that relevance as communities have grown a mile out.

We have a lot of data that says clients have visited PNC, even though today they reside 30 minutes, 45 minutes out from that area of convenience. Then we work to understand: What other untapped parts of the community that we are getting some from, do we believe we can get more? Also, we may be their secondary bank today, but believe we can be their primary bank tomorrow, if we are eight minutes out, instead of 30.

We also look to make sure we are in underserved communities and affluent communities. These areas we’ve identified, we plan on being there forever. So we want to make sure there’s some social mobility, that there’s an aspect in which we’re there for the mass market client as well. We’ll look at sites based on availability, but also the size and scope of the community.

PNC has closed dozens of locations this year, after shuttering more than 200 in 2023. How does the bank square these expansion plans with the pruning of its branch network?

We think we’ve done good work over the last five to seven years that has allowed us to reinvest in the network. People will try to decouple what is creating an efficient and effective network with growth. In my opinion, they go hand-in-hand. It’s a reinvestment, not a separate part.

There was a little bit of a clean-up. There were some redundancies that came from past acquisitions. Some of the biggest consolidations we’ve done were in the in-store space. That was a shift in strategy. We had about 130 branches inside a supermarket, and we knew, based on data, where customers choose to bank, where they want privacy, the in-store layout – it wasn’t what would carry us the next 10 years, although it served a purpose in the last 10.

How do these new branches look, feel and operate differently than older ones?

We’ve done a lot of work to understand what our clients want. The big theme is centered around hospitality. Even the ergonomics of the branch provide a warm welcome, such as the furniture. That initial feeling and the way we design our branches is to feel welcome immediately.

Privacy is at the center. The types of conversations our clients want to have with us – especially through big milestones in their lives, such as retirement, marriage, home ownership – require additional partners, added privacy, and we’re able to facilitate that in all of our branches. But we also have places where we can have informal conversations.

Having bankers being bankers, tellers being tellers, allows us to be really good at the interaction clients are looking for, not just a transaction. It’s an interaction, advice-centric location that feels hospitable, it feels warm. We want a place where people want to go, don’t want to rush out, and that environment is welcoming enough where they may stay for a cup of coffee and conversation, or walking through their entire investment portfolio.

There is no shortcut to really thought-out, curated and individual advice. We drive technology and resources to amplify that; we never do that in reverse. Empathy will continue to be lacking in the industry if you use just technology and not people.

What about branch size or location within a community?

Our model averages between 3,000 and 4,000 square feet. We want to be able to say, OK, we would have liked a 3,500 square foot location, but this perfect location’s 3,000 and we have the exact model that’ll still bring the functionality. What you may lose is, say, one office. A lot of it will be determined by the communities that we’re in, how we align with available properties.

It’s being where our clients want to be. Understanding client habits, we’re looking at destinations with anchor grocers, other businesses that allow us to be part of everyday life for clients. Aligning with multiple others creates an easy atmosphere that allows our clients to do banking, do some shopping, and we’re convenient for them in town.

You want to make sure there’s visibility to the brand. In Atlanta today, where we have 60, 65 branches and prepare to add another 25, as we add one more, the two and three existing branches around it see a positive halo effect in brand recognition, in convenience. It creates this added momentum, not only in those 25 de novos, because communities see we’re investing and that’ll drive affinity to existing branches.

What comes next?

As we delineate between a regional bank and a national bank, it’s filling in some of these areas we’re underserved, or underpenetrated. We’ll look at that probably two years down the road, as we start to materialize the success of this expansion and understand what’s next.

We know we lack scale in some of the areas we’ve dipped our toe in. What you’re seeing from us is an intentionality we haven’t had historically, where we were happy doing onesie, twosies broadly. Now, we’re going into market to reach optimal branch share, to drive winning market share, and we won’t move to the next priority until that’s right.