Fintechs may gain at banks’ expense in Trump era

President Donald Trump’s return to the White House this year is likely to mean opportunity and change for the fast-evolving payments industry.

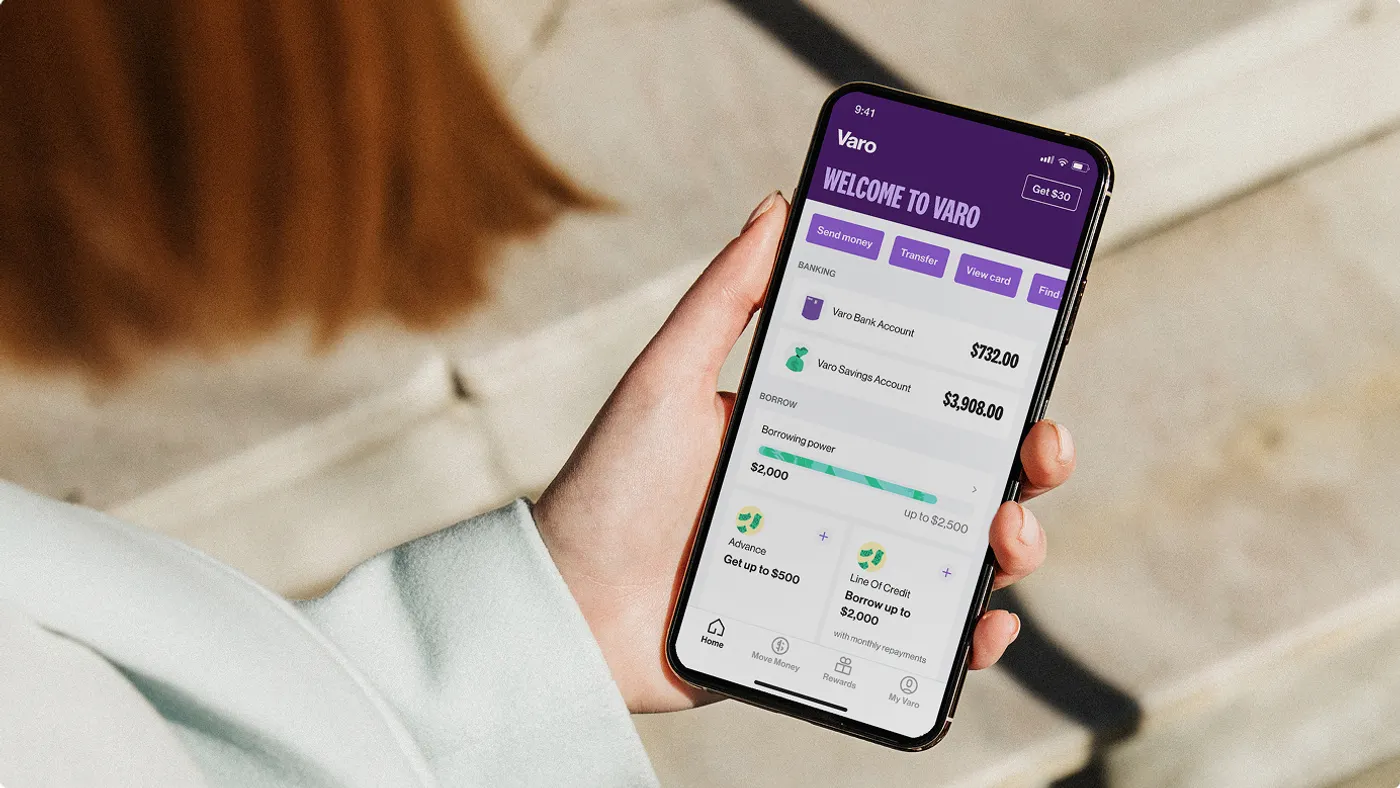

Payment fintechs, which have proliferated over the past decade, have been eagerly lobbying for regulatory leeway to offer more services, with less government friction. Trump’s administration is likely to give it to them, but that doesn’t mean there won’t be tumult and uncertainty over how the new era progresses, say lawyers who are familiar with the industry.

Fintechs have been begging for more credibility with the federal government for years, seeking to secure some of the same privileges as U.S. banks and credit unions.

National bank charter prospects

With Trump’s administration expected to be more friendly to business interests and innovation, nonbank payments players may finally see a path in pushing the Treasury Department toward creation of a special-purpose national bank charter, allowing fintechs to operate in certain areas without a bank license or partner, said Freshfields partner David Sewell.

That quest has bridged Republican and Democratic presidencies despite states’ objections, with attempts at introducing it through the Office of the Comptroller of the Currency, said Sewell, who heads Freshfields’ U.S. financial services regulatory work.

The Federal Deposit Insurance Corp.’s similar industrial loan company charters have also failed to get traction. Payments players and fintechs often must secure 50 state licenses, one by one, to offer their services nationwide, Sewell said in January.

Such special-purpose national charters might preclude the need for companies to obtain money transmitter licenses in every state when they’re seeking to set up a nationwide payments system. For instance, Trump’s billionaire donor Elon Musk has been on a campaign to collect state licenses to create a payments tool attached to his social media site X, though a partnership with Visa’s international real-time rail may do the trick.

“If we take the Trump administration at their word, and I don’t see any reason why we shouldn’t ... I think some kind of a new charter option needs to be on the table,” Sewell said.

Treasury Secretary Scott Bessent, though, hasn’t shown his hand on the prospects for such a special bank charter.

Stablecoins gain ground via Trump

As for digital assets, the Trump administration issued an executive order Jan. 23 touting the importance of fostering innovation in the space. That order supports the increased use of stablecoins, a cryptocurrency tied to the value of a fixed asset, such as the dollar.

As a result, stablecoins may develop more relevance in the economy, including possibly as a form of payment. It’s another area where the federal government has an opportunity to overcome the current dominance of some states, including New York, in setting regulations for stablecoin use, said Crowell & Moring partner Anand Sithian.

Republican majorities in the House and the Senate may aid Trump’s stablecoin agenda. That could mean a new charter of sorts for stablecoins too, Sithian said. “What I see there is really a role for Congress to step in and provide a federal regulatory framework,” he said in January.

At the same time, Trump’s order echoed congressional moves to steer away from the issuance of a central bank digital currency.

How Congress handles the Credit Card Competition Act proposal remains to be seen. While the legislation’s key proponent was former Senate Majority Whip Sen. Dick Durbin, D-IL, one of the bill’s few sponsors last year also included then-Sen. J.D. Vance, R-OH, who is now Trump’s vice president. The bill’s aim to break Visa and Mastercard’s dominance in exacting fees from merchants also received Republican support during a Senate Judiciary hearing last year.

How Trump will shape CFPB policy on payments

Under the Biden administration, the Consumer Financial Protection Bureau’s efforts to rein in payments companies was aggressive. The agency has issued rules attempting to set parameters for emerging payments tools, like buy-now-pay-later and earned wage access services. Some of them, including those related to BNPL and oversight of big tech companies’ digital wallets, have been challenged in court.

Indeed, many states have been active, albeit at odds oftentimes, in trying to set new regulations for BNPL and EWA. They’ve also had different approaches to other emerging payments legislation, such as whether to allow credit card issuers and networks to impose interchange fees on taxes and tips.

Former CFPB General Counsel David Silberman, who is now a visiting lecturer at Yale Law School, points to the mission statements of the first Trump administration to suggest it will likely encourage financial enterprises.

“The CFPB, under the Trump administration, would probably have a strong free market orientation, and would be looking to assure that consumers are empowered to make decisions for themselves, whereas under [Biden-era] Director [Rohit] Chopra, there was more of an emphasis of establishing rules of the road, [and] prohibiting practices that were deemed to be unfair or abusive,” Silberman said in January.

Any CFPB rules are subject to being rescinded, noted Silberman. The Congressional Review Act gives Trump and his Republican allies in Congress a chance to reverse regulations.

Banks may lose as paytechs gain

Regardless of how specific CFPB issues play out, industry professionals expect a new regulatory environment to support fintech and paytech firms’ efforts to innovate and expand. And that may come at the banks’ expense.

The Trump administration may pave the way for new entrants taking on established financial institutions, especially in light of the president’s sometimes testy tone toward big banks and their CEOs. While he has leveled barbs at Bank of America and JPMorgan Chase, Trump has recently embraced technology players, inviting Amazon founder Jeff Bezos and Apple CEO Tim Cook to inaugural festivities.

“You're seeing the innovators and the new entrants into the market in a somewhat more favorable position right now than legacy players,” said Sewell. “Don't forget that President Trump, and a lot of people around him, don’t like the big banks, at all.”