Page 2

-

Thread Bank digital chief advocates for unified AI strategy

“We don't want 30 different vendors doing 30 different AI things,” said Marty Miracle, the Tennessee lender’s first chief digital officer.

-

FDIC would give banks flexibility on digital signage in proposed rule

The proposal focuses display requirements toward screens and webpages most relevant to consumers, simplifying rules for signage on bank websites, mobile apps and ATMs.

-

FundCanna launches BNPL tool for cannabis businesses

Funding challenges in the cannabis market have created a massive delinquent receivables problem, according to one economist. ReadyPaid, FundCanna’s new B2B BNPL platform, aims to remedy that.

-

Virginia’s TowneBank to buy NC’s Dogwood in $476.2M deal

The move would add 17 branches – many along the I-85 corridor in the Carolinas. TowneBank is set to close a separate acquisition of Old Point Financial on Sept. 1.

-

Texas lender embraces independence amid flurry of consolidation

“People like to do business with folks that know the community, know the state, know the region,” and “that’s where banks of our size fit,” said Danny Butler, CEO of San Antonio-based Jefferson Bank.

-

Truist settles web tracker lawsuit

California resident John Tasker sued the North Carolina lender in May for alleged privacy law violations. He filed a similar lawsuit against BMO that remains active.

-

N26 co-founder Valentin Stalf to step down

That leaves co-founder Max Tayenthal as the sole CEO for the moment. The executive shift comes amid rumors that a German regulator intends to launch fresh action against the digital bank.

-

Fed nixes novel activities supervision program

The Federal Reserve’s oversight of banks’ crypto and fintech activities will be folded back into the normal supervisory process, the central bank said Friday.

-

GOP lawmaker seeks probe into StanChart sanctions case

Rep. Elise Stefanik, R-NY, urged U.S. Attorney General Pam Bondi to launch an investigation into Standard Chartered Bank’s “illicit payments” and related “inaction” from New York’s attorney general.

-

Early Warning shirked safeguards, NY says

As states step into the breach left by the CFPB, New York alleges Zelle’s parent devised security policies in 2019 to counter fraud on the payments network, but didn’t impose them for four years.

-

Trump scraps Biden order that toughened M&A standards

The revocation Wednesday undoes the previous administration’s “flawed philosophical underpinning” for “undue hostility” toward mergers and acquisitions, Trump’s FTC chair said.

-

DC Circuit reopens path to CFPB firings

The split ruling vacates a preliminary injunction that prevented Trump administration officials from cutting 95% of the bureau’s employees.

-

FDIC oversight of large third parties needs clearer goals, OIG says

While the FDIC has “taken steps to establish goals and metrics” in its oversight of large third-parties, they were not “measurable or directly linked to program success factors.”

-

Connecticut credit union discloses data breach

Roughly 172,000 people’s information may have been exposed in a June cyber incident against North Haven-based Connex.

-

Goldman, JPMorgan alum gambled seed round funding: DOJ

Richard Kim told investors his company was developing a cryptocurrency-enabled gaming app, then “gambled away substantially all of the company’s money,” prosecutors said.

-

Embezzlement cases engulf Alabama, Tennessee bankers

An Alabama banker made roughly 273 fraudulent ACH transactions totaling over $2.3 million, the DOJ said. Last week, the Fed banned an ex-First Horizon banker over embezzlement charges.

-

Ethics questions cloud Bessent’s assets

The treasury secretary is delayed in complying with a conflict-of-interest agreement to divest certain investments, including farmland. He received an extension and pledged to comply, but that’s not enough for some.

-

Citi exec: Retail simplification is paying off

“We're not trying to sell different packages or explain the nuances of” various product levels, said Kate Luft, the lender’s head of retail banking. “That's a complication, I would say, externally of Citi right now.”

-

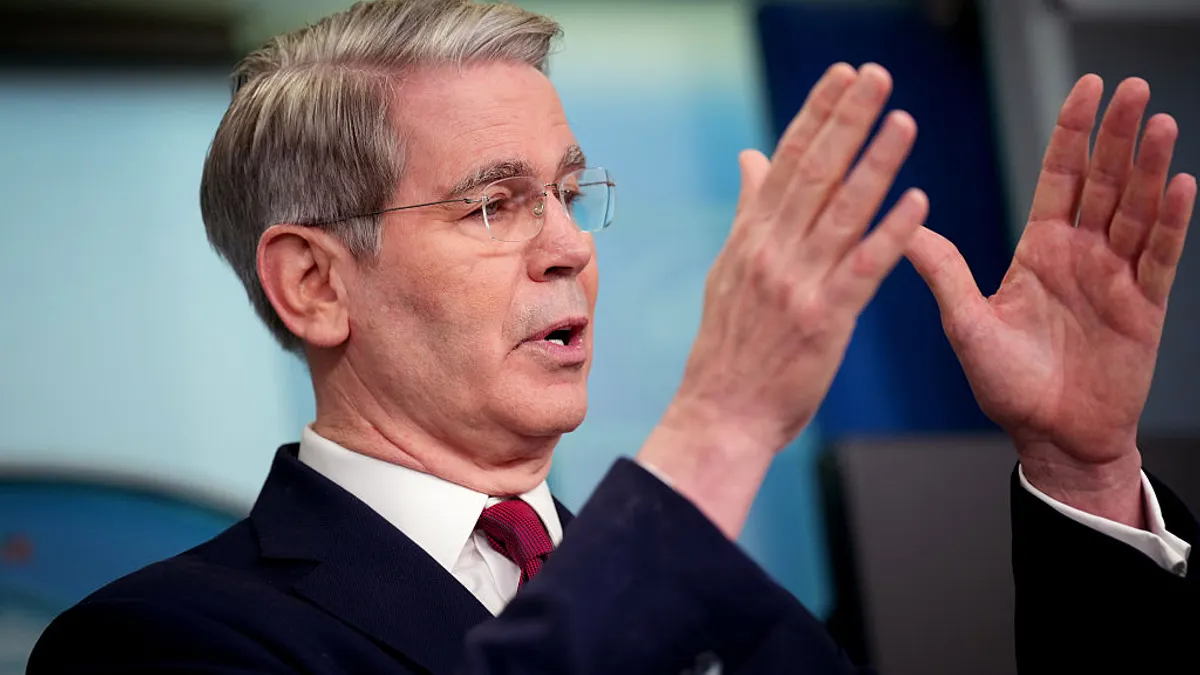

Evolve Bank names CEO with regulatory expertise

Consultant and FDIC vet Bob Hartheimer has taken the reins at Evolve Bank & Trust and aims to “restore trust” in the embattled bank.

Updated Aug. 13, 2025 -

NY sues Early Warning Services over Zelle fraud

The NY attorney general’s lawsuit comes five months after the Consumer Financial Protection Bureau dropped a federal action over the same matter.

-

CIBC taps new US CEO

The Canadian bank named Kevin Li the next CEO of its U.S. operations. Current U.S. CEO Shawn Beber will shift to a special adviser role in November before retiring next July.

-

Column

Dive Deposits: Goldman’s CEO, chief economist and even Steve Mnuchin face Trump barbs

The president blasted David Solomon (and his erstwhile DJ side gig) in a social post Tuesday, suggesting he fire a top analyst at the bank. Trump also teased legal action against Fed Chair Jerome Powell.

-

Paxos seeks OCC trust charter

The crypto firm’s renewed application for a national trust charter comes shortly after being fined by the NYDFS, connected to its past relationship with Binance.

-

Do Kwon pleads guilty to fraud counts

Prosecutors plan to recommend a sentence of 12 years, and $19 million in penalties, as long as Kwon doesn’t commit any more crimes.

-

PNC picks next risk chief from within

Amy Wierenga will succeed Kieran Fallon next month as the Pittsburgh-based lender’s chief risk officer, and Fallon will return to the bank’s legal department.