Fintech

The latest fintech news for banking professionals.

-

Wise to pay $4.2M, boost AML oversight in 6-state settlement

Wise allegedly failed to provide for frequent independent review of its anti-money laundering program. Regulators also found deficiencies in the investigation and reporting of suspicious activity.

By Justin Bachman • July 10, 2025 -

Community banks view embedded finance as key to longevity: report

Despite increased regulatory scrutiny of banking-as-a-service, over half of the surveyed community bank respondents are considering implementing BaaS or embedded banking solutions.

By Rajashree Chakravarty • July 9, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Monzo fined $28.7M over AML flaws

This is the 10th financial crime control failings-related fine imposed by the FCA in the last four years, and follows a similar action against fellow U.K. neobank Starling last year.

By Gabrielle Saulsbery • July 9, 2025 -

Court denies open banking briefs

A federal judge said “friend of the court” briefs wouldn't be helpful in litigation over the Consumer Financial Protection Bureau’s open banking rule.

By Justin Bachman • July 9, 2025 -

Wealthfront files for IPO

It’s at least the fifth fintech that’s filed to go public this year, but one investor said it’s not a trend – it’s more “a return to normal.”

By Gabrielle Saulsbery • July 2, 2025 -

Circle applies for national trust charter

The proposal to create the First National Digital Currency Bank “marks a significant milestone to build an internet financial system,” CEO Jeremy Allaire said. Wise applied for a similar charter in June.

By Rajashree Chakravarty • July 2, 2025 -

Judge again denies request to slash Ripple’s SEC penalty

The SEC can “change course after an enforcement action is initiated,” the judge wrote last week. “But the parties do not have the authority to agree not to be bound by a court’s final judgment.”

By Dan Ennis • July 2, 2025 -

Early Warning Services pitches Zelle to Treasury

The company that owns the peer-to-peer service Zelle suggested the U.S. Treasury Department use that tool to replace checks with digital payments.

By Patrick Cooley • July 1, 2025 -

Envestnet spins off Yodlee to private-equity firm

The data aggregator is being sold to STG for an undisclosed amount in a deal set to close in the third quarter.

By Dan Ennis • June 30, 2025 -

Banking conferences yet to come in 2025

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • June 27, 2025 -

Spinwheel raises $30M in series A to boost agentic AI platform

The latest fundraise will help to develop its product stack that would reduce implementation time frames from over a year to just a few months, CEO and co-founder Tomás Campos said.

By Rajashree Chakravarty • June 25, 2025 -

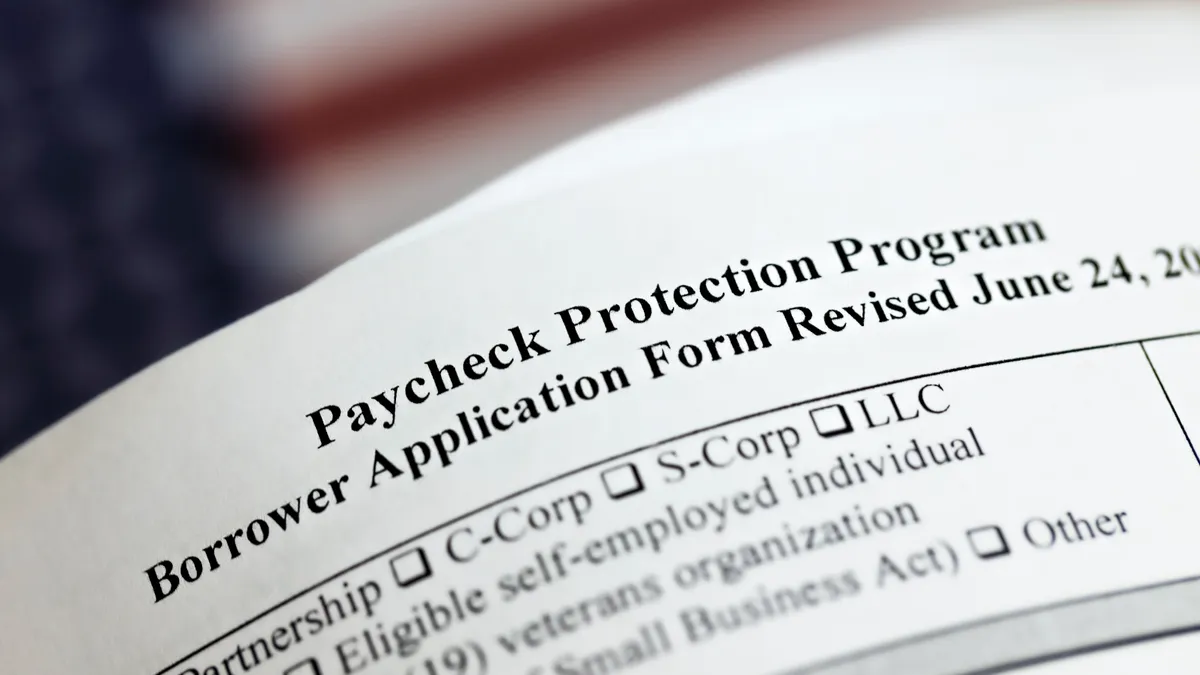

Blueacorn founder guilty on one count, faces up to 20 years

Stephanie Hockridge “abused the generosity of the American people by stealing money dedicated to the survival of small businesses to fraudulently enrich herself,” one acting U.S. attorney said.

By Gabrielle Saulsbery • June 25, 2025 -

Klarna, Google join forces

The Swedish buy now, pay later business integrated its payments tool into the search giant’s digital wallet, making its services more widely available.

By Patrick Cooley • June 24, 2025 -

GENIUS Act puts renewed spotlight on stablecoins, digital assets

The regulatory clarity the measure proposes to bring to the stablecoin space can help ease some of the worries of more conservative entities, such as banks, examining the space, EY’s Paul Brody said.

By Grace Noto • June 18, 2025 -

Synctera’s new risk chief doubles down on compliance planning

Fintech Synctera has tapped a former Fed and OCC examiner as CRCO, as the firm pursues growth with a focus on regulatory compliance.

By Rajashree Chakravarty • June 18, 2025 -

Primis to sell some of its stake in medical fintech

An undisclosed buyer will purchase Panacea Financial for $22 million. A timeline for the deal was not disclosed.

By Gabrielle Saulsbery • June 18, 2025 -

Ramp raises $200M, valued at $16B

The latest capital raise was led by billionaire Peter Thiel’s Founders Fund, and featured investments from Thrive Capital and 8VC.

By Justin Bachman • June 17, 2025 -

Gemini pursues IPO

A number of cryptocurrency firms have filed for initial public offerings in 2025. More may follow given “pent-up demand for crypto-oriented companies,” according to one crypto VC.

By Gabrielle Saulsbery • June 11, 2025 -

Varo’s new tech chief views responsible AI as differentiator

Rathi Murthy, who became the San Francisco-based all-digital bank's CTO in March, has hired for two new and complementary roles aimed at business diligence and strategic development.

By Rajashree Chakravarty • June 11, 2025 -

Q&A

FTA CEO says open banking central to fintechs’ work

The leader of the Financial Technology Association sees a federal court battle over the Consumer Financial Protection Bureau rule as critical to innovation.

By Justin Bachman • June 11, 2025 -

Fiserv CEO embraces stablecoins

The processor is developing an infrastructure that would let its merchant customers make use of the digital assets, Mike Lyons said.

By Patrick Cooley • June 10, 2025 -

Walmart returns to Synchrony for new cards

The shift comes more than a year after the retailer received permission from a federal judge to end its credit card partnership with Capital One because of customer service issues.

By Lynne Marek • June 9, 2025 -

Yotta sues Evolve alleging ‘Ponzi scheme’

A federal judge dismissed Yotta's September lawsuit against the lender for alleged misappropriation of millions. Yotta filed a new lawsuit Wednesday with a fresh “Ponzi scheme” accusation.

By Rajashree Chakravarty • June 6, 2025 -

Circle CFO takes post-IPO victory lap for stablecoin, company

The public offering represents an “accelerant” for Circle as it seeks to establish itself at the heart of a new “internet financial system,” CFO Jeremy Fox-Geen said.

By Grace Noto • June 5, 2025 -

Payments firms account for bulk of fintech revenue

Of the $378 billion in global fintech revenues in 2024, $126 billion came from payments firms, according to a new report. The sector is poised for more growth with AI innovation.

By Gabrielle Saulsbery • June 4, 2025