Dive Brief:

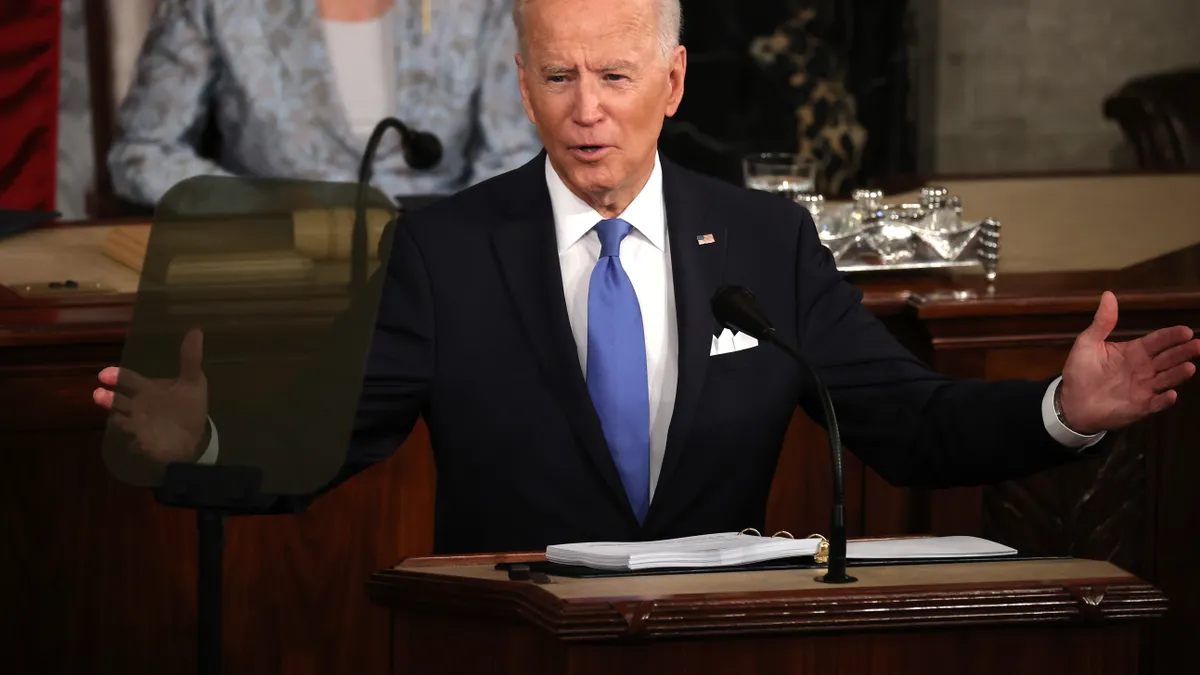

- President Joe Biden's $1.8 trillion American Families Plan would require banks and P2P payment services to report annual account inflows and outflows to the IRS — an effort that could help the agency collect an extra $460 billion in taxes, The Wall Street Journal reported Thursday, citing people familiar with the plan.

- The new data requirements would mostly affect the bank accounts of business owners. High-income taxpayers disproportionately accrue wealth from harder-to-track sources such as partnerships and proprietorships. Up to 55% of taxes owed on less visible income streams is unpaid, the Treasury Department said in a statement Wednesday.

- The effort would help the IRS chip away at a tax gap — the amount the agency says is owed, but hasn't been paid — last year that stood at $600 billion, a former IRS commissioner told the Journal. Focusing on unpaid taxes may be a way to delay raising taxes on people and entities that already pay the full amount owed.

Dive Insight:

Under the plan, individuals or businesses wouldn't be forced to report more information to the government. Rather, that task would fall to banks.

How much the banking industry pushes back against the proposal will depend on the extra time and effort involved in compliance, said Dan Stipano, a partner at the law firm Davis, Polk & Wardwell who previously served the Office of the Comptroller of the Currency (OCC) as deputy chief counsel and director of the agency's enforcement and compliance division.

"If it is something that they already capture, it may not be such a big deal," Stipano told The Wall Street Journal. "But if not, I could see it adding significantly to their already considerable compliance costs and burdens."

Financial institutions now must report interest, dividend and investment income to the IRS, which can also glean information through audits.

"Providing the IRS this information will help improve audit selection so it can better target its enforcement activity on the most suspect evaders, avoiding unnecessary (and costly) audits of ordinary taxpayers," the Treasury Department said Wednesday.

Requiring inflow and outflow data won't explicitly indicate to the IRS that there is unreported income. Some business expenses can be deducted. Nontaxable gifts would also fall outside the inflow-outflow purview.

Congress would have to approve changes to the scope of customer data that banks share. Rep. Kevin Brady, R-TX, for one, called the turnover of extra information "dangerous overreach" wherein banks could risk becoming extensions of the IRS.

"I do think there are ways to improve information reporting that isn't that intrusive," Brady told reporters Thursday.

However, Larry Summers, a Harvard University professor who served as Treasury secretary during the Clinton administration, said the extra information would help auditors find dissonance between a taxpayer's business and bank statement.

"We require extensive reporting when employers send money to employees," he said, according to the Journal. "Why shouldn't we require extensive reporting on interactions between wealthy customers and banks?"