The Biden administration promoted new guidance issued by the Consumer Financial Protection Bureau (CFPB) on Wednesday that aims to eliminate billions of dollars in surprise fees banks charge consumers.

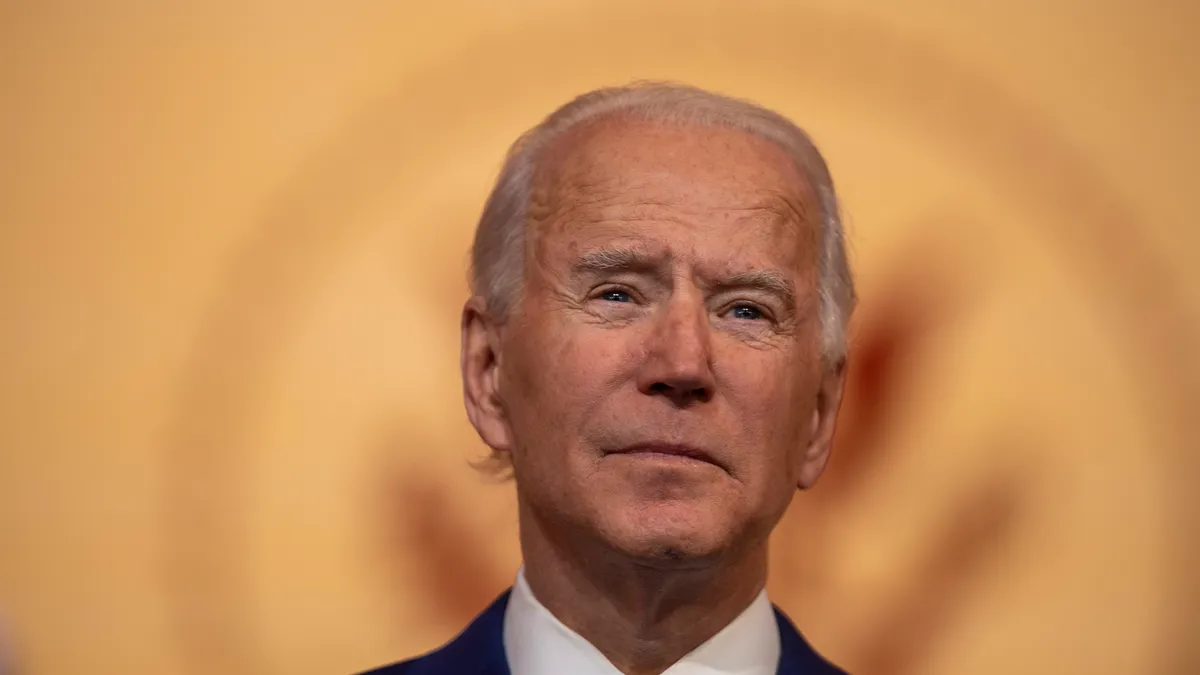

During a White House press conference where he was joined by CFPB Director Rohit Chopra and Federal Trade Commission Chair Lina Khan, President Joe Biden threw his support behind the CFPB guidance that prohibits banks from charging surprise overdraft fees on debit transactions and surprise depositor fees on checks that bounce.

The Biden administration’s focus on these so-called “junk fees” is being touted as an effort to combat rising inflation, and comes just two weeks before the 2022 midterm elections.

“Junk fees are those unavoidable, unnecessary and surprise charges that inflate costs for families while providing little to no value or service,” Chopra said during Wednesday’s press conference. “And these fees have been creeping across the economy for years and years, adding to our monthly bills with no real explanation, and they're impossible for families to budget for.”

Banks collected $15.5 billion in overdraft and non-sufficient funds (NSF) fees in 2019, according to an estimate by the CFPB.

Lenders, however, pressured by lawmakers and facing competition from fintechs and digital banks, have been revamping their overdraft policies over the last several years.

Chopra on Wednesday acknowledged the overdraft policy changes some financial institutions have adopted.

“We've been hard at work on banking fees that cost consumers tens of billions of dollars each year, and we're making progress,” he said. “Banks across the country are cutting and even eliminating these fees, saving families billions.”

Trade groups push back

Biden on Wednesday said his administration is “making it clear surprise overdraft fees are illegal.”

Bank trade groups, however, were quick to push back on the president’s remarks.

“The remarks are harmful and misleading and are a mischaracterization of the services that community banks offer their customers,” Independent Community Bankers of America (ICBA) President and CEO Rebeca Romero Rainey said in a statement on Wednesday. “In his remarks he said that disclosed fees for certain bank services are ‘illegal.’ Such language demonstrates the administration’s lack of understanding for the many ways in which community banks serve their customers and Main Street America.”

Consumers often choose overdraft services as a protection against “the domino effect of mounting fees” caused by returned items and late payments, she said.

Consumer Bankers Association (CBA) President and CEO Lindsey Johnson said the nation’s largest banks are required by law to clearly disclose fees charged for the products and services they provide consumers.

“The nation’s largest banks have introduced new, innovative products and policies designed to provide consumers greater choice, transparency, and control of their money,” she said. “These changes were made without regulatory or legislative intervention.”

The Bank Policy Institute (BPI) called out the CFPB’s decision to issue guidance on overdraft fees rather than issue a notice and request for comment on a proposed rule.

“[The CFPB] continues to rely on invective-filled guidance, which is legally non-binding but which the CFPB has a history of improperly enforcing through the non-public examination process and threats of enforcement action,” BPI President and CEO Greg Baer said in a statement. “Banks remain committed to serving their customers by offering the best products at competitive prices, and would welcome a return to a regulatory world where the rules are clear and transparent, and applied universally.”

The Biden administration’s backing of the CFPB comes as the agency reckons with a recent court ruling that threatens to stifle the agency’s efforts to rein in consumer abuses in the financial services industry.

Last week the New Orleans-based 5th U.S. Circuit Court of Appeals ruled that because the CFPB receives funds from the Federal Reserve and not Congress, the bureau’s funding apparatus violates the separation-of-powers principles in the U.S. Constitution.