Dive Brief:

-

Cambridge Savings Bank launched a digital-only bank called Ivy Bank to help take its services nationwide, the $5 billion-asset financial institution announced Thursday.

-

The Massachusetts-based bank said the platform has been in the works for the past two years and will aim to compete with other digital-only banks in the marketplace.

-

"Ivy was born out of our desire to meet customers where they are in this changing market environment and provide an opportunity for us to deliver a relationship-centric digital bank with the backing of our historic financial institution," Wayne Patenaude, president and CEO of Cambridge Savings Bank, said in a statement.

Dive Insight:

Cambridge said a combination of digital services aided by human-centric support is how Ivy Bank aims to "stick out from the crowd."

"Ivy lets us combine the best of our heritage as a relationship-oriented, customer-centric bank and combines that with a best-in-class digital offering," said Katie Catlender, Cambridge Savings Bank’s chief customer officer. "By leveraging a long-standing, trusted institution, we’re giving consumers nationwide the ability to access their whole financial lifecycle, at their fingertips. People across the country want the opportunity to grow their money to the best of their ability, and our job is to make it as easy, simple and transparent as possible for people to do this."

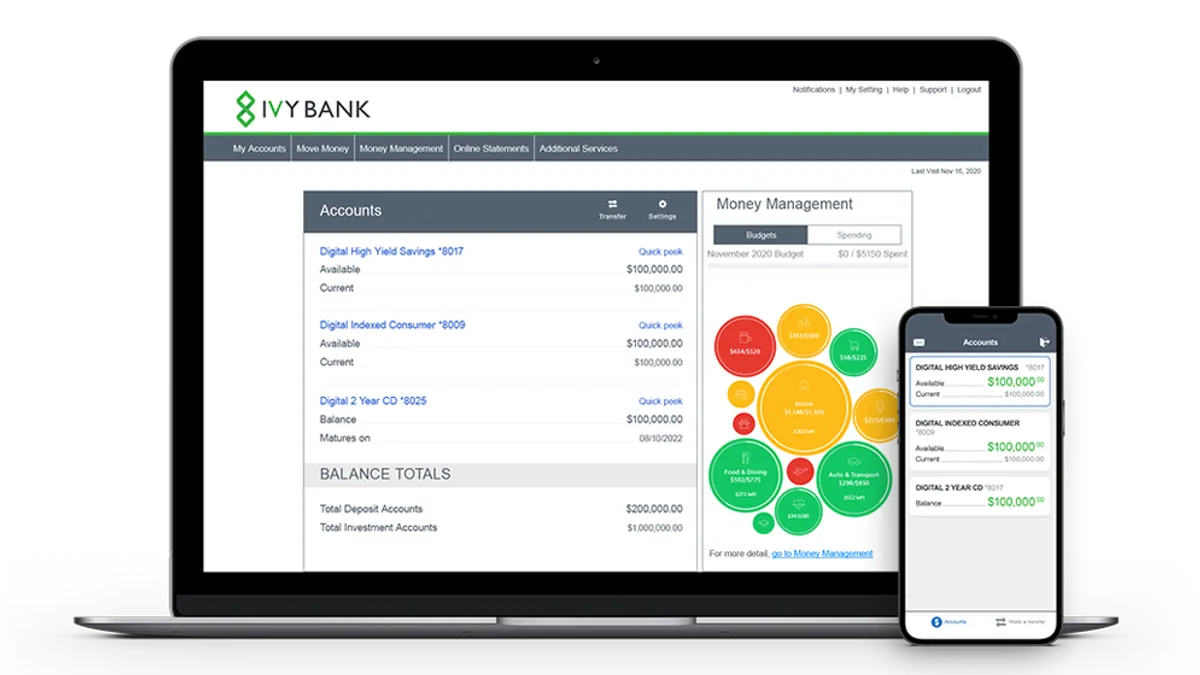

Cambridge said the new platform’s money management tool allows customers to view all bank accounts in one dashboard, including those held at other financial institutions, visualize spending by category, set and manage budgets, manage debt and view net worth.

The bank, which declined to share how many accounts Ivy Bank has, said customer account openings on the new platform take an average of five minutes.

The digital bank also features a high-yield savings account with a 0.61% annual percentage yield (APY), which applies to minimum balances of $2,500, and a five-year certificate of deposit (CD) with a 1% APY as long as the opening deposit is $1,000 or more.

"With top-of-the-market rates, Ivy will be competitive with other offerings in the marketplace," Catlender said.

Cambridge Savings Bank is partnering with several fintechs and third-party providers to launch the platform: MANTL for its account-opening process, NCR for account automation and MX for money management capabilities, Catlender said.

As more traditional banks introduce products such as overdraft avoidance and early paycheck access to compete with neobanks and other digital-only firms, Catlender said Cambridge is eyeing similar products.

"It is our intention to continue to innovate and to ensure we make it as easy as possible for consumers to meet their financial well-being goals and anticipate future needs such as avoiding overdraft, early pay and more," she said.

Cambridge Savings Bank has 17 branches in the Greater Boston area.