Stuart Sopp, founder and CEO of digital bank Current, said the coronavirus pandemic has highlighted how his bank serves workers whose jobs have been deemed essential during the crisis.

"Our members' addressable market has grown in size and we didn't know it before this pandemic hit, but we were already banking many of these workers who are now deemed essential, and who are working more hours and earning higher wages than ever before," he told Banking Dive.

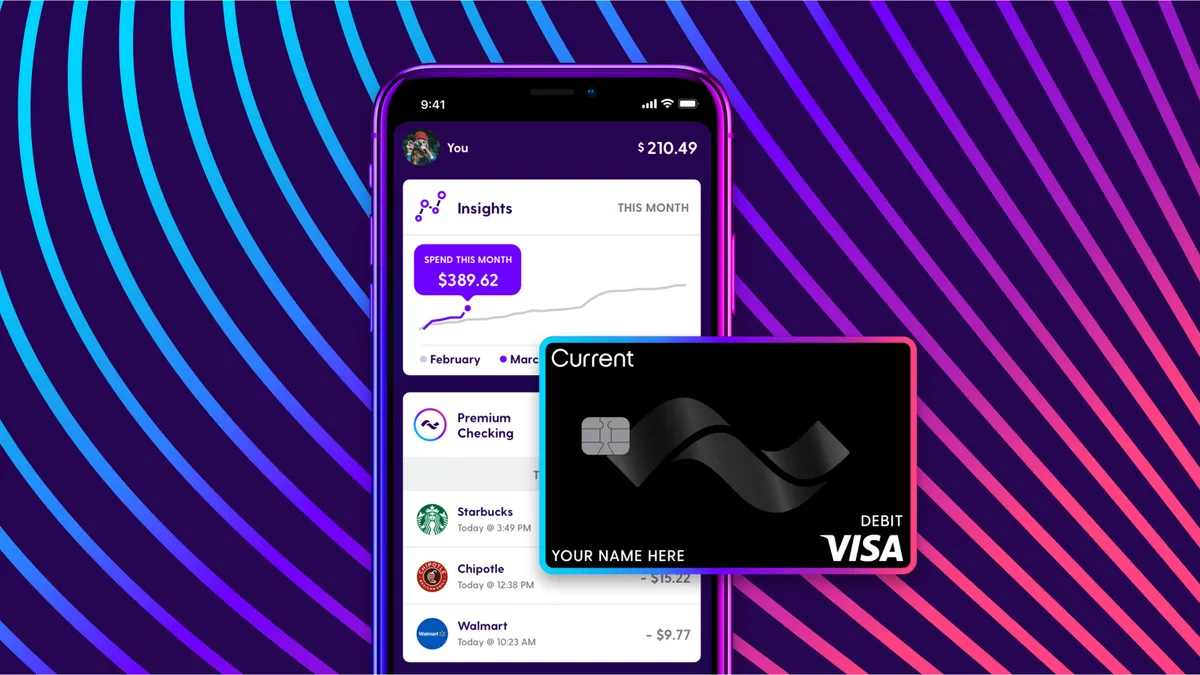

Current, based in New York, says it has around 800,000 customers, many of whom live paycheck to paycheck.

"We’ve seen the number of our members working for DoorDash, Instacart, Amazon, FedEx, UPS and similar delivery and big-box retailers surge throughout this crisis, as we already had a banking system and business model in place set to serve them, which is focused on liquidity and getting cash into their pockets as quickly as possible," Sopp said.

In April, Current was one of the first banks to credit the government stimulus checks by making the funds available to its customers immediately instead of waiting for them to settle.

Sopp spoke with Banking Dive about how the crisis has accelerated the bank’s product deliveries as well as how the pandemic might impact M&A in the fintech space.

This interview has been edited for clarity and brevity.

BANKING DIVE: Has Current had to halt or slow down any strategic plans as a result of the pandemic?

STUART SOPP: No, if anything, it has further demonstrated the need for our products, and we’ve accelerated plans in order to get our members faster access to money at a time they need it most. We did prioritize some product builds over others to adjust to our members' needs. But as a whole, this pandemic has highlighted that we had a business model and products that were already working for this demographic, these essential workers, so we are moving ahead with our plans in order to keep improving financial outcomes for even more Americans.

We expanded our free overdraft, called Overdrive, to enroll thousands more members each week, giving them access to overdraft up to $100 without fees and also were the first to credit the government stimulus checks, which was five days faster than traditional banks.

We also recognized an increased need for access to funds for many of our members to pay for their basic life necessities, like their rent, groceries. So not only did we credit stimulus payments faster but we quickly built a whole section of our Current app to provide our members easy access to information and how to apply for their payments.

Also with unemployment skyrocketing, we saw an increased amount of members receiving state unemployment benefits, so our product and engineering teams were able to quickly pivot once again, and create a dedicated section in the app to help our members file their claims and receive the funds via direct deposit to their Current accounts, which we can also credit up to five days faster. Thousands of members have now been able to quickly file their claims and receive their funds using the feature.

Have you received any acquisition inquiries since the start of the pandemic?

SOPP: The virus is an accelerant of business model and strategy. Most regional and local banks and credit unions use third-party infrastructure and do not have a very modern technology solution or consumer product.

However, the fintech incumbents, who have been around five years or so like Current, have established themselves in this pandemic. We ended up banking these essential workers and, in this environment, we’ve done exceptionally well. Are we attractive to banks? Yes, I’d say so, and even more so now.

However, at the moment, we are focused on delivering on our mission to our members to improve their financial outcomes. I think they need us more than ever. We aren't focused on selling and exiting quite yet. We think there is a lot of work to be done. It is a tumultuous time for many in our communities. I think it would be irresponsible to sell at this point. We are a Series B company, and there are Series F fintechs who still haven't sold. I think we have some runway before looking at serious opportunities.

How will the coronavirus pandemic impact fintech acquisitions in general?

SOPP: I think you will see some more forced conversations. Valuations and runway have meant some more serious conversations. Bank stocks have been hit materially. They are much healthier than they were in 2008. This is a demand/frozen problem in the economy. There are massive deflationary forces here. Are they really looking at lending more? I could imagine massive charge-offs. Lending as a feature is great, but if you don't have deposits, you don't have a business model that makes sense.

Most regional and local banks are built on legacy infrastructure. The whole point of Current is we built a whole new banking core technology that makes it profitable to bank people who do not have much or many deposits because we've dramatically lowered the costs of maintaining accounts. With acquisitions, there are the problems of two sets of developers, two different sets of pipes. They say they can do it themselves, but they don't realize they have structural inefficiencies.

In the fintech community, I do think there eventually will be consolidation at some point. Between all of us, we have a Chase. Over the next three years, a lot of us, maybe not Current, but the bigger guys will IPO or get together and have a massive [initial public offering]. To me, that makes more sense than a bank acquiring us.

Do you still plan to raise more funding this year?

SOPP: We will still be looking to raise our Series C. I have had very frank conversations with investors interested in us and said, 'Let's regroup later in the year when things start to settle.'

Raising money now would not be a problem, but you can't raise money from people who you have never met. As much as [venture capital firms] say they are open for business, diligence is done in person. As an investor, you have to believe materially there is a better world next year. As this clears this up this summer, I think Q3 will be a lively environment for investors.

We have the best customer acquisition costs and some of the best unit economics in the business. Some competitors focus on getting a banking license, which I think is crazy at this stage for us. As the year progresses, you will see more normal-type fundraising come through. I think when you print a bunch of money like you saw in 2008, you will see massive growth equity rounds. We saw people chasing yield and I think you'll see that again. And we have a proven business model.

We believe valuations are stabilized here. I’m not of the opinion that they are down forever. I'm also a trader and I recognize that to get the best valuation we should wait a little while. I also think waiting will bring some degree of clarity the investment community needs around business models, which I think will only increase our value.

What do you think will be the biggest impact this pandemic will have on fintech and the banking industry?

SOPP: I think it has highlighted both the importance of digital banking technology and called attention to just how many Americans are living paycheck to paycheck in this country.

With stay-at-home orders, many customers could not go to their local or regional banks, and while the biggest banks in the world have pretty good digital experiences, it is often not the case for smaller banks. You can't sign up for an account in two minutes on their apps like you can with Current, or transfer funds between accounts as easily, or get your paycheck faster.

Digital banks offer a better solution to the problem of liquidity for the majority of Americans, who all need access to premium and affordable banking, through utilizing technology that provides faster and more immediate access to paychecks and eliminates the need for in-person banking, as well as the costs of legacy infrastructure. Payments are becoming contactless, checks are deposited with a phone's camera, and customers can contact support simply by opening their banking app. The COVID-19 crisis has really highlighted this trend and differentiation.

As I mentioned before, I also think it will have implications on fundraising and acquisition for the rest of this year and as the year progresses, I think you will see massive growth equity rounds.

Do you think there are any silver linings to this pandemic?

SOPP: New appreciation of essential workers and people who have kept the country running, as well as clarification of the fintech field. It was very noisy until the pandemic and now this event has really cleared up who is providing value and who is not.

What will be the biggest challenges for digital banks in the years to come?

SOPP: As digital banks grow in size, there will be a reversal of pressure on having them hold banking licenses by the regulators. At the moment, there is opposition in the banking industry and most digital banks aren't pursuing this yet, but over the next two-to-three years we will see that scale will change this narrative. A lot more digital banks will need to harness lending as part of this expertise to take full advantage of this new future and many do not have that DNA yet.

Does Current have any plans to obtain its own banking charter?

SOPP: For us, it does not make sense with our core demographic being Americans who live paycheck to paycheck. As soon as you have your own bank charter, then you are focused on lending and deposits vs. spend, and it would mean our company focus would then turn away from our core demographic. Our banking partners are great, they do what they are good at, we do what we’re good at and we have great relationships.

I think it just depends on what your strategy is. If you’re going after affluent millennials, you’ll focus on deposits. But I think the big banks like Chase, Bank of America are doing quite a good job with them already.