Bank executives last week detailed their expectations of a lighter regulatory touch and a pro-growth agenda during Donald Trump’s second presidential term.

Speaking at the BancAnalysts Association of Boston conference on Thursday and Friday, some executives — such as First Horizon CFO Hope Dmuchowski — were vocal about their hope for significant change around bank merger and acquisition approvals and efforts to revamp capital requirements.

Other bank executives, such as U.S. Bank CFO John Stern, took a more measured approach to what Trump’s reelection may mean, pointing to likely positives, as well as potential negatives, for the industry.

Citi CEO Jane Fraser, speaking with CNBC on Friday, noted last week was a good one for the stock market, on the back of “a quick, a clear and a decisive” result.

Below are comments from C-suite executives of six banks on what a second Trump term is expected to offer the banking industry.

Wells Fargo CFO Mike Santomassimo:

As the industry awaits more detail on bank regulators’ tweaked capital requirements proposal, the outcome of the election “probably makes it more complicated, not less complicated,” Santomassimo said Thursday.

Regulators had been working on a rule that would mean a 9% boost to bank capital — less than half the 19% jump regulators sought in the first iteration in July 2023 — although the adjustment appeared to lack support from the Federal Deposit Insurance Corp. Under Trump, the proposal to increase the amount of capital banks are required to hold may not move forward.

Beyond capital requirements musings, the San Francisco-based bank’s CFO offered little commentary on what Trump’s reelection may mean for the industry, but emphasized the challenges of operating in such a fluid environment, as Wells considers expectations around deposit and loan growth, for example.

“It feels like every time you think things are starting to settle down — you got a really clear path of rates and where things are going — [Nov. 5] happens, right?” he said.

That’s been a recurring theme the past few years, Santomassimo added. “Every time you think it's going to settle down, something else happens.”

Citi CEO Jane Fraser:

“We’re expecting some lighter regulation,” Fraser told CNBC on Friday.

She noted “constructive discussions” with the Federal Reserve on the modified capital requirements proposal, which she expects will be a lighter version of the original. Still, a variety of different scenarios could play out, in light of Trump’s election. “We will have to wait and see what happens,” she added.

Broadly, Citi expects Trump’s administration “to be pro-growth and beneficial,” Fraser said.

Regarding the Consumer Financial Protection Bureau, “personnel will drive policy,” she said, but the bank expects “a lighter environment on that front,” which she said she hopes fuels competitiveness.

Fraser’s “wait and see” approach also applies to Trump’s tariff plans and how they might affect the economy, as she suggested the eventual outcome could differ from what Trump has promised. Trump has pledged to impose broad tariffs, including a 20% worldwide tariff and 60% tariff on imports from China, which economists have said may end up raising prices for consumers.

“What we’ve often found is that what’s said and then what actually happens tends to be more of a negotiating ploy, to get certain expectations too high, and then we’ll see what actually passes,” Fraser told CNBC. “These things take time. Tariffs, tax policy, they don’t tend to happen overnight.”

U.S. Bank CFO John Stern:

Amid an evolving environment, Stern stressed that the Minneapolis-based bank is focused on its own execution.

“Obviously, regulatory agencies will change and shift. That will move some things, perhaps favorably, for the banking industry,” he said Thursday. “But the other side of that is we saw interest rates increase.”

That could mean people shy away from taking out loans, “because that’s become, again, more expensive on the mortgage side, or on the commercial side,” he added.

“I see puts and takes to this,” Stern said. “There’s going to be some positives out of it and perhaps some negatives with it, and so we just have to take it in stride.”

Stephen Philipson, U.S. Bank’s head of wealth, corporate, commercial and institutional banking, noted the lender’s institutional customers had expressed hesitancy to invest in capital expenditures or build inventory due to election uncertainty.

Following the election, “the certainty helps companies have a little more confidence in investing in cap-ex. But that could be offset by higher rates,” he said, underscoring Stern’s comments.

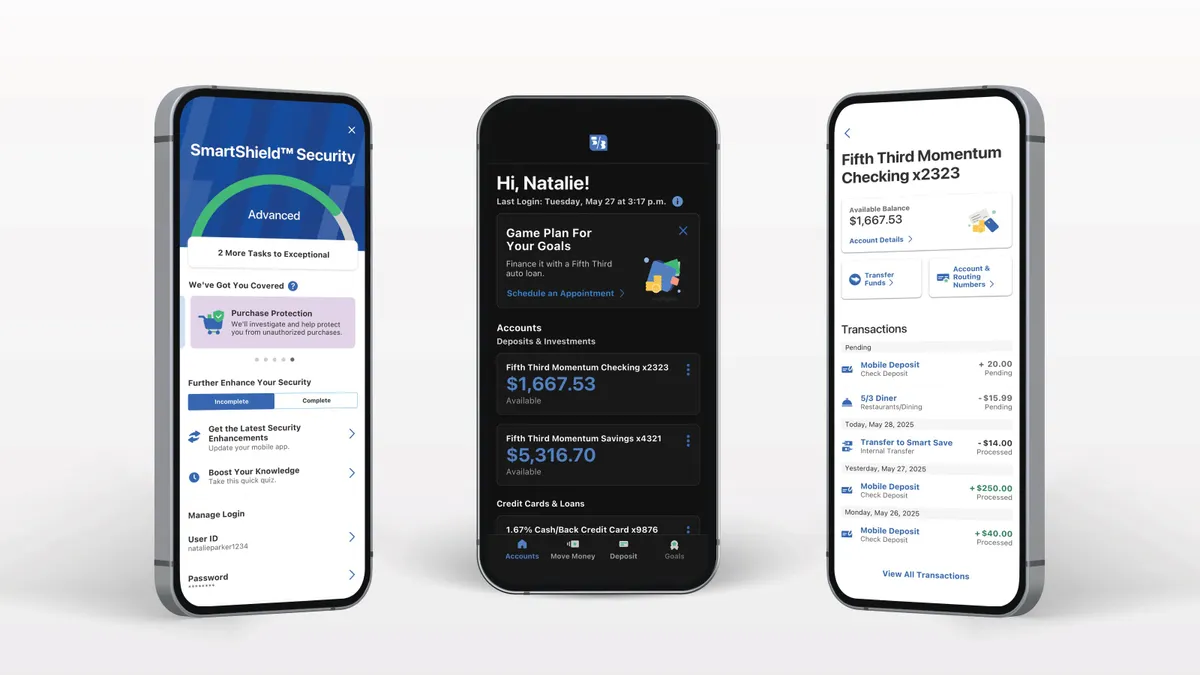

Fifth Third CFO Bryan Preston:

The expectation that the next administration ushers in a more business-friendly environment should help nudge the bank’s customers as they think about investing, Preston said Friday.

Still, the finance chief of the Cincinnati-based regional bank expressed some caution, similar to U.S. Bank executives. Inflation could return, and if long rates were to rise further, “that would be something that would potentially be a cross-wind that would counter-balance some of the benefits that people were expecting out of the election,” he said.

M&T CFO Daryl Bible:

Trump’s “much more pro-growth” administration will likely push more employees back to offices, the CFO of the Buffalo, New York-based bank said. Coming out of the COVID-19 pandemic, office vacancy rates have affected banks with a high concentration of commercial real estate office loans.

Speaking Friday at the conference, Bible also said he thinks the president-elect’s administration will use the banking industry “to help stimulate and help grow faster the economy, which, I think, will play very positively for our whole peer group, as we kind of move forward.”

First Horizon CFO Hope Dmuchowski:

The finance chief at the Memphis, Tennessee-based lender lamented the pace of regulatory change in recent years and the resulting expense for banks.

“We are hopeful, with the change in administration, that the pace of regulatory change that makes banking more and more expensive every year starts to slow if not reverse,” she said Thursday.

Dmuchowski said she believes the outlook for bank M&A changed significantly in the immediate wake of Trump’s election, since the Republican was pro-business and pro-M&A during his previous term.

Going into a Trump presidency with a Republican-controlled Senate, “we are hopeful and are expecting that it’s going to be more M&A friendly, from a scale standpoint, from a time standpoint, as well as clear rules,” Dmuchowski said.

The past two years, it’s been difficult to engage in bank M&A as rules on bank mergers “have not always been followed,” and banks don’t know what they might have to agree to along the way to an approval, she asserted.

She said she’s eager for more clarity under Trump. “I do believe we’ll get there in the next four years. I’m just not sure if it’s going to come immediately, or it’ll come a little bit slower,” she said.

The $82.6 billion-asset lender awaits other changes, too, including to the process for banks nearing and crossing the $100 billion-asset threshold and to the capital requirements proposal.

“Basel III was really punitive to the smaller banks. Getting rid of tailoring was punitive,” Dmuchowski said. It could be consequential for the bank’s earnings and return on equity “if we see the tailoring come out, and we don’t see it increase for the [Category] IV banks.”