The coronavirus pandemic has created market uncertainty for virtually every business, no matter its size or stage of growth.

For Grasshopper Bank, which caters to the entrepreneur and venture capital market, the virus has created an environment where its clients, now more than ever, are relying on the bank's tailored offerings to navigate the crisis.

"Our response to the pandemic is simply continuing to do what we do, but doing even more of it," Jeremy Shure, head of Grasshopper's early stage practice, told Banking Dive. "When we think about the banking relationship with our clients, there's two pieces to it. There is the transactional, which is making sure that their money is safe and secure, and that they have a frictionless, painless experience with their transactional needs. But there's another really big part of that relationship. And that's how to be a partner."

Our response to the pandemic is simply continuing to do what we do, but doing even more of it.

Jeremy Shure

Global Head of Early Stage Practice, Grasshopper Bank

In response to the crisis, the New York-based digital-only bank created a resource guide, where the bank hopes to address pressing concerns such as the state of the market, how to manage remote teams, how to lower burn rate and how to approach raising capital amid the pandemic.

The bank is also hosting a virtual event Thursday called, "Don’t Panic, Let’s Talk," aimed at providing information to help founders, business leaders and entrepreneurs navigate the crisis, Shure said.

"It’s not an easy time to be a founder, so we're trying to create spaces for founders to be able to share their struggles or successes," Shure said.

Grasshopper Bank CEO Judith Erwin, who founded the bank in 2016, told Banking Dive in November the company aims to serve a market that traditional banks have largely neglected in favor of consumer banking.

"Our cost structure is so much lower than most banks that I have the capacity to invest in businesses," Erwin said. "I think clients and their bankers have gotten further and further away from each other in the drive to get big. Everything defaults to just getting bigger and bigger, when that's not necessarily the best choice for the consumer."

As quarantine orders continue to halt in-person interactions, Grasshopper is facilitating virtual pitch practices to help entrepreneurs adjust and prepare for digital investor presentations, Shure said.

"Founders who have meetings with investors or potential customers are going to have those meetings most often over video ... and there's nuances doing it over video versus live,” he said. The bank is also hosting virtual "founder coffees."

"Founders can feel isolated and anxious. They want to talk about their go-to-market strategy, they may want to talk about pivots, or they may want to talk about the state of the market," Shure said. "And so we offer virtual coffees for anyone that simply wants to talk, and that is certainly happening quite often."

As the pandemic brings the economy to a standstill, businesses across the country are facing tough decisions. The situation is no different for Grasshopper's clients.

"We certainly know founders that are in fundraising mode with six months to burn remaining and are now having to rethink the raise. And that's a challenging spot to be in," Shure said. "At the same time, those that have raised in the past eight months are still fine. However, they’re being highly cautious on things like making new hires.

"I think, generally, there's a pause that's happening," Shure added.

Common questions from clients during the crisis are about raising capital in the short or long term, or whether they should rethink an upcoming raise entirely, Shure said.

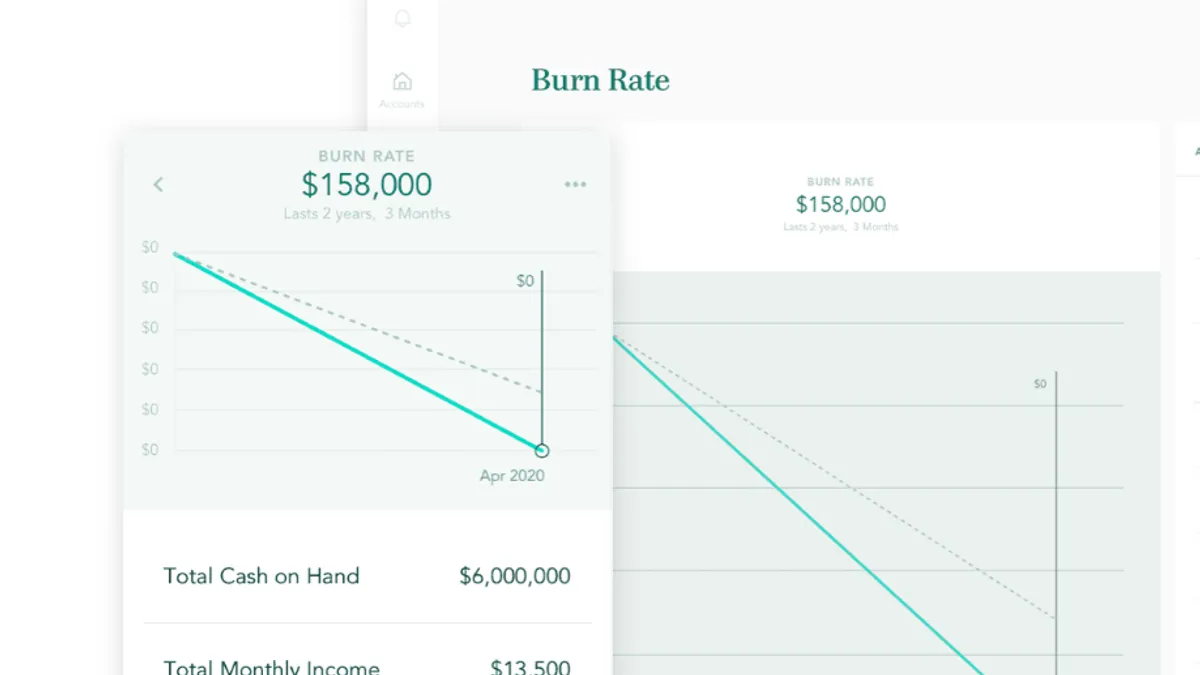

The bank’s burn rate calculator, which allows clients to engage in scenario planning, is getting high usage at the moment, Shure said.

The feature allows clients to run a number of scenarios based on factors such as number of hires, salary, benefits, insurance, software, travel and entertainment.

"All of these things, even office supplies, are things that founders are paying even closer attention to," he said.

A new normal

As a branchless bank, the impact of social distancing orders has only affected employees at its New York headquarters. With employees scattered across the country, remote work is already part of the company’s culture, Shure said.

"It's an interesting time to be a digital bank, where folks don't have to come into a branch and meet with someone to process any sort of transactions," he said.

Once the economy emerges on the other side of the crisis, Shure said he thinks companies will place a greater emphasis on digital offerings. "I think digital will no longer be an afterthought," he said.

And as companies across industries adapt to what may be an extended period of managing a remote workforce, the new normal may lead to financial institutions hiring more remote employees once the pandemic is over, Shure said.

"My hope is that there's an openness for financial institutions, many of which are headquartered in very expensive cities, to think about hiring a more diverse workforce. And by diverse, I also mean geographically diverse," he said. "It will hopefully level the playing field a bit."