Majority, a digital bank that has been servicing immigrants in Houston since April as part of an invite-only beta program, is taking its product nationwide, the company announced Monday.

The bank’s nationwide launch comes as another player announced it, too, was targeting the market. Seattle-based digital remittance company Remitly launched Passbook on Monday, a new bank aimed at immigrants.

“We’re super excited,” Majority CEO Magnus Larsson told Banking Dive, on his company's expansion effort. “We’ve been working on this for quite some time now. We’re confident about the build and we’re happy about the initial responses we’re getting from our communities that we work with.”

The digital bank has 5,000 subscription-based users, a number it says it expects to grow within the next year through its Meetup spaces opening in Houston this month and Miami later this year.

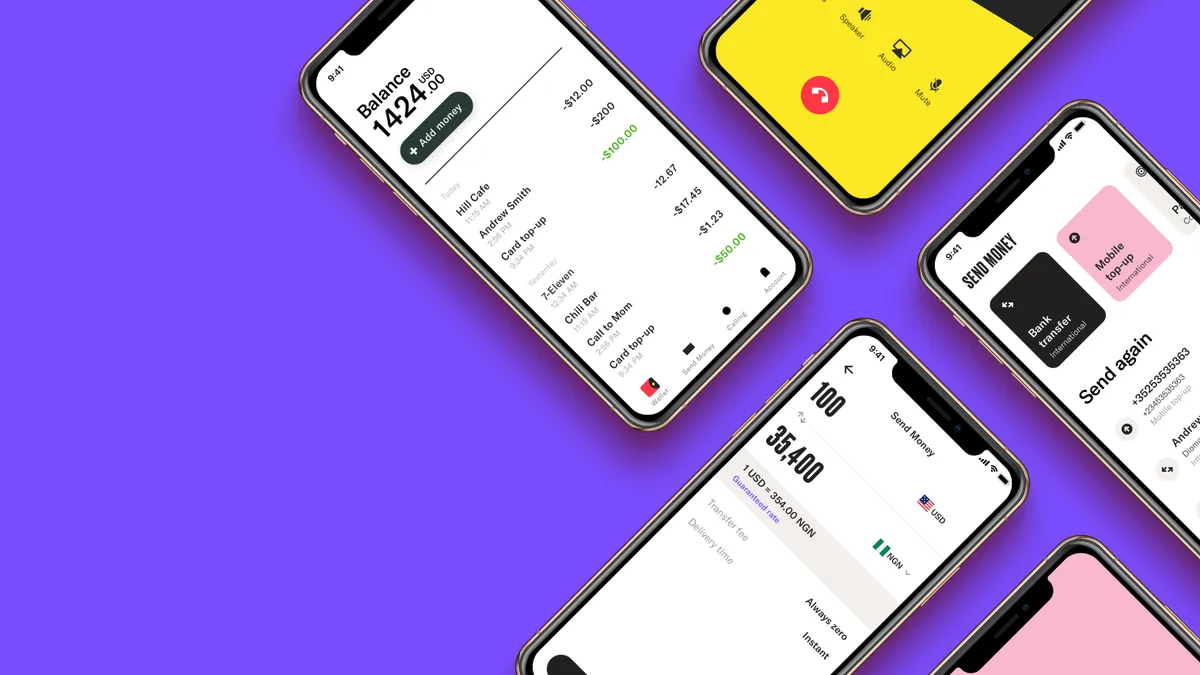

Majority's model is subscription based. For $5 a month, users can take advantage of three core services: mobile banking, remittances and an international calling functionality. Concurrent with the launch, the bank is introducing an early direct deposit feature, where users can get their paychecks up to two days early.

“Normal banks will keep that money on their accounts,” Larsson said. “This is just a way of giving the consumer what they deserve.”

Majority customers have access to more than 55,000 ATMs across North America, as well as free and unlimited remittance to Nigeria, Ghana, Kenya and Senegal. The bank said it plans to open remittances to 15 additional countries by the end of 2020, with Mexico becoming available this spring.

Majority, which partners with Attica, Ohio-based Sutton Bank to offer FDIC-insured deposits, also provides free international calling to more than 25 countries.

But as Majority looks to grow, it could be met with competition from Remitly, which already targets the immigrant community with its money-transfer services, and says it now plans to make banking more accessible and affordable for that same demographic.

“Passbook is the next step in Remitly’s mission to transform the lives of the millions of immigrants around the world who make the huge sacrifice of leaving their families behind to live and work in another country,” Matt Oppenheimer, Remitly CEO and co-founder, said in a statement. “Passbook was born from countless hours listening to customers’ experiences navigating financial services not built for them. Our team has a unique ability to deliver industry-changing products for immigrants. We’re going to change banking like we changed remittances.”

Remitly has partnered with St. Paul, Minnesota-based Sunrise Banks to offer its FDIC-insured deposits.

“There will be other players that find this interesting,” Larsson said of Remitly’s announcement. “We were first to work with this segment, but I think competition is always good. At the end of the day, the consumer will always get better services.”

There are more than 44 million first-generation adult immigrants in the U.S., representing more than one-sixth of the country's workers, according to Remitly.

Immigrants earn more than $1.3 trillion in wages annually and have over $900 billion in spending power, the company said.