Onboarding businesses as bank customers is a notoriously inefficient process, according to Kyle Mack, founder of business identity platform Middesk.

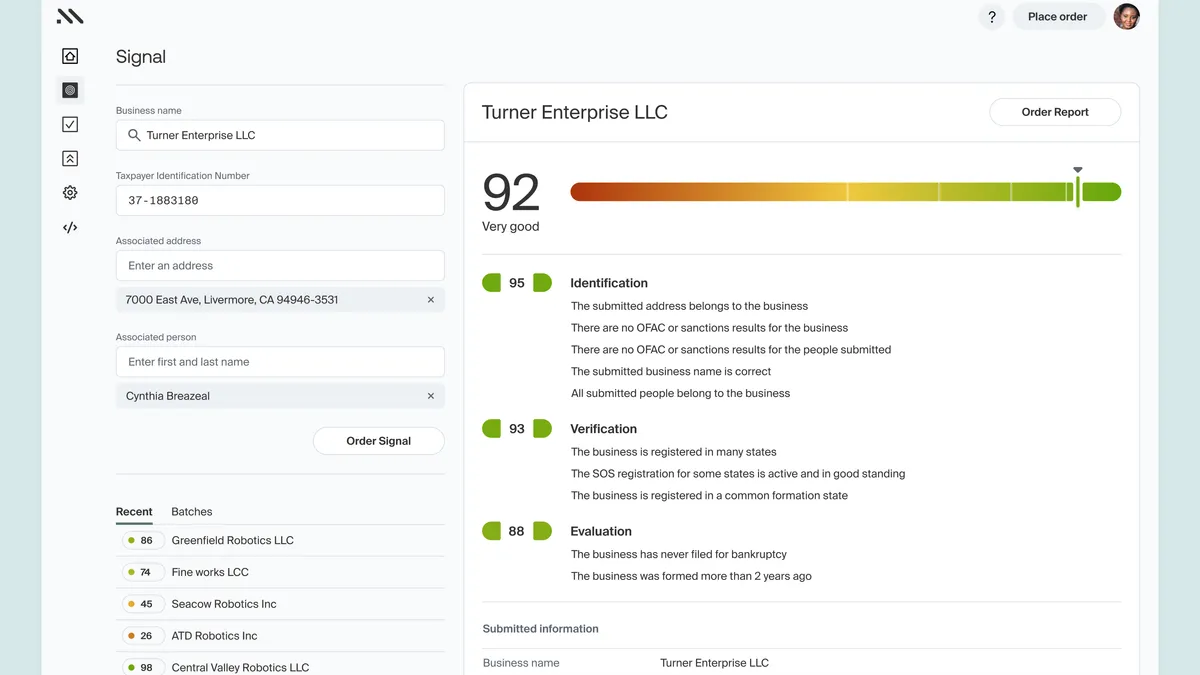

Mack wants to change that: Middesk aims to eliminate friction within bank’s know-your-business processes by helping banks more easily verify applicants.

It all starts with quality data, he said.

“Historically, business data has been owned by just a couple incumbent companies, like Dun & Bradstreet, LexisNexis, the big credit bureaus. But the fidelity and the quality of the data is really, really bad,” Mack said.

Such companies don’t update their business data as much as Middesk is able to, he explained, so banks that use those firms when evaluating a potential business customer could be using outdated or incomplete information, he said.

Banks then waste time and manpower seeking further documentation from potential business customers – a compounding issue, when millions of businesses are started each year and most seek business bank accounts.

“It's not uncommon that when we start working with a bank, they might be approving 10% to 20% of their applications, with 80% to 90% of applications going into a document request process,” he said. “Inevitably, a bunch of those people [asked for further documentation] don't reply.”

In doing its due diligence, he explained, the bank is losing potential customers. But when the bank has better data upfront, its KYB team is able to approve more business customers without further paperwork.

That, in turn, affects how much operational overhead goes into onboarding, and then ultimately, the experience for the small business trying to open the account, Mack explained.

“Friction when required makes a lot of sense,” he said. “But there are a lot of good businesses put through the ringer of having to really prove [legitimacy] largely because the infrastructure to help a bank understand who that customer is has just been really bad.”

“That's why we're focused on this as a data and insights problem, so we can tell a more complete and accurate story on who these companies are, which ultimately means they should be able to get access to these products easier and faster and with less friction,” he said.

Gathering the amount of business data needed to help bank clients properly know their customers has been a “messy, messy process,” said Mack. Much of the data comes from state, county and even city-level business offices, which Middesk has formed and maintained relationships with.

“There's no APIs for doing this – what it looks like in some cases is getting CDs in the mail, and sending hard drives to different state agencies to have them load all the business data on those hard drives to mail back to us,” Mack said.

Middesk also uses artificial intelligence agents to pull information from state databases in real time. For the states that don’t update their databases daily, Middesk has a team of roughly 35 employees to chase down data.

Middesk counts two of the nation’s three largest banks as customers, along with roughly 100 smaller banks and credit unions, according to Mack. On Wednesday, Middesk announced a partnership with Attune, a digital origination fintech geared to streamline bank customer onboarding.

“As fraud, sanctions, and geopolitical landscapes evolve, lenders face increasing risks and banking’s competitive landscape requires optimal onboarding experiences,” said Attune CEO AK Patel in a prepared statement.

“With this partnership, we are equipping our customers with essential, reliable data and insights about prospective borrowers to successfully navigate and lead in this environment,” he said.