Varo Bank is pursuing faster growth by integrating machine learning models into various aspects of the customer life cycle, said incoming CEO Gavin Michael.

Varo’s strategy includes leveraging artificial intelligence and ML in underwriting for the neobank’s low-dollar loan offerings, fraud prevention and detection, and in data-driven customer experiences with enhanced personalization. He also sees the bank using it in app curation to help customers better manage their finances and enhanced customer service.

AI and ML can “help make sure the great experience that our customers are seeing on the way in and through our app is reflected in every touch point they have — simple, human, personalized experiences that happen across all of our channels,” Michael told Banking Dive.

Michael, the former CEO of Bakkt, was instrumental in taking the cryptocurrency exchange public in 2021. He joined Varo in November as a leader, according to his LinkedIn profile. Michael’s prior stints include head of technology for Citi’s global consumer bank, head of digital for consumer and community banking at Chase, chief technology innovation officer at Accenture, and IT director for Lloyds Banking Group’s retail banking business.

It was at Lloyds, in 2009, that he met Colin Walsh — the outgoing CEO of Varo, who has led the company for the past 10 years — and the two kept in touch over the years.

“When the opportunity came along to bring Gavin into Varo, I was very excited about that, and got the board excited about it, and started to put in motion what I would say is a very well planned out succession,” Walsh said, adding that Michael will help put the company in “turbocharge” mode.

Michael’s expertise in software development will help him drive commercial success — a skillset that Varo needs right now, Walsh noted. Varo was not profitable in 2024, though its revenue grew 22%, lending rose 45% with a 38% reduction in losses, he said. Varo recently secured $55 million in funding, according to the outgoing chief.

The ongoing transition of power should be completed this month or next, Walsh said. He will remain active on the bank’s board as founder and a major shareholder and will engage in public speaking for the company.

Michael stressed that Varo will remain focused on customer value and financial inclusion. To further those efforts, the San Francisco-based company will practice more careful management of its expenses, align technology development with commercial goals, and implement a multi-quarter roadmap with clear priorities.

“The next stage is scaling and just taking the business to the next level, achieving profitability, and then thinking about part of why we brought Gavin in is — he's taken a company public as well,” Walsh chimed in. “So we'll see. We will keep all options on the table.”

Technology boosting customer experience

Varo’s “secret weapon” is its charter allowing it to offer fee-free banking and lending products, Michael said.

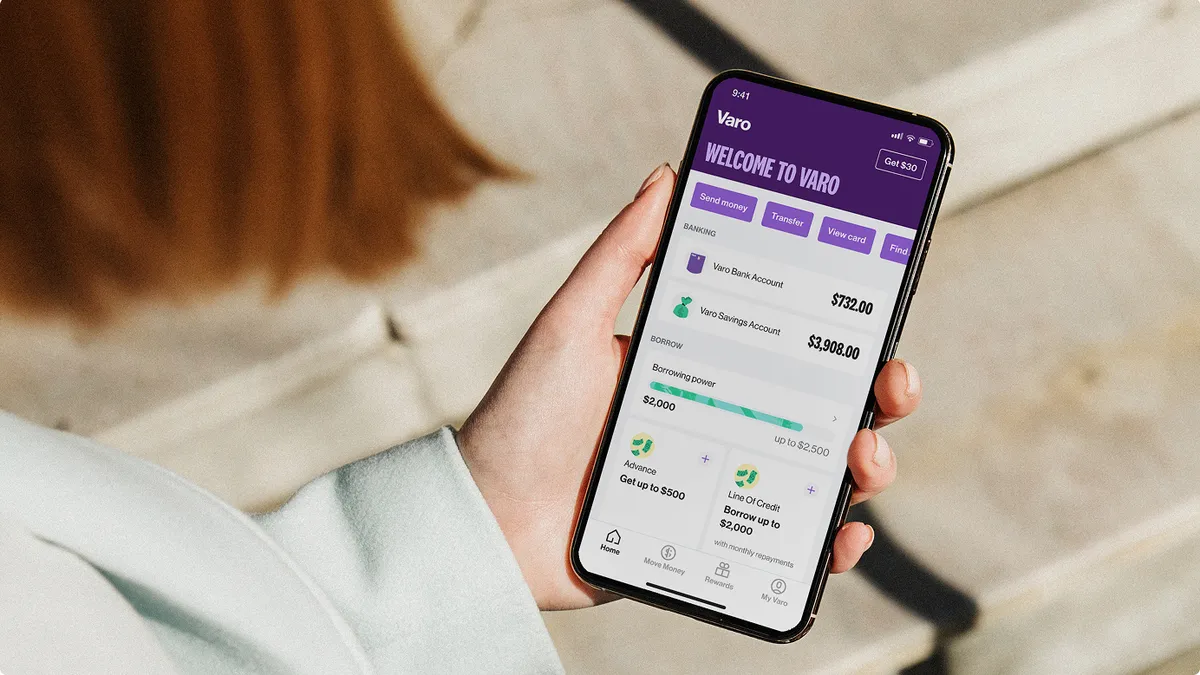

Varo focuses on building products that precisely match its target customer needs, like high-interest savings accounts, deposit products, evolving cash back offerings, free banking access through a partnership with drugstore chain CVS, secured credit cards and low-dollar loans.

Varo’s products are typically created in-house, and Michael believes this suite serves Varo’s target market well. That group includes low-to-middle income customers, financial beginners, and those with thin or no credit files.

The lender has undergone a major upgrade of its app, moving from iOS, Android and web platforms into a single React Native app. Walsh underscored Michael’s contribution to the change and he believes that Varo will begin to see the benefits this year with a clearer path toward profitability.

Rather than expanding to new product categories, Varo plans to refine its existing offerings, Michael said. While the lender is open to building, buying, or partnering as customer needs evolve, the current focus is on scaling the company’s existing products.

“And it's the charter that enables how our business operates. And that's something that is the secret weapon that allows us to be able to serve everyday Americans,” Michael said.

Customer acquisition, crypto

Last year, Varo’s customer acquisition cost fell 31%. Walsh credited the company’s new chief marketing officer, Hussein Kalaoui, for improving efficiency through disciplined marketing. Varo currently has about 5 million customers, he noted.

Walsh said there’s potential to bring back customers who left Varo, by leveraging customized product offerings. Michael also emphasized the importance of customer acquisition and retention in Varo's growth strategy.

Although he has a background in crypto and aims to leverage his experience in technology and banking, Michael underscored that Varo will not rush into new technologies unless they provide meaningful impact.

Walsh noted that he sees digital finance opening up new avenues for financial inclusion.

“Gavin has been very much a practitioner in the space, having run Bakkt. So, I think it's a matter of, how do some of these things intersect at some point, as we think about our technologies and our product offerings over time?” he said.