Dive Brief:

-

Former Wells Fargo board members defended their actions in the wake of the bank’s widespread consumer abuse scandal amid bipartisan criticism during a hearing on Wednesday.

-

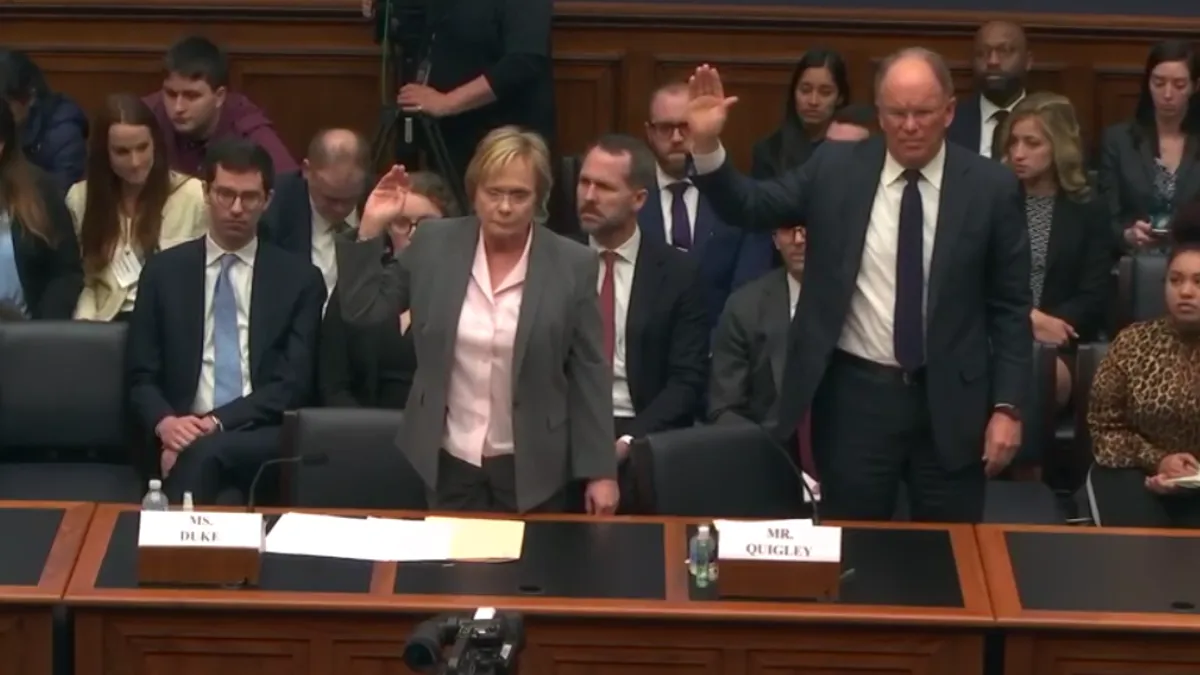

Former Chair Betsy Duke and former board member James Quigley faced the House Financial Services Committee panel after resigning from the bank’s board on Sunday, which followed the release of a scathing House report criticizing the bank’s board and senior management for their failure to comply with regulatory consent orders.

-

During the nearly three-hour hearing, lawmakers accused the former board members of showcasing a lack of urgency in complying with regulators and failing to hold former CEO Tim Sloan accountable for the bank’s consumer abuses.

Dive Insight:

Both Duke and Quigley said they were shocked and troubled when they first learned of the bank’s misconduct, which involved Wells Fargo employees creating roughly 3.5 million fake accounts to receive sales-based incentives, but both told the panel they had done all they could to steer the bank in the right direction.

"Do you disagree that as board chairs you were responsible for the board’s approval of poor quality consent order submissions and failure to hold ineffective leaders like former CEO Tim Sloan accountable?" Committee Chairwoman Maxine Waters, D-CA, asked Duke and Quigley.

Duke said she and Quigley did their job as "thoroughly and as completely" as they could, and deferred to the bank’s senior management, saying the board’s role was to review consent order submissions from a "very high level."

"Any of the deficiencies that were in the details of those submissions are the responsibility of management," she said.

When asked if he believed there had been a dereliction of duty regarding the board’s handling of consent orders, Quigley said he was "comfortable" with the way he performed his role.

"I did my very best. I could do nothing more and the company deserved nothing less," Quigley said.

Rep. Nydia Velázquez, D-NY, accused the former board members of being more concerned with lifting the bank out of a 2018 asset cap set by the Federal Reserve than fixing the bank’s management problems, referring to emails included in the House report.

"The priority of the two of you and the overall focus of the board was on lifting the asset cap and exiting the consent decree and not actually fixing the risk management problems at the bank or holding senior management accountable," she said.

During the hearing, Duke addressed regret over an email exchange outlined in the report, where she questioned why requests from the Consumer Financial Protection Bureau (CFPB) were being sent to her rather than a department manager.

"I found that he did send us letters on details that belonged somewhere else," she said, telling lawmakers she had found the individual “difficult” and "not knowledgeable" about the bank’s situation. "But I should never have said that."

Perhaps the most passionate line of questioning came from Rep. David Scott, D-GA, who asked the witnesses to explain how the bank’s sales scandal was able to go on the way it did.

"I hope and I pray that the people of this country see your stone silence when you won’t even answer this question," he said. "This is an unpardonable sin that Wells Fargo has embanked on the American people."

Rep. Al Green, D-CA, questioned Wells Fargo’s size, a point often raised by Democrats who say the bank is too big to manage.

Green said individuals at a small bank would face criminal charges for creating fraudulent accounts like Wells Fargo did.

"Is it the case that if you become so big and create such a grand scheme that you are beyond the law?" he said. "At some point the long arm of the law has to reach Wells Fargo."

Last month Wells Fargo agreed to pay $3 billion to the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) as part of a settlement over the bank's fake-accounts scandal.

The bank was also ordered by the SEC this month to pay $35 million to unsuspecting clients harmed by its high-risk investment advice.

Wednesday's hearing was the second of three such hearings taking place this month focusing on Wells Fargo's consumer abuses. CEO Charlie Scharf faced the panel on Tuesday and a third panel examining the bank's "toxic culture" is scheduled for March 25.