Commercial: Page 29

-

Regions customers get an extra day to avoid overdraft fees

The new enhancement will be effective from June 15 for all Regions consumer banking and private wealth management checking accounts.

By Rajashree Chakravarty • June 16, 2023 -

NFL gets $78M in loans from 16 nonwhite-owned banks

The deal will generate Tier 1 capital for the banks. Fees and interest garnered from the loan will strengthen the banks' lending power by millions of dollars, CNBC reported.

By Gabrielle Saulsbery • June 15, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Column

Perella Weinberg’s cuts show it’s an employer’s market again

The boutique bank is cutting about 7% of its workforce to free up funds to hire top talent, Bloomberg reported. That's a far cry from January 2022, when banks were sweating first-year salaries.

By Dan Ennis • June 15, 2023 -

Wells Fargo CFO warns of commercial real estate weakness

Wells Fargo CFO Mike Santomassimo is the latest big-bank executive to detail commercial real estate distress and its potential impact on lenders.

By Maura Webber Sadovi • June 14, 2023 -

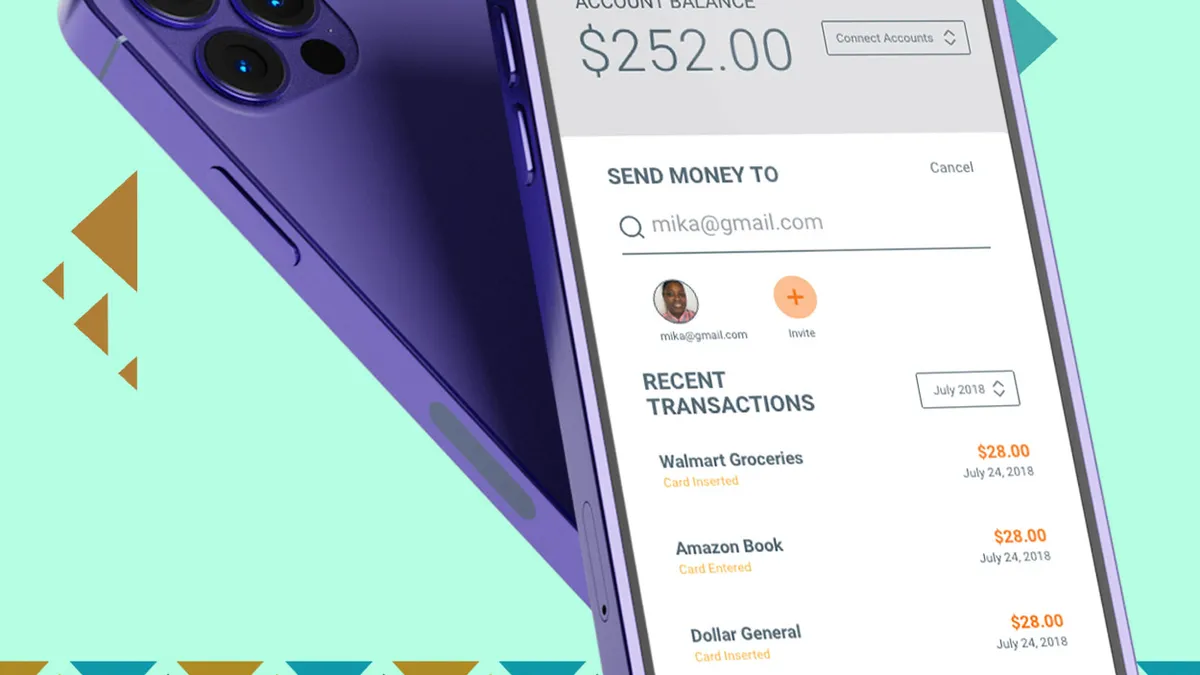

BNY Mellon, MoCaFi link up to bring digital payments to unbanked

The bank's treasury services clients will now be able to disburse payments to those without bank accounts through MoCaFi.

By Gabrielle Saulsbery • June 14, 2023 -

HSBC sustainability exec takes sabbatical

The move comes less than a week after Goldman Sachs’ Platform Solutions chief, Stephanie Cohen, took a leave of absence.

By Gabrielle Saulsbery • June 14, 2023 -

Bittrex to open for customer withdrawals

The U.S. arm of Bittrex Global filed for bankruptcy last month following regulatory enforcement.

By Gabrielle Saulsbery • June 14, 2023 -

Citizens hires 50 ex-First Republic bankers in wealth-management buildout

The hires are meant to help Citizens establish a wider presence in metropolitan New York, Boston and Florida, and add new commercial banking capabilities on the West Coast.

By Dan Ennis • June 13, 2023 -

Credit Suisse CFO, others out as UBS deal closes

Roughly 20% of the 160 leadership positions at the combined bank are coming from Credit Suisse, a UBS spokesperson told Bloomberg. Meanwhile, Credit Suisse employees must adhere to a few new rules.

By Dan Ennis • June 12, 2023 -

Column

After TD, First Horizon appears ready for its hot bank summer

Investor events for both banks this week indicate each is eyeing aggressive growth. If they were people, they might be checking each other’s social-media feeds and engaging in a relationship detox.

By Dan Ennis • June 9, 2023 -

Goldman Sachs exec Stephanie Cohen goes on leave

“I have made the decision that taking some time away from work to focus on my family is the best choice,” the Platform Solutions chief wrote in a memo Friday, according to reports.

By Rajashree Chakravarty • June 9, 2023 -

Climate First mulls Florida exit after anti-ESG bill passes

In response to the legislation, the bank nixed its exclusionary list, outlining the sectors with which it has said it won’t do business, such as the fossil-fuel sector or other extractive industries.

By Anna Hrushka • June 9, 2023 -

Morgan Stanley, JPMorgan consider cutting ties with hedge fund

The move comes after the Financial Times published a report in which 13 women accused financier Crispin Odey of misconduct. The U.K.'s Financial Conduct Authority is investigating.

By Rajashree Chakravarty • June 8, 2023 -

Citizens to end car dealer financing business

The bank had $11.5 billion of auto loans outstanding as of March 31 — down 6.5% from the end of December, and 20.1% from March 31, 2022.

By Anna Hrushka • June 8, 2023 -

Morgan Stanley M&A chief to jump back to big law

Rob Kindler, a 17-year veteran of the bank who played crucial roles in the E*Trade and Eaton Vance acquisitions and the sale of a minority stake of Morgan Stanley to MUFG, will join law firm Paul Weiss after Labor Day.

By Dan Ennis • June 7, 2023 -

FTX’s legal team has its hands full

The bankrupt crypto exchange is fighting court battles on multiple fronts, and former CEO Sam Bankman-Fried’s attorneys say the U.S. government is overdue to supply evidence in its case against him.

By Gabrielle Saulsbery • June 7, 2023 -

GlobeNewsWire

https://www.globenewswire.com/en/news-release/2022/06/27/2469596/30865/en/Greystone-Appoints-Hafize-Gaye-Erkan-as-CEO.html

Column

ColumnCentral bank role would make ex-First Republic exec’s career path make sense

Once the heir apparent at First Republic, Hafize Gaye Erkan stunned the bank by hopping to a client — then leaving that job three months later. But she didn't have to bow to JPMorgan.

By Dan Ennis • June 6, 2023 -

UBS could close Credit Suisse deal next week

The Swiss bank may delay its second-quarter results until the end of August to give investors a clearer update on its plans for Credit Suisse’s domestic business, the Financial Times reported.

By Rajashree Chakravarty • June 5, 2023 -

Sponsored by West Monroe

Prioritizing governance, risk and compliance to build a lasting impact in banking

Only 53% of banks report being nimble enough to adopt risk-related improvements, meaning many banks will miss the opportunity to grow and win.

June 5, 2023 -

Fed issues consent order to Silvergate to ensure wind-down

Silvergate must submit a self-liquidation and wind-down plan within 10 days to the central bank and California’s Department of Financial Protection and Innovation.

By Gabrielle Saulsbery • June 2, 2023 -

TD’s Cowen shuts down crypto unit

Cowen had launched digital asset services in March 2022. An email seen by Bloomberg indicated May 31 was “the last day” for the unit and its 10 employees.

By Gabrielle Saulsbery • June 1, 2023 -

Goldman Sachs plans third round of job cuts

The reduction, said to affect fewer than 250 employees, could include partners and managing directors, a source told Reuters. It follows September and January cuts, and comes amid a stubborn dealmaking slump.

By Dan Ennis • May 31, 2023 -

Column

Asia’s pushing in. Europe’s pulling out. Mizuho and Citi show it’s not that simple

Japanese banks are doubling down on M&A, as U.S. and European banks forgo retail for wealth.

By Dan Ennis • May 30, 2023 -

Dimon deposed in Epstein suits

JPMorgan Chase's CEO said he wasn't involved in keeping the late convicted sex offender as a client for several years.

By Gabrielle Saulsbery • May 30, 2023 -

JPMorgan axing 1,000 First Republic employees

The nation's largest bank is bringing 85% of First Republic employees over with its purchase of the failed bank, leaving about 1,000 without offers.

By Gabrielle Saulsbery • May 26, 2023