Credit Unions

-

Illinois credit union to buy bank; NCUA closes Maryland credit union

Fewer CU-bank deals have been announced in 2025, and the NCUA has been plagued with changes.

By Gabrielle Saulsbery , Caitlin Mullen • Sept. 2, 2025 -

Connecticut credit union discloses data breach

Roughly 172,000 people’s information may have been exposed in a June cyber incident against North Haven-based Connex.

By Dan Ennis • Aug. 15, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

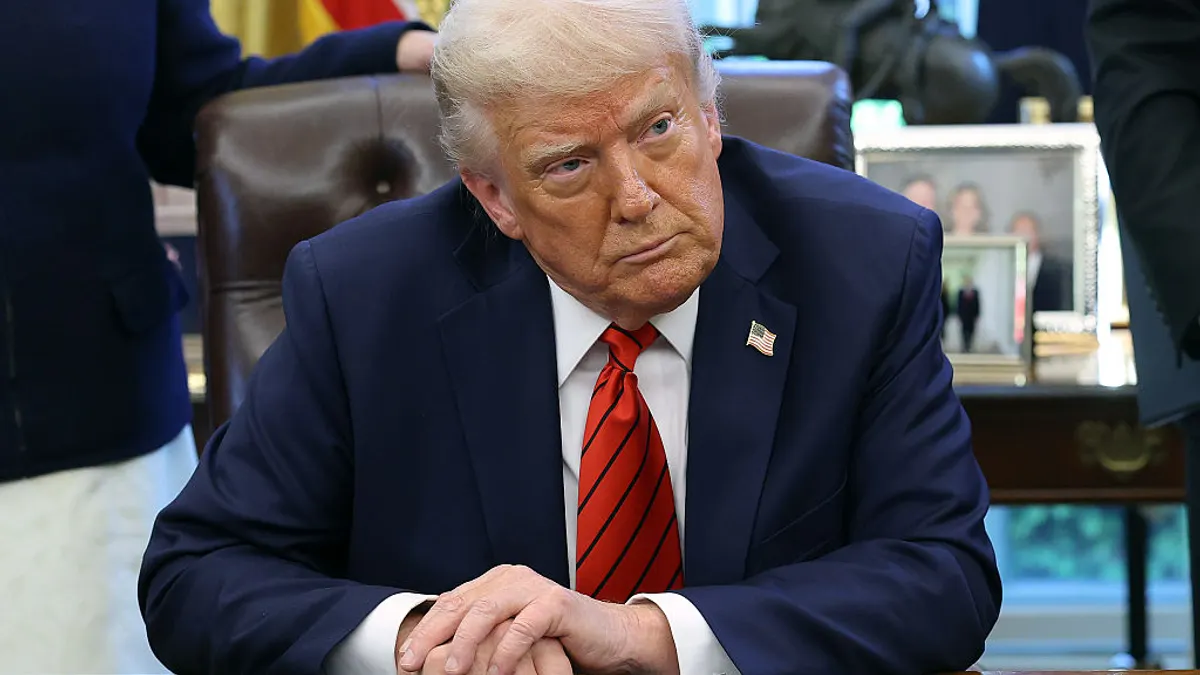

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Louisiana credit union to buy in-state bank

Heritage Nola’s nearly $26 million deal with OnPath Credit Union comes after the bank mutually terminated a merger proposal with a Louisiana lender, MC Bancshares.

By Rajashree Chakravarty • July 25, 2025 -

Judge reinstates fired NCUA members

President Trump fired Todd Harper and Tanya Otsuka in April, leaving one sole member to perform supervisory and enforcement duties over the U.S.’s more than 4,000 credit unions.

By Gabrielle Saulsbery • July 23, 2025 -

San Francisco credit union to buy California bank

The deal marks the eighth whole-bank purchase by a credit union announced this year.

By Rajashree Chakravarty • July 23, 2025 -

Senators demand details behind CFPB ending Navy Federal order

Sen. Ruben Gallego, D-AZ, led lawmakers accusing the bureau of “lip service” over its refocus toward “threats” to service members and veterans, in its “abrupt” reversal on a $95 million penalty against the credit union.

By Dan Ennis • July 21, 2025 -

CFPB drops $95M overdraft case against Navy Federal

The move is yet another example of the current bureau’s retreat from Biden-era consent orders.

By Rajashree Chakravarty • July 2, 2025 -

NCUA closes 2 credit unions in 2 days

The regulator closed Aldersgate Federal Credit Union and Butler Heritage Federal Credit Union; Aldersgate was placed in conservatorship last month, after operating in an “unsafe and unsound manner.”

By Rajashree Chakravarty • July 1, 2025 -

Banking conferences yet to come in 2025

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • June 27, 2025 -

Warren, Waters probe NCUA chair on Trump firings

A letter sent Friday follows up on “troubling information” received from the NCUA IG after the April firings of two board members.

By Rajashree Chakravarty • June 20, 2025 -

Idaho credit union to expand into Montana with bank buy

First Citizens Bank of Butte will be the sixth whole bank a credit union has announced it would acquire in 2025.

By Dan Ennis • May 2, 2025 -

NCUA’s Harper: Firings laying groundwork for Fed dismissals

“I think they’re chipping away, so that they can get to the Federal Reserve Board,” the former NCUA chair said Thursday of his and a fellow board member’s dismissal by the Trump administration.

By Caitlin Mullen • May 2, 2025 -

NCUA liquidates NJ credit union

Unilever Federal Credit Union, with roughly $46.6 million in assets, was declared insolvent and asked to cease operations Wednesday.

By Rajashree Chakravarty • May 1, 2025 -

Safe Harbor’s new CEO: ‘The idea is: grow’

Terry Mendez, who replaced Sundie Seefried this year at the helm of the cannabis banking pioneer, has cut costs and seeks to rebound after the company’s loss nearly tripled last year.

By Caitlin Mullen • April 30, 2025 -

Fired NCUA board members sue Trump

Todd Harper and Tanya Otsuka’s removals were “patently unlawful," the lawsuit claims. Two lawmakers wrote the NCUA’s inspector general Tuesday asking how a one-member NCUA board can operate.

By Gabrielle Saulsbery • April 29, 2025 -

MidFlorida Credit Union buys Tallahassee bank

Acquiring Prime Meridian Bank would give MidFlorida a physical presence in the state’s panhandle. It's the credit union’s third bank purchase since 2019.

By Dan Ennis • April 23, 2025 -

Oregon credit union to buy in-state bank

Salem-based Maps Credit Union’s purchase of Lewis & Clark Bank marks the fourth whole-bank acquisition proposed by a credit union this year.

By Dan Ennis • April 16, 2025 -

Credit union trade group chief to retire

Jim Nussle will retire as CEO of America's Credit Unions, though no exact date was given. Nussle plans to remain until a successor is found.

By Rajashree Chakravarty • April 7, 2025 -

Alabama credit union to acquire in-state community bank

Legacy Community Federal Credit Union’s move to buy Cullman-based First Community Bank is the third proposed acquisition of a bank by a credit union this year.

By Rajashree Chakravarty • March 19, 2025 -

Illinois’ NuMark Credit Union to buy in-state bank

The deal for The Lemont National Bank, expected to close in the second half of 2025, is the second proposed acquisition of a bank this year by a credit union.

By Rajashree Chakravarty • March 13, 2025 -

Golden 1 CFO sees culture fit as crucial in hiring

Keeping credit union membership at top of mind sometimes means tweaking the "pure math" approach to solutions, Golden 1 CFO Allyson Hill said.

By Grace Noto • March 5, 2025 -

Fed delays start of new Fedwire standard

The central bank postponed a deadline for banks and credit unions to move Fedwire payments to the ISO 20022 format. That may also hold up a broader industry modernization effort.

By Lynne Marek • Feb. 19, 2025 -

Deep Dive

Banking sector girds for M&A uptick in 2025

Bank M&A rebounded in 2024, with six deals over $1 billion announced. The Fed approved the two largest before the Trump administration took office. But where to go from here?

By Rajashree Chakravarty • Jan. 31, 2025 -

California credit union to buy in-state bank

The $56.4 million acquisition of Community Valley Bank will give Frontwave Credit Union $315.8 million in added assets, five locations and entry to Imperial County.

By Rajashree Chakravarty • Jan. 23, 2025 -

Massachusetts, Michigan deals push credit union-bank record to 22

Not every deal crosses the finish line, though. Atlanta Postal Credit Union and Affinity Bank terminated their proposed combination Monday.

By Rajashree Chakravarty • Jan. 2, 2025