Fintech: Page 10

The latest fintech news for banking professionals.

-

Q&A

Sezzle evolves alongside BNPL industry

The company now offers more products but also faces more regulatory pressure, Sezzle CEO Charlie Youakim said.

By Patrick Cooley • Sept. 25, 2024 -

NY credit union-bank tie-up pushes 2024 to brink of M&A record

Rochester-based ESL's proposed acquisition of Generations Bancorp is the 16th announced whole-bank purchase by a credit union this year, tying it with 2022.

By Rajashree Chakravarty • Sept. 24, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

NY’s Five Star Bank pivots away from BaaS

The bank cited regulators’ changing expectations. Banking-as-a-service accounts for 2% of Five Star’s deposits and less than 1% of its loans and two of its 12 clients have already begun offboarding, it said.

By Dan Ennis • Sept. 20, 2024 -

Evolve Bank ‘failed in its most basic duty,’ stole from customers: lawsuit

The allegations come from Yotta Technologies, a fintech that says its customers are currently locked out of more than $100 million in funds.

By Gabrielle Saulsbery • Sept. 18, 2024 -

Brex rolls out embedded payments tool

With the new offering, the fintech aims to capture a larger share of the B2B payments market, working with partners in addition to selling directly, Brex's president said.

By Rajashree Chakravarty • Sept. 18, 2024 -

Lawmakers push for crackdown on fintech, ban on false claims

Sens. Elizabeth Warren and Chris Van Hollen demanded tighter regulations on BaaS and fintech partnerships, saying they pose “a broader threat to the stability of our banking system and the economy.”

By Rajashree Chakravarty • Sept. 13, 2024 -

Retrieved from OCC.

Retrieved from OCC.

Innovation may slow amid bank-fintech partnership scrutiny: analysts

Additional guardrails, however, are necessary as business connections grow more complex and as fintechs tackle more compliance responsibilities, a regulator said.

By Suman Bhattacharyya • Sept. 11, 2024 -

FIS draws fintech startups into accelerator

Fidelity National Information Services this week continued an annual program backing young fintechs that are striving to disrupt the financial services landscape.

By Lynne Marek • Sept. 11, 2024 -

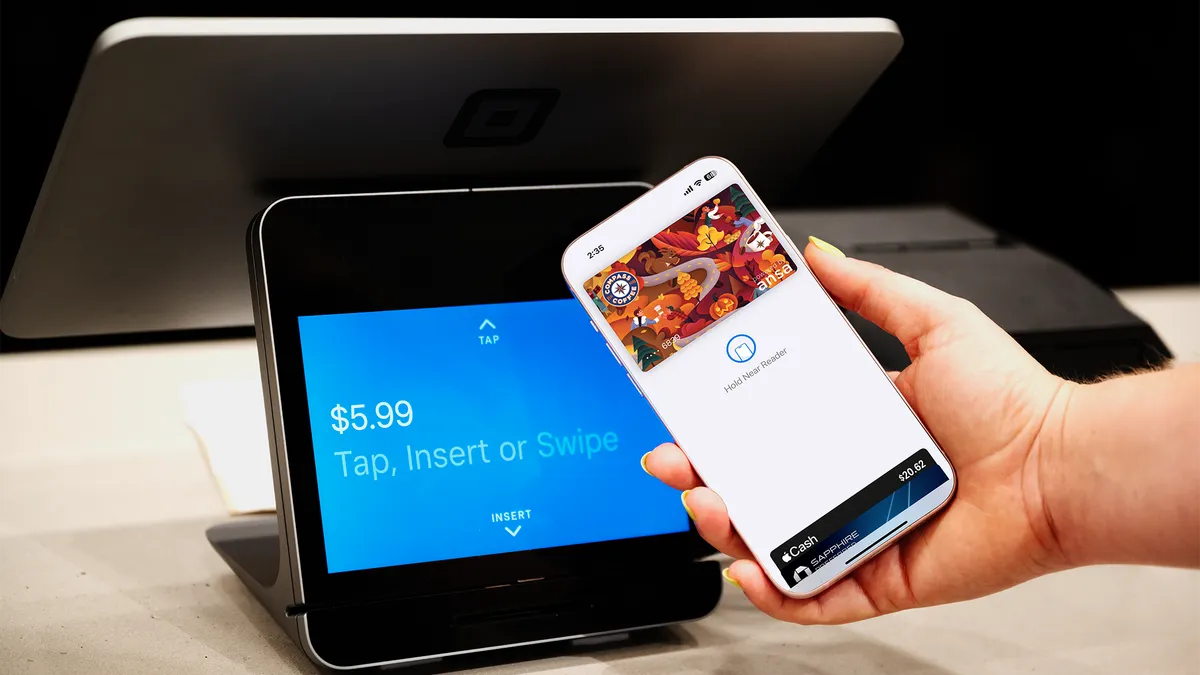

Ansa debuts in-store digital wallet capabilities

Ansa last week launched a software development kit, which can be integrated into a brand’s mobile app. “The pain’s on our side to make sure all their systems talk,” co-founder Sophia Goldberg said.

By Gabrielle Saulsbery • Sept. 11, 2024 -

Airwallex eyes embedded payments in globalization push

Headcount increases in Brazil and Mexico are among the “immediate bets” the company is making, executive GM Ravi Adusumilli said.

By Grace Noto • Sept. 10, 2024 -

Debt recovery software firm acquires SpringFour

Under the acquisition by C&R Software, social impact fintech SpringFour plans to continue innovating and bringing new solutions and products to the collections and debt recovery market.

By Rajashree Chakravarty • Sept. 4, 2024 -

Custodia cuts 25% of its staff amid Fed lawsuit: report

The digital asset-focused bank, chartered in Wyoming, is putting its resources toward an ongoing lawsuit with the Federal Reserve, which denied the lender a master account last year.

By Gabrielle Saulsbery • Aug. 30, 2024 -

Fed’s Waller questions faster cross-border payments ties

There could be more fraud and money laundering if countries move too quickly to link their faster payments systems, the central bank governor said Wednesday at a conference.

By Lynne Marek • Aug. 29, 2024 -

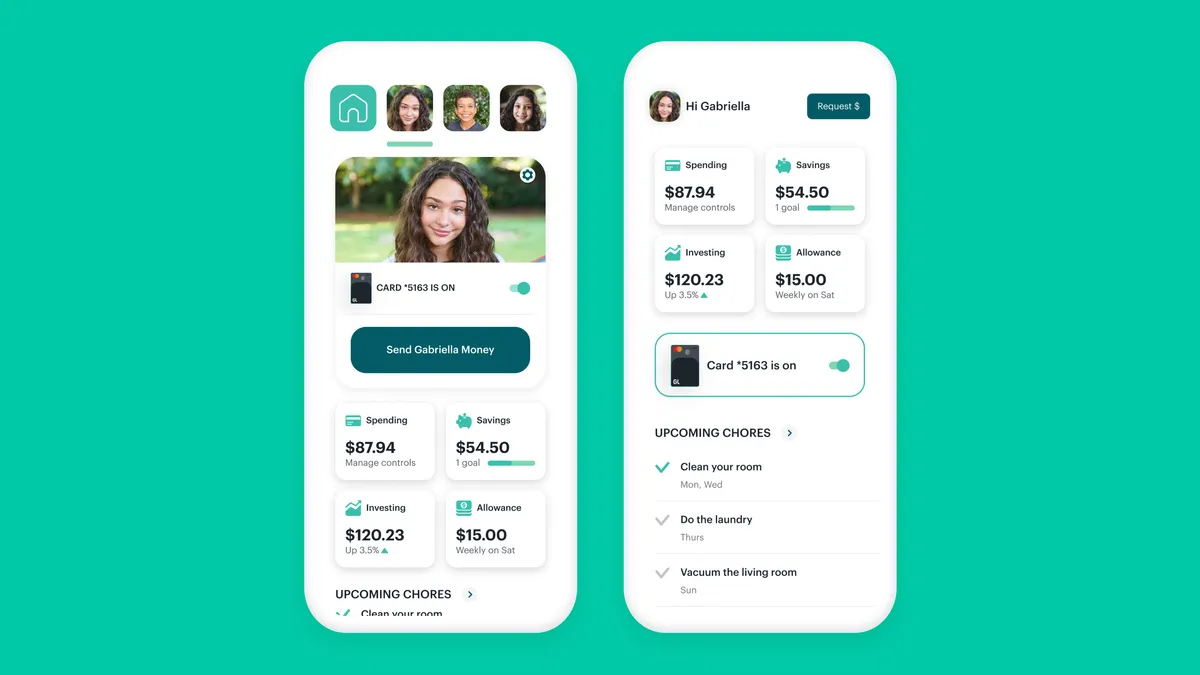

Q&A

Greenlight CEO talks partnerships, forthcoming features

Going beyond its banking scope, the fintech that caters to parents and kids sees safety as an area of continued opportunity, said CEO and co-founder Tim Sheehan.

By Caitlin Mullen • Aug. 28, 2024 -

Unit launches business continuity tool for bank partners of fintechs that fail

If a fintech powered by one of Unit’s partner banks fails, the bank can immediately connect to end users, with no service disruption, CEO Itai Damti said.

By Gabrielle Saulsbery • Aug. 28, 2024 -

MoneyGram, Adyen add chief technology officers

The payments companies are bolstering their tech leadership as big changes roil the industry and stoke competition.

By Lynne Marek • Aug. 28, 2024 -

Aeropay targets pay-by-bank evolution in US

The Chicago fintech has moved from servicing small merchants to handling cannabis payments, and now it’s catering to gaming clients.

By Lynne Marek • Aug. 27, 2024 -

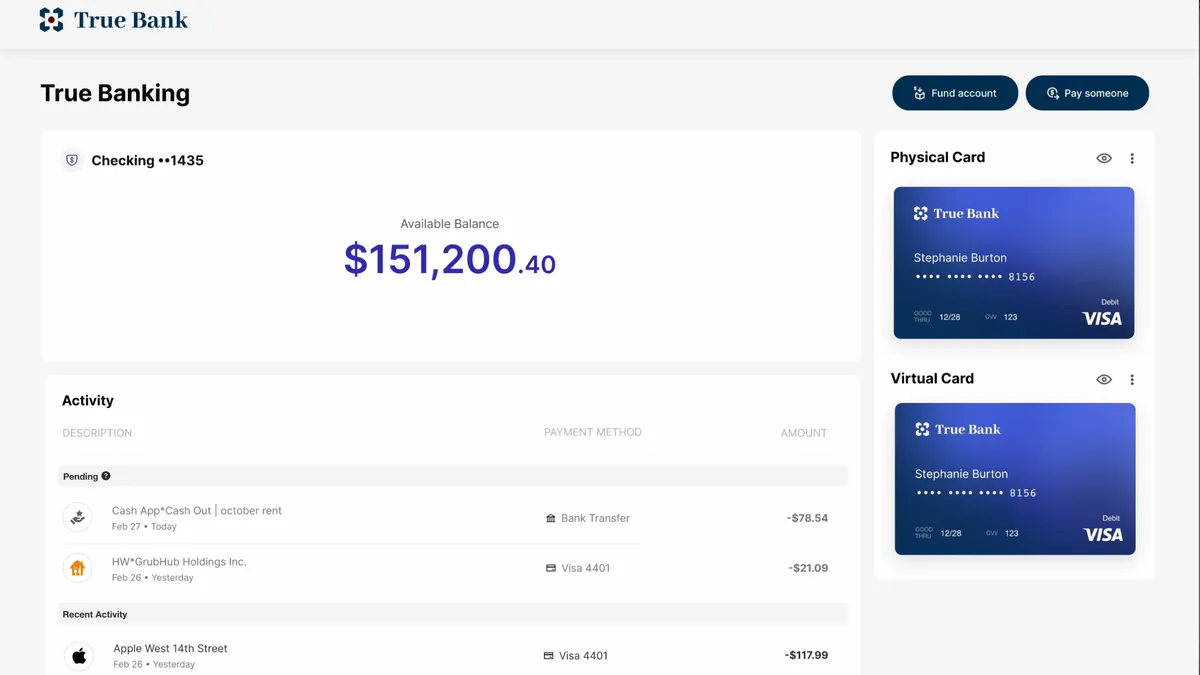

Sponsored by Giesecke+Devrient (G+D)

The power of issuance-as-a-service in the phygital era

Discover how Issuance-as-a-Service is revolutionizing the card issuance process, enabling banks to seamlessly integrate physical and digital services.

By Mehdi Heidari is the head of product management digital issuance at Giesecke + Devrient (G+D). For more information, please visit www.gi-de.com/en/. • Aug. 26, 2024 -

Lettuce Financial gets $15M in fresh funding

The tax and accounting fintech has had a busy year announcing two funding rounds, launching a major product and inking several partnerships to serve the solopreneur community.

By Gabrielle Saulsbery • Aug. 21, 2024 -

Q&A

Marqeta CEO says his platform is no ‘single-trick pony’

Simon Khalaf cites the need for banks to change their behavior to focus on customer service. He also says upcoming underwriting tech could put the banking sector “on steroids.”

By Rajashree Chakravarty • Aug. 21, 2024 -

Revolut valued at $45B

The British fintech has completed a secondary share sale with new and existing investors to provide liquidity to employees.

By Gabrielle Saulsbery • Aug. 16, 2024 -

Klarna jumps into banking business

The Swedish buy now, pay later company will let consumers use savings accounts to make payments, receive refunds and earn cash rewards from some retailers.

By Lynne Marek • Aug. 15, 2024 -

Fintechs ramp up lobbying over earned wage access, crypto, AI

Chime, PayPal and Block, for example, spent more on lobbying in the first half of 2024 than for the same span last year, OpenSecrets reported.

By Suman Bhattacharyya • Aug. 14, 2024 -

Tally sunsets over failure to raise capital

After nine years of operation, "we have made the difficult and sad decision to shut down Tally,” due to lack of funds, founder and CEO Jason Brown said in a LinkedIn post Monday.

By Rajashree Chakravarty • Aug. 14, 2024 -

How embedded payments are changing the way we pay

As payments technology advances, more companies are embedding the payments process in websites and apps. Here’s a primer on how this trend is advancing and changing the payments arena.

By Patrick Cooley • Aug. 14, 2024