Fintech: Page 12

The latest fintech news for banking professionals.

-

Senators prod Synapse partners to return customer funds

“As those that made the current situation possible, you must accept the tremendous responsibility that comes with handling consumers’ money,” lawmakers scolded.

By Caitlin Mullen • July 2, 2024 -

FDIC orders Thread Bank to step up BaaS oversight

The Rogersville, Tennessee-based bank must implement a documented risk assessment of its fintech partners, the agency said. The bank’s board also must approve risk tolerance thresholds.

By Caitlin Mullen • July 1, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Crypto firm Abra settles with 25 states for operating without a license

Abra agreed to repay customers some $82 million in crypto. CEO Bill Barhydt said all but $2 million, yet to be claimed, has been repaid.

By Gabrielle Saulsbery • June 27, 2024 -

Funding Circle sells its US unit, returns SBLC license

iBusiness Funding, a subsidiary of Ready Capital, agreed to acquire the fintech for roughly $42 million. In March, Funding Circle's CEO said it was exploring the sale of its U.S. unit.

By Rajashree Chakravarty • June 26, 2024 -

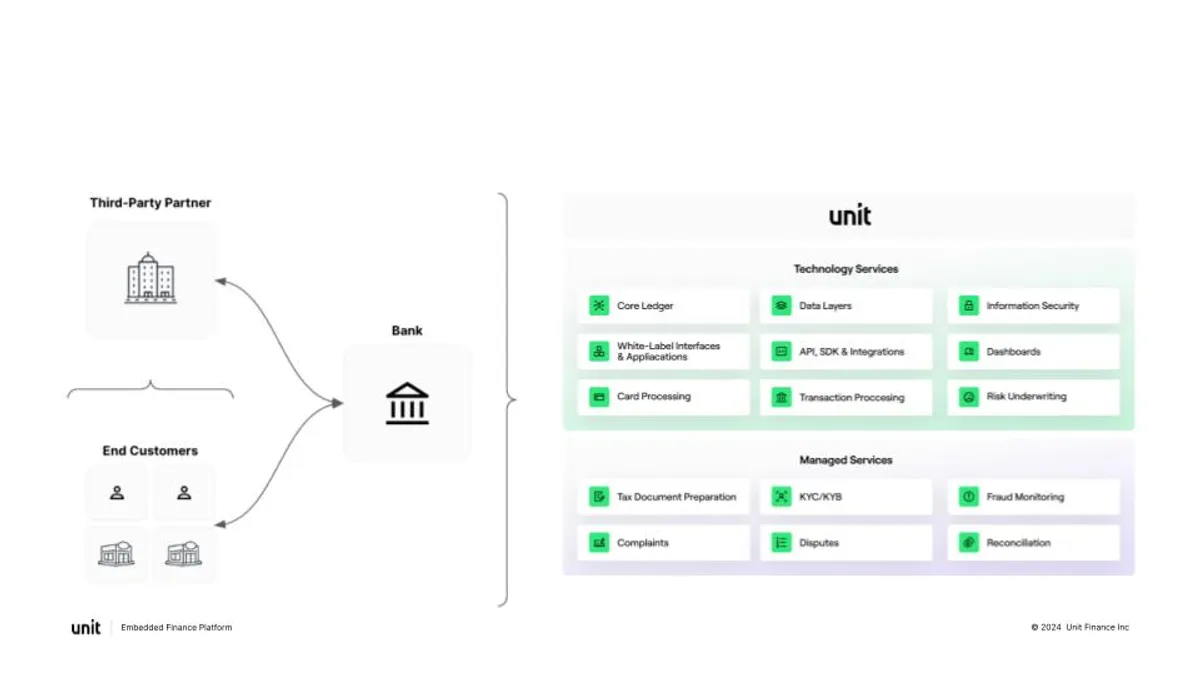

Unit Finance cuts 15% of staff

The embedded finance fintech “has always maintained a large balance sheet, and the changes we are making today will further solidify our strength,” founders Itai Damti and Doron Somech said.

By Gabrielle Saulsbery • June 18, 2024 -

JPMorgan, Greek fintech get a roadmap to bridge their dispute

A London judge detailed how Viva Wallet should be valued. Previous estimates — and the fine print in a deal that gave JPMorgan a minority stake in the fintech — have sparked lawsuits on both sides.

By Dan Ennis • June 17, 2024 -

Fed hits Synapse partner Evolve with enforcement action

An exam last year revealed Evolve Bank & Trust didn’t have an effective risk management framework in place for its fintech partnerships, the Fed said.

By Caitlin Mullen • June 14, 2024 -

Column

Dive Deposits: In HSBC’s eyes, Revolut can have Canary Wharf

The fintech signed a deal to occupy a high-rise alongside G-SIBs. But Revolut's coup — grabbing 40% more office space to match its 40% headcount bump — comes as the U.K.'s biggest bank is leaving the area.

By Dan Ennis • June 14, 2024 -

Terraform Labs, Do Kwon to settle with SEC for $4.47B

Meanwhile, Kwon remains in Montenegro as courts wrestle with whether or not to extradite him to his home country of South Korea or to the U.S. to face charges.

By Gabrielle Saulsbery • June 13, 2024 -

Brex moves to single-CEO model

Pedro Franceschi will become sole chief executive, while co-founder Henrique Dubugras will move to board chair as the company aims for a 2025 IPO.

By Dan Ennis • June 13, 2024 -

Synapse trustee McWilliams finds $85M gap in frozen funds

Partner banks of the bankrupt fintech middleman hold roughly $180 million in demand deposit and for-benefit-of accounts associated with end users. But those users are owed $265 million, a court filing shows.

By Dan Ennis • June 12, 2024 -

Apple unveils new iPhone touch and pay feature

The P2P ‘Tap to Cash’, which enables iPhone users to transfer money by holding their phones together, was unveiled along with a slate of other features Monday.

By Patrick Cooley • June 12, 2024 -

Ex-Bank of America lawyer builds female-focused investment app

A beta version of WealthMeUp, an application designed to help women navigate investment and address the disparity between how men and women look at the space, launched Tuesday.

By Rajashree Chakravarty • June 12, 2024 -

Robinhood leans further into crypto with $200M Bitstamp deal

Acquiring the crypto exchange would embed the brokerage deeper in digital assets and help it trade a greater variety of tokens in more markets globally.

By Dan Ennis • June 12, 2024 -

Rivals Adyen, Stripe partner with Capital One to combat fraud

The three companies announced last Wednesday that they are teaming up to launch a free service intended to combat fraud and reduce the amount of transactions that are improperly declined.

By Patrick Cooley • June 10, 2024 -

Yotta CEO: 85K customers lose access to funds due to Synapse-Evolve tussle

The fintech’s customers, who have a combined $112 million in savings, have been locked out of their accounts amid the Synapse-Evolve Bank & Trust dispute, Yotta CEO Adam Moelis told CNBC.

By Rajashree Chakravarty • June 5, 2024 -

SoFi hires JPMorgan, Citi alum as general counsel

Stephen Simcock, recent general counsel for consumer banking at JPMorgan, replaces Rob Lavet, who is retiring.

By Dan Ennis • June 5, 2024 -

Fintech Copper burned by Synapse collapse

The teen-focused fintech had to shut down its bank deposit accounts and debit cards mid-month — an earlier wind-down than expected due to turmoil experienced by its middleware provider, Synapse.

By Rajashree Chakravarty • May 29, 2024 -

N26 readies for a post-cap future

Germany's financial regulator will drop its limit on the fintech's growth June 1. N26's CEO said the cap has cost billions in lost valuation. But its compliance systems can handle an increased load.

By Dan Ennis • May 29, 2024 -

Klarna uses AI to save $10M on marketing annually while upping output

More than one-third of the Stockholm-based fintech’s marketing savings in Q1 are attributable to AI.

By Chris Kelly • May 29, 2024 -

Visa preps for US pay-by-bank services

The card network is focused on “stubborn categories” where large account-to-account payments have taken hold, such as in healthcare, education and rent, a Visa executive said.

By Lynne Marek • May 28, 2024 -

Paze targets nationwide coverage by year-end shopping season

The big bank-backed digital wallet is now accepted by about 80,000 “primarily small” merchants, according to James Anderson, managing director at Early Warning Services.

By James Pothen • May 28, 2024 -

Q&A

Compliance is an ‘opportunity to showcase integrity’: Maast CEO Jonathan O’Connor

O’Connor became Maast CEO, and chief-third party payments officer of its parent company Synovus Financial, earlier this year.

By Gabrielle Saulsbery • May 22, 2024 -

Varo Bank faces lawsuit over March data breach

The lawsuit accuses the online bank of failing to protect personal information stored within its network, including customer phone numbers and the last four digits of Social Security numbers.

By Rajashree Chakravarty • May 22, 2024 -

CFPB sues SoLo Funds, alleging it concealed costs from borrowers

The fintech's tip structure inflates the APR on loans, but most loans aren't funded unless a tip is included. And the option not to donate was hidden, the regulator argued.

By Dan Ennis • May 22, 2024