Payments: Page 10

-

Citi moves deeper into e-commerce through digital couponing

The bank recently launched a browser extension that searches for coupons on merchant checkout pages, suggests applicable codes and can activate cash-back offers.

By Suman Bhattacharyya • Feb. 12, 2024 -

Q&A

Banks should step up scam response: fraud expert

With regulators gearing up to take a stronger stance against digital payments fraud, banks must focus on how they handle scams, one executive says.

By Caitlin Mullen • Feb. 9, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Ex-Heartland Tri-State CEO charged with embezzling $47M in crypto

A Heartland customer told authorities he saw a red flag when Shan Hanes, the bank’s CEO until July, asked him for $12 million to help take his money out of a crypto investment, according to Bloomberg.

By Gabrielle Saulsbery • Feb. 8, 2024 -

Fleet fintech ditches Visa for Mastercard

Fuel card startup AtoB, with $112 million in financial backing, plans to take on dominant fleet service rivals Wex and Fleetcor.

By Lynne Marek • Feb. 6, 2024 -

Yellen asks Congress for stablecoin legislation

Treasury Secretary Janet Yellen renewed a call for Congress to act on digital assets, saying “there is no appropriate regulatory framework.”

By James Pothen • Feb. 6, 2024 -

Why ‘pay-by-bank’ faces adoption hurdles in US retail

Pay-by-bank has been catching on slowly, and it’s a particularly long shot for showing up at the point of sale any time soon.

By Suman Bhattacharyya • Feb. 5, 2024 -

Celsius emerges from bankruptcy after 18 months

As part of its bankruptcy exit, the crypto exchange is distributing $3 billion to creditors and launching a Bitcoin mining firm.

By Gabrielle Saulsbery • Feb. 2, 2024 -

One in four companies ban GenAI

The research by Cisco found that generative artificial intelligence tools are putting many companies’ sensitive data at increased risk of public exposure.

By Alexei Alexis • Jan. 30, 2024 -

Rivals may chase Fiserv special bank charter lead

If the payments giant receives a special Georgia charter and gains access to the card networks, it could open the floodgates for other merchant acquirers, attorneys said.

By Caitlin Mullen • Jan. 25, 2024 -

Carlyle expands its reach on student loans as banks back out

The private-equity firm bought a $415 million portfolio, reportedly from Truist, and invested in student loan specialist Monogram.

By Dan Ennis • Jan. 25, 2024 -

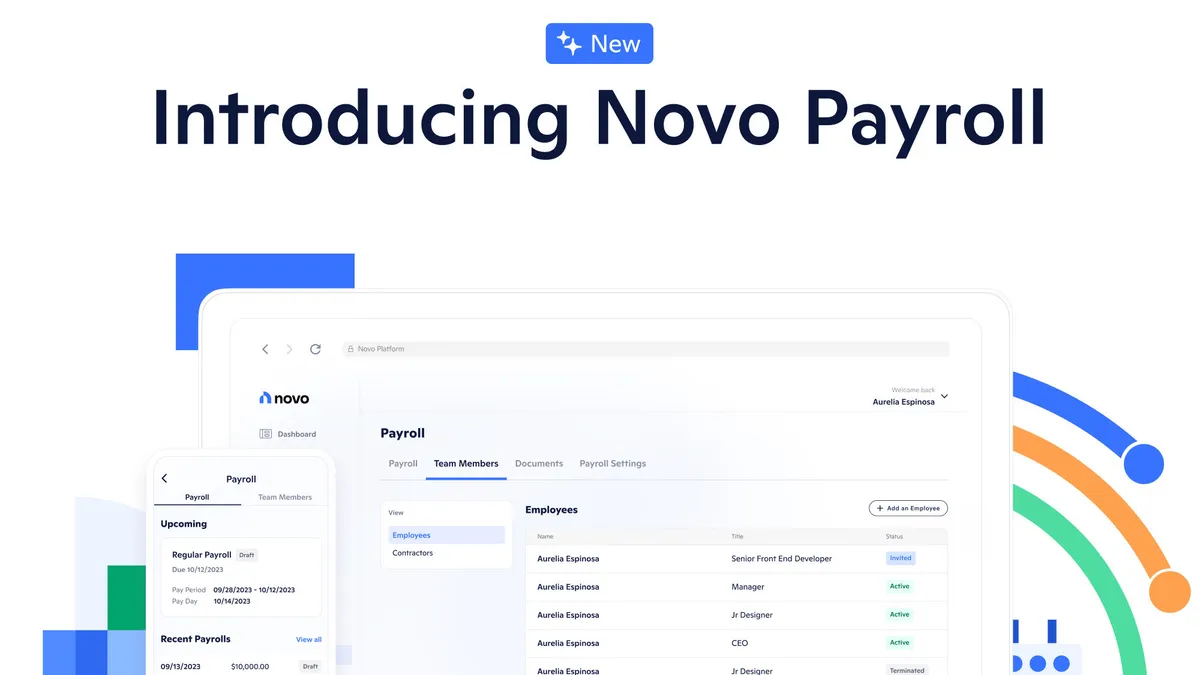

Novo rolls out an embedded payroll tool for small businesses

Powered by Check, the new tool, Novo Payroll, aims to help small businesses manage their finances from a single platform.

By Rajashree Chakravarty • Jan. 24, 2024 -

Klarna adds subscription plan

With an IPO on the horizon, the BNPL firm is offering customers a subscription service for $7.99 per month.

By Caitlin Mullen • Jan. 24, 2024 -

Retrieved from LinkedIn on January 23, 2024

Jack Henry vaults COO to CEO seat

Greg Adelson, the company’s current president and chief operating officer, will take the reins from outgoing CEO David Foss in July.

By James Pothen • Jan. 23, 2024 -

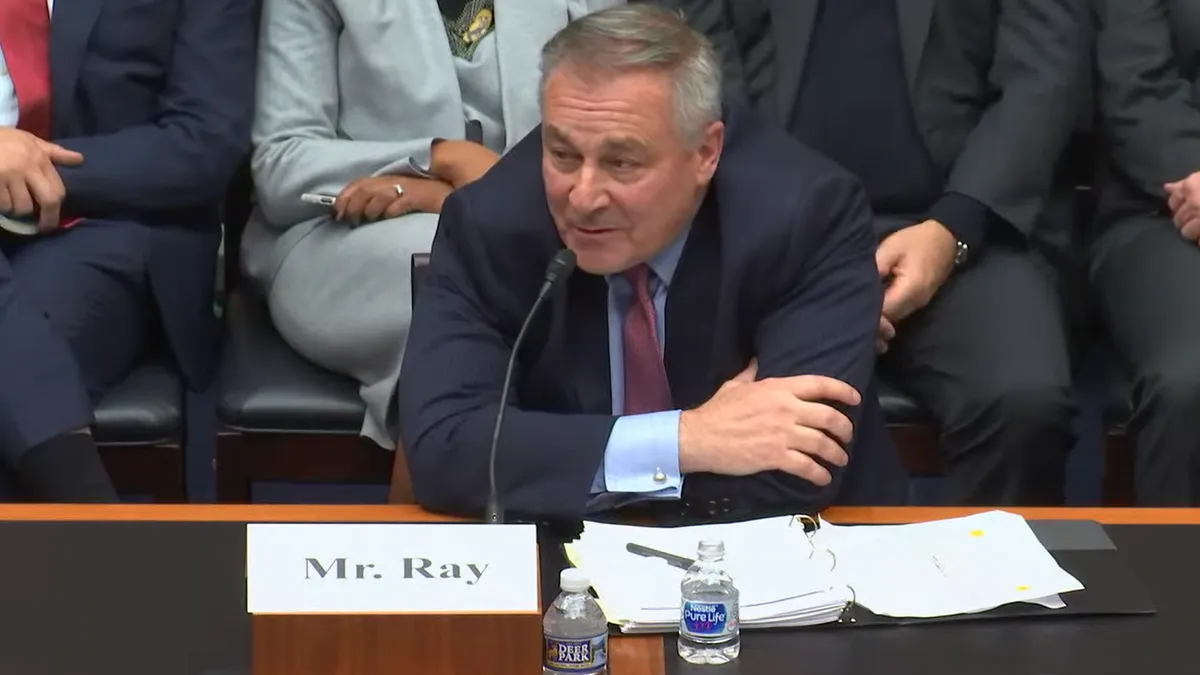

Binance, SEC face off in court

For the second time in one week, the Securities and Exchange Commission sought to convince a judge that crypto is a security, and a crypto company sought to convince her of the opposite.

By Gabrielle Saulsbery • Jan. 23, 2024 -

Synchrony to buy Ally’s point-of-sale lending unit

The deal, expected to close this quarter, includes relationships with nearly 2,500 merchant locations and more than 450,000 active borrowers in home improvement services and healthcare, the companies said.

By Rajashree Chakravarty • Jan. 23, 2024 -

FedNow draws some banks, as others lag

The Federal Reserve is building up bank participation in FedNow, but big financial institutions such as Bank of America, Citi, PNC and Capital One, remain on the sidelines — for now.

By Lynne Marek • Jan. 19, 2024 -

Coinbase, SEC face off in court

Coinbase is seeking the dismissal of an SEC lawsuit which accused the crypto exchange of trading more than a dozen tokens that should have been registered as securities.

By Gabrielle Saulsbery • Jan. 18, 2024 -

Visa picks fintech startups for accelerator

A debt repayment app startup and a small business lender are among the U.S. startups selected by the card network and its partner this year.

By Tatiana Walk-Morris • Jan. 17, 2024 -

Fiserv seeks special-purpose bank charter

The designation would allow the payment processor to own transactions from end-to-end, removing the need for a bank partner.

By Caitlin Mullen • Jan. 12, 2024 -

X plans payments launch for this year

“I would be surprised if it takes longer than the middle of [2024] to roll out payments,” X owner Elon Musk said during a conversation last month with Ark Invest CEO Cathie Wood.

By James Pothen • Jan. 10, 2024 -

Remitly taps ads to woo new clients

The cross-border payments company has boosted marketing to build up its remittance clientele.

By Lynne Marek • Jan. 10, 2024 -

Q&A

Visa leans on fintech partners

Teaming with emerging fintechs is “a way of staying very, very relevant,” said Jim Schinella, Visa’s global head of digital partnerships.

By Caitlin Mullen • Dec. 20, 2023 -

U.S. Bank fined $36M over freezes of COVID-era unemployment benefits

The Minneapolis-based lender flagged a CFPB probe into prepaid card use last year. The OCC added a separate penalty Tuesday.

By Dan Ennis • Dec. 20, 2023 -

Don’t know what a digital wallet is? We’ve got you covered.

This primer fills in the gaps on how digital wallets work, what companies compete to provide such payment tools and what to expect from them in the future.

By James Pothen • Dec. 20, 2023 -

FTX files plan to end its expensive bankruptcy

The plan values assets at their Nov. 11, 2022, rate, which is much lower than their value today. Bitcoin, for example, has more than doubled in price since then.

By Gabrielle Saulsbery • Dec. 19, 2023