Payments: Page 14

-

FedNow goes live for banks, credit unions

The Fed’s long-awaited instant payments system stands to give consumers and businesses a new route for speedier transactions.

By Lynne Marek • July 20, 2023 -

Cannabis fintech Dama Financial looks to double sponsor bank network

Dama Financial’s network of sponsor banks holds the deposits for cannabis-related businesses which, due to conflicting state and federal laws, often operate outside of the banking sector.

By Anna Hrushka • July 19, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Retrieved from Consumer Financial Protection Bureau.

Retrieved from Consumer Financial Protection Bureau.

CFPB, European regulator open a dialogue on digital rules

Buy now, pay later platforms, artificial intelligence and other developments “if left unchecked, could increase consumers’ exposure to fraud and manipulation,” the regulators said Monday.

By Rajashree Chakravarty • July 18, 2023 -

Synchrony braces for late-fee rule

The CEO of the private-label card issuer expects a final rule on the CFPB’s proposed credit card late-fee cap later this year, and litigation could follow, he said.

By Caitlin Mullen • July 18, 2023 -

Fintech funding drops in Q2

While there was a drought of venture capital for payments startups and other fintechs in the first half of the year, industry reports spot potential for new flows in the second half.

By Lynne Marek • July 18, 2023 -

The image by Aeroplanepics0112 is licensed under CC BY-SA 3.0

The image by Aeroplanepics0112 is licensed under CC BY-SA 3.0

Cleveland Fed chief touts FedNow’s fraud tools

In the run-up to the instant payments system’s launch this month, the reserve bank president spelled out some of FedNow’s anti-fraud features.

By Lynne Marek • July 14, 2023 -

Apple debuts recurring payments

The tech giant, now valued at $3 trillion, is continuing to expand its financial offerings after debuting a buy now, pay later feature and a savings account earlier this year.

By James Pothen • July 14, 2023 -

Photo by Levi Meir Clancy on Unsplash

Twitter snags money transfer license in Arizona

That’s the fourth state in which the social media company has received a license, inching it closer to creating the payments tool and super-app envisioned by owner Elon Musk.

By James Pothen • July 12, 2023 -

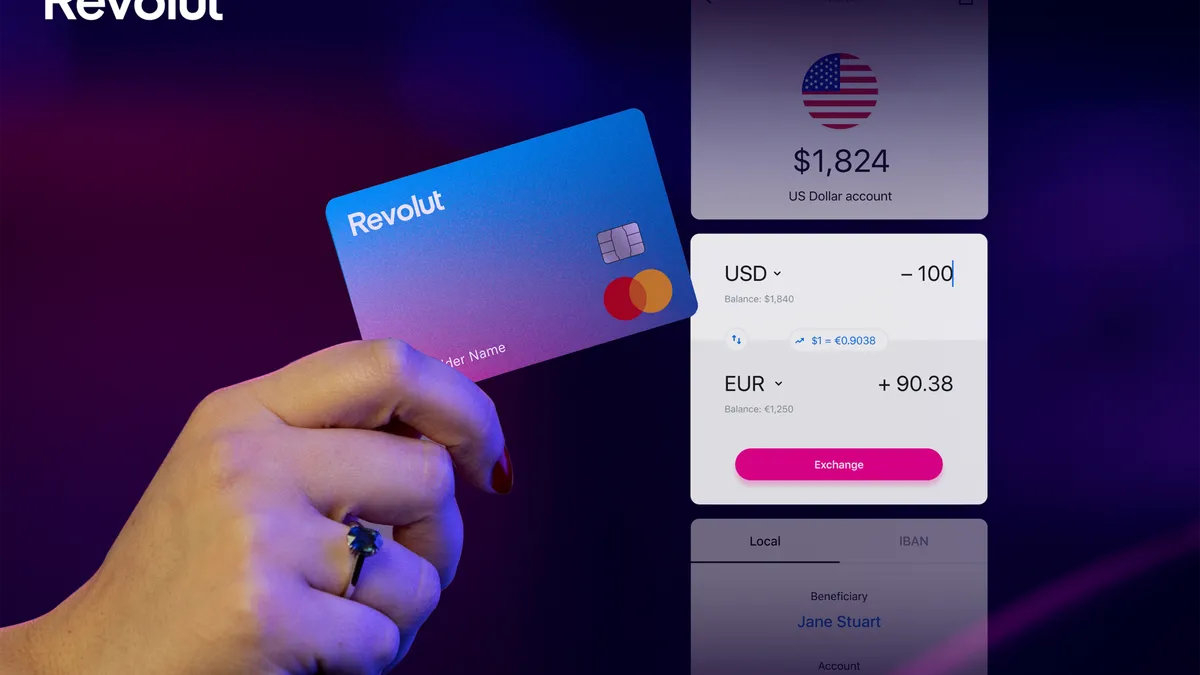

Criminals stole $20M from Revolut via payment loophole: report

Differences in the firm’s U.S. and European systems meant the neobank would use its own money to erroneously refund certain declined payments, the Financial Times reported.

By Anna Hrushka • July 10, 2023 -

Kraken ordered to hand over user info to IRS

The IRS requested the information earlier this year, but Kraken refused. The tax agency then asked a judge to enforce a summons issued to the exchange’s holding company.

By Gabrielle Saulsbery • July 6, 2023 -

Goldman in talks to transfer Apple card deal to Amex: reports

The move, if true, would mark a 180-degree turn after the bank and tech giant extended their partnership until 2029 in October.

By Gabrielle Saulsbery • July 5, 2023 -

Fed lists 57 FedNow participants as report notes system’s downside

JPMorgan Chase, Wells Fargo, BNY Mellon and U.S. Bank are among the soon-to-launch real-time payments system’s early adopters, while Bank of America, Citi, PNC, Capital One and Truist are not.

By Lynne Marek • June 30, 2023 -

Visa to acquire Pismo for $1B

Visa said it has agreed to acquire the Brazilian company to provide more card issuing and banking services to fintechs and financial institutions.

By Lynne Marek • June 29, 2023 -

Remittance fintech launches neobank

Piermont Bank will provide the underlying banking services for Sendwave Pay, which offers users a debit card and reimbursements for international transaction fees when the card is used outside of the U.S.

By Anna Hrushka • June 28, 2023 -

Fraudsters stole more than $200B in COVID relief loans, watchdog says

At least 17% of $1.2 trillion disbursed through the pandemic-era PPP and EIDL programs may have gone to questionable characters, the SBA's Office of Inspector General said Tuesday.

By Gabrielle Saulsbery • June 28, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

FedNow battles conspiracy theories

The central bank has launched a marketing campaign aimed at debunking disinformation that derides the real-time payments system, set to roll out next month, as a government power grab.

By Lynne Marek • June 28, 2023 -

Capital One expands travel perks with curated list of boutique hotels

The bank’s Lifestyle Collection builds upon earlier travel-related offerings, including revamps to airport lounges and an acquisition this month of digital concierge platform Velocity Black.

By Noelle Mateer • June 28, 2023 -

Square tests credit card for merchants

The card aimed at providing more financial services to merchants comes amid a slew of competition to serve that clientele.

By Caitlin Mullen • June 28, 2023 -

Amex promotes deputy to CFO

When longtime American Express CFO Jeff Campbell exits in August, the company’s deputy CFO, Christophe Le Caillec, will take the top financial post.

By Caitlin Mullen • June 27, 2023 -

Plaid launches anti-fraud network for banks, fintechs

The collaborative anti-fraud network is “designed to stop the chain reaction of fraud that occurs when identities are stolen and accounts are compromised,” the company said.

By Anna Hrushka • June 23, 2023 -

Robinhood to buy card startup X1 in $95M deal

The online brokerage said it will take on X1 employees, including co-founders Deepak Rao and Siddharth Batra, but did not specify how many.

By Lynne Marek • June 23, 2023 -

US servicemembers ensnared by digital payment app scams

Servicemember complaints about digital payment apps surged last year, according to a CFPB report, which also highlighted military families’ susceptibility to payments fraud.

By Lynne Marek • June 22, 2023 -

Shopify taps Adyen in bid for bigger clients

Canadian e-commerce company Shopify is upgrading its integration with Dutch fintech Adyen in an effort to serve larger merchants in North America and on the international stage.

By Caitlin Mullen • June 21, 2023 -

Deutsche Bank applies for crypto custody license

BlackRock and a Charles Schwab-backed platform have entered or clearly made plans to broach the cryptosphere in the past week, which could bode well for crypto-native companies.

By Gabrielle Saulsbery • June 21, 2023 -

Visa hires CFO replacement

The card giant has selected Chris Suh as its new finance chief. The Electronic Arts and Microsoft veteran will receive a $3 million signing bonus and $20 million in longer-term compensation.

By Lynne Marek • June 20, 2023