Payments: Page 2

-

MoneyGram CEO targets digital remake

Anthony Soohoo is tackling a digital transformation of the legacy cross-border payments company, leaning on experience at Walmart and Apple.

By Lynne Marek • June 4, 2025 -

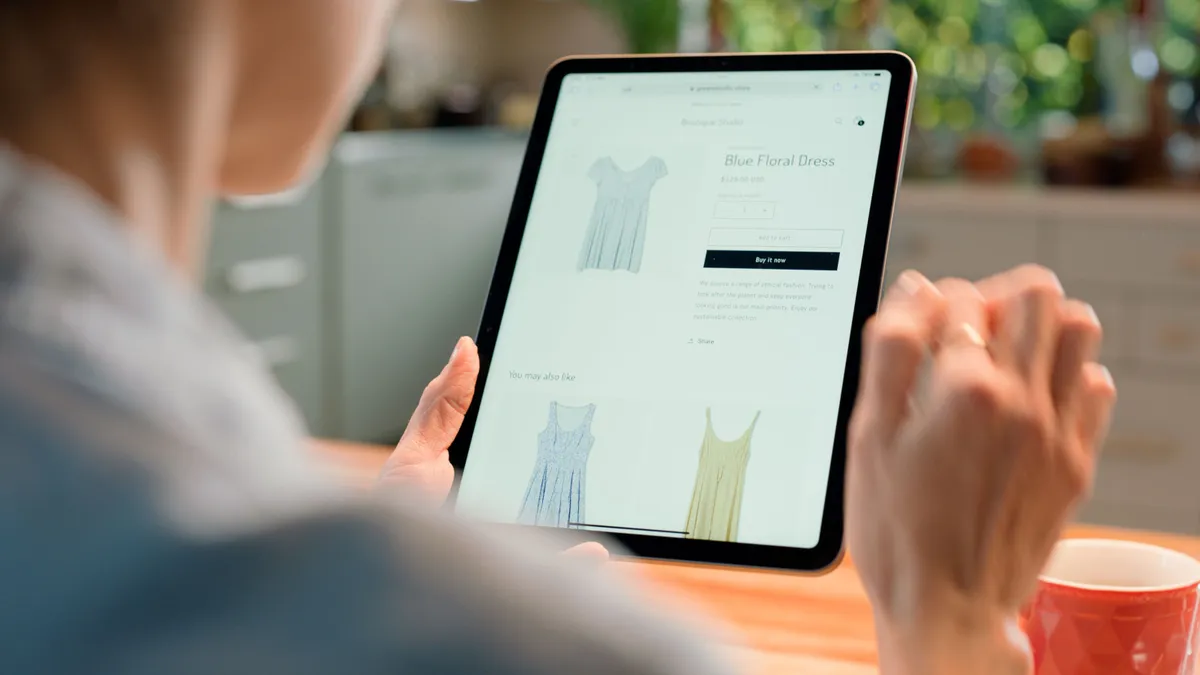

Why BNPL appeals to salons

The buy now, pay later option attracts more customers and leads to bigger spending, asserts a payments software executive.

By Patrick Cooley • June 4, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

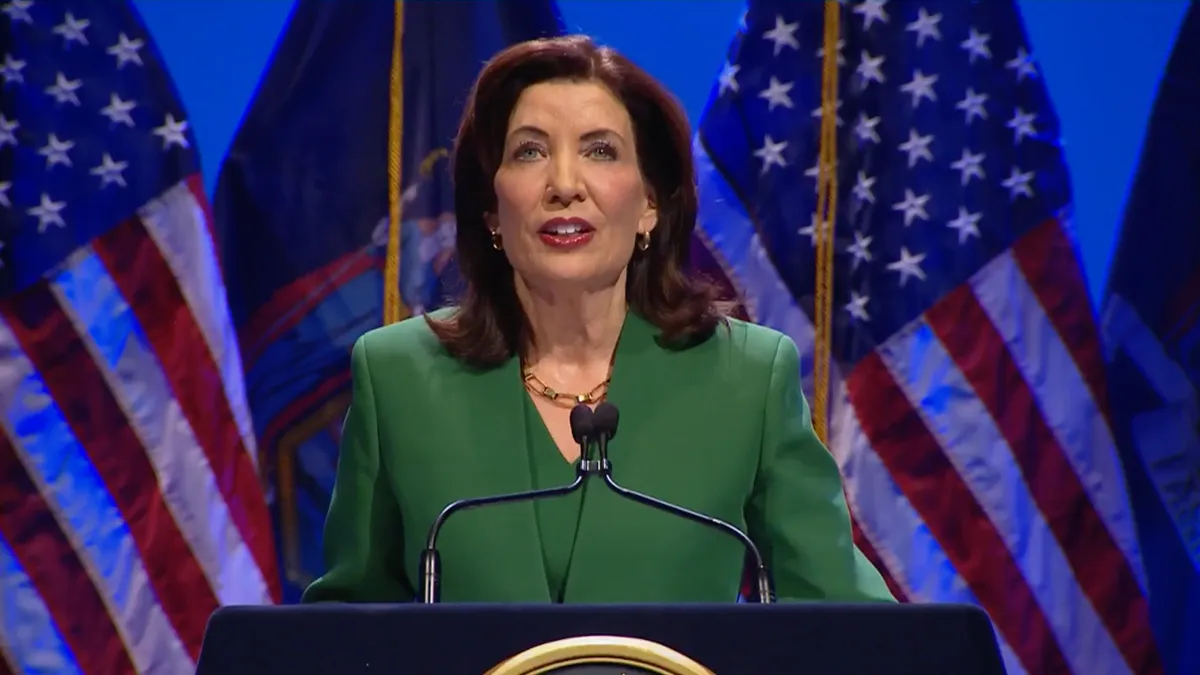

Retrieved from Office of the Governor of the State of New York.

Retrieved from Office of the Governor of the State of New York.

Fintech groups oppose state BNPL rules

Lobbying organizations argue that New York's rules treat buy now, pay later purchases too much like credit card transactions.

By Patrick Cooley • May 28, 2025 -

Global Payments to sell payroll unit for $1.1B

The payments processor agreed to sell the division to software company Acrisure as it focuses on selling merchant services.

By Lynne Marek • May 28, 2025 -

CFPB to yank ‘unlawful’ open banking rule

That move bends to bank groups that filed a lawsuit last year to block the Consumer Financial Protection Bureau rule aimed at making it easier for consumers to move their financial accounts.

By Justin Bachman • May 27, 2025 -

Circle co-founder to build new ‘AI-native’ bank

Catena Labs recently secured $18 million in a seed funding round, which it plans to use to build a bank designed to serve the emerging AI economy, said co-founder and CEO Sean Neville.

By Rajashree Chakravarty • May 21, 2025 -

Sponsored by Federal Reserve Financial Services

New survey: Innovative use cases drive businesses to instant payments

New research reveals that 66% of businesses are ready to embrace instant payments, signaling a major shift in digital finance.

May 19, 2025 -

Banks struggle to talk about fraud

Financial institutions battling an increase in fraud, particularly push-payment scams, have been stymied in sharing information that might help them better protect customers.

By Lynne Marek • May 16, 2025 -

Q&A

JPMorgan Chase taps payments tech head

The bank’s payments arm named Sri Shivananda to head up its technology operations this year. Now, he’s overseeing decisions on stablecoins, real-time transactions and other advances.

By Lynne Marek • May 15, 2025 -

Q&A

Marqeta chief focuses on revenue diversity, execution

Interim CEO Mike Milotich wants to boost the processor’s non-Block revenue and expand its embedded finance offerings via a new mobile app for customers.

By Justin Bachman • May 12, 2025 -

Celsius founder gets 12 years in prison

Alex Mashinsky misrepresented Celsius’ business and financial position to woo customers into “unbanking themselves,” and then manipulated Celsius’ native token to enrich himself, the DOJ said.

By Gabrielle Saulsbery • May 9, 2025 -

CFPB spurns BNPL rule

Enforcement actions against buy now, pay later players won’t be a priority, with the possible exception of those related to service members or veterans, the bureau said.

By Lynne Marek , Patrick Cooley • May 7, 2025 -

Ex-PNC president named Fiserv’s CEO

The company disclosed Michael Lyons' promotion minutes after the Senate confirmed outgoing CEO Frank Bisignano to lead the Social Security Administration.

By Patrick Cooley • May 6, 2025 -

Visa pursues stablecoins for cross-border payments

The biggest U.S. card network is setting up partnerships and innovating behind the scenes to develop stablecoins for cross-border uses.

By Lynne Marek • May 6, 2025 -

Zelle service unavailable for many users after Fiserv tech glitch

The P2P payments service experienced technical troubles Friday as Fiserv cited an "internal issue" in its disruption.

By Justin Bachman • May 5, 2025 -

Warren, Waters urge Fed to reconsider Capital One-Discover

The Democratic lawmakers blasted the central bank’s “analysis, or lack thereof,” arguing the Fed “repeatedly parroted assertions made by Capital One in its application.”

By Dan Ennis • May 5, 2025 -

Relaxed regulatory oversight spurs bank-crypto activity

Since January, federal bank regulators have done an about-face on crypto guidance, inspiring banks to explore the space.

By Gabrielle Saulsbery • April 30, 2025 -

Paze aims to pump up the volume with Fiserv

The digital wallet owned by seven banks has loaded 150 million customer cards onto the system. Now, it’s working with its processor ally to add more banks.

By Lynne Marek • April 29, 2025 -

Nexo reenters US market

Co-founder Antoni Trenchev credited the regulatory shift under Trump for the firm’s reemergence in the U.S. Nexo’s exit was preceded by failed regulatory talks and followed by a $45 million SEC fine.

By Gabrielle Saulsbery • April 28, 2025 -

Fed joins FDIC, OCC in withdrawing crypto-skeptical guidance

The guidance withdrawals “ensure the Board's expectations remain aligned with evolving risks and further support innovation in the banking system,” the Federal Reserve said Thursday.

By Gabrielle Saulsbery • April 25, 2025 -

Coinbase considers applying for federal bank charter

Regulatory willingness to work with crypto seems to have inspired Coinbase, and reportedly others, to engrain themselves deeper into the traditional financial sector.

By Gabrielle Saulsbery • April 23, 2025 -

Fiserv, Kansas to open fintech hub

The hub will open later this year in Overland Park, Kansas, and help Fiserv better serve Midwestern customers, the company said in a news release Monday.

By Patrick Cooley • April 23, 2025 -

Ramp reportedly angles for part of $700B US credit card program

The fintech is seeking to handle a piece of the SmartPay federal employee charge card program, assisted by its close ties to the Trump administration, ProPublica reported.

By Justin Bachman • April 23, 2025 -

Capital One readies for Discover integration work

With Discover, “we will be going back into the world of data centers” for “a number of years,” Capital One CEO Richard Fairbank said Tuesday.

By Caitlin Mullen • April 23, 2025 -

FedNow draws 1,300 financial firms

The instant payments service has attracted mostly small and mid-sized financial services firms as it inches up adoption by financial institutions.

By Tatiana Walk-Morris • April 23, 2025