Payments: Page 23

-

Robinhood developing early direct deposit access, app code shows

Similar features have gained traction at challenger banks and incumbents as an alternative to overdraft fees. The trading app is looking to broaden its revenue stream beyond trading.

By Dan Ennis • Sept. 2, 2021 -

Fintech veteran gears neobank toward musicians

Kasasa executive John Waupsh decided to launch Nerve after noticing musicians, struggling to access business accounts, often rely on personal checking accounts for business deposits and expenses.

By Anna Hrushka • Aug. 25, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Fiserv strikes up a bevy of new partnerships

The payments processor has fresh ties to MovoCash, Selecta Group and Venmo that will allow it to keep expanding its digital payment services.

By Lynne Marek • Aug. 24, 2021 -

Wells Fargo reverses course on personal lines of credit

The lender's July decision to close existing lines generated outcry from customers whose credit could be hurt by the move. Borrowers who haven't used PLOCs in 12 months have until Dec. 2 to activate their lines.

By Dan Ennis • Aug. 19, 2021 -

How Square's Afterpay deal plays into its SMB, consumer banking goals

The $29 billion deal will bring the Australian firm's point-of-sale financing technology and large merchant portfolio under Square's umbrella, further enabling the fintech to continue its push into banking services.

By Anna Hrushka • Aug. 18, 2021 -

Wells Fargo combines treasury management, payment units

The bank is also hiring a BNY Mellon executive to oversee the combined business.

By Dan Ennis • Aug. 18, 2021 -

Column

Walmart, NYCB show 2 ways to angle for blockchain expertise

The retailer posted a job description for a crypto product lead, while New York Community Bank partnered with fintech Figure.

By Dan Ennis • Aug. 17, 2021 -

Retrieved from Pixabay on July 18, 2021

Retrieved from Pixabay on July 18, 2021

Zelle owner doubles down on marketing, targets older group

The digital payment network's owner, Early Warning Services, is trying to break through post-COVID competition for consumers' attention by demonstrating new use cases for the American family.

By Lynne Marek • Aug. 16, 2021 -

Big bank, merchant groups weigh in on Fed rule clarification

Bank and merchant trade groups weighed in on the Fed's debit rule clarification at the 11th hour, digging in their heels in a long-time battle over whether to ease merchant access to increased debit transaction networks.

By Lynne Marek • Aug. 12, 2021 -

Revolut readies for US growth with marketing push, product expansions

Since launching quietly stateside last year, the fintech has rolled out a small-business banking product, applied for a bank charter, and has begun offering remittances between the U.S. and Mexico.

By Anna Hrushka • Aug. 11, 2021 -

Sable taps Wise for cross-border payments

The companies are teaming up on a new tool aimed at simplifying cross-border payments for expatriates and international students, among others.

By Lynne Marek • Aug. 6, 2021 -

Neobank MovoCash launches real-time cryptocurrency conversion

The fintech, which launched in 2017, introduced a feature that allows users to rapidly convert 10 cryptocurrencies — including Bitcoin and Ethereum — into fiat money.

By Robin Bradley • Aug. 4, 2021 -

Square buys BNPL player Afterpay for $29B

The acquisition of the Australian company is Square's biggest ever, and underscores CEO Jack Dorsey's ambitious plans to build his merchant and banking empire in new retail directions and across the globe.

By Lynne Marek • Aug. 2, 2021 -

Inside MoneyLion's quest to become a financial 'super app'

The neobank is diversifying its revenue sources and aiming to boost engagement frequency to transcend beyond finance to "life transactions."

By Suman Bhattacharyya • Aug. 2, 2021 -

7 big banks sign on for SWIFT's low-value cross-border offering

The product lets small businesses and individuals send payments of less than $10,000 internationally, giving the network a potential foothold in a fintech-filled remittance space.

By Robin Bradley • July 30, 2021 -

Clearing House urges caution on CBDCs

A Federal Reserve-backed digital currency could "destabilize both the domestic and foreign banking and financial services sectors," the payments system operator said.

By Lynne Marek • July 30, 2021 -

Fiserv, Goldman strike pact on cross-border payments

The move follows more than a month after the investment bank and card network Visa partnered to bolster corporate and commercial clients' ability to send payments to businesses and consumers worldwide.

By Lynne Marek • July 27, 2021 -

Failed payments cost North American banks $33.7B in 2020: report

Respondents ranked the reduction of manual processes as the top challenge they face during payment processing, followed by regulation and balancing accuracy with speed, the report found.

By Tatiana Walk-Morris • July 20, 2021 -

Square launches business banking, savings products

Banking will allow Square to strengthen client relationships and drive higher customer lifetime value as it targets sellers who use the company's payment devices and inventory-management products, analysts said.

By Suman Bhattacharyya • July 20, 2021 -

Wells Fargo shuts down personal lines of credit

The product was positioned as a means for customers to consolidate credit card debt. Its termination comes as the bank is boosting its card profile and reevaluating business units it sees as non-core.

By Dan Ennis • July 9, 2021 -

Clash over debit card routing persists in comments to Fed

Merchants have long argued that having more than one available network holds down costs for consumers. But card networks and banks have said that's not necessarily the case.

By Lynne Marek • July 8, 2021 -

Mastercard CEO, FDIC chair press fintechs on financial inclusion

Michael Miebach and Jelena McWilliams acknowledged the importance of tapping innovative companies to draw in unbanked and underserved people.

By Lynne Marek , Vaidik Trivedi • July 1, 2021 -

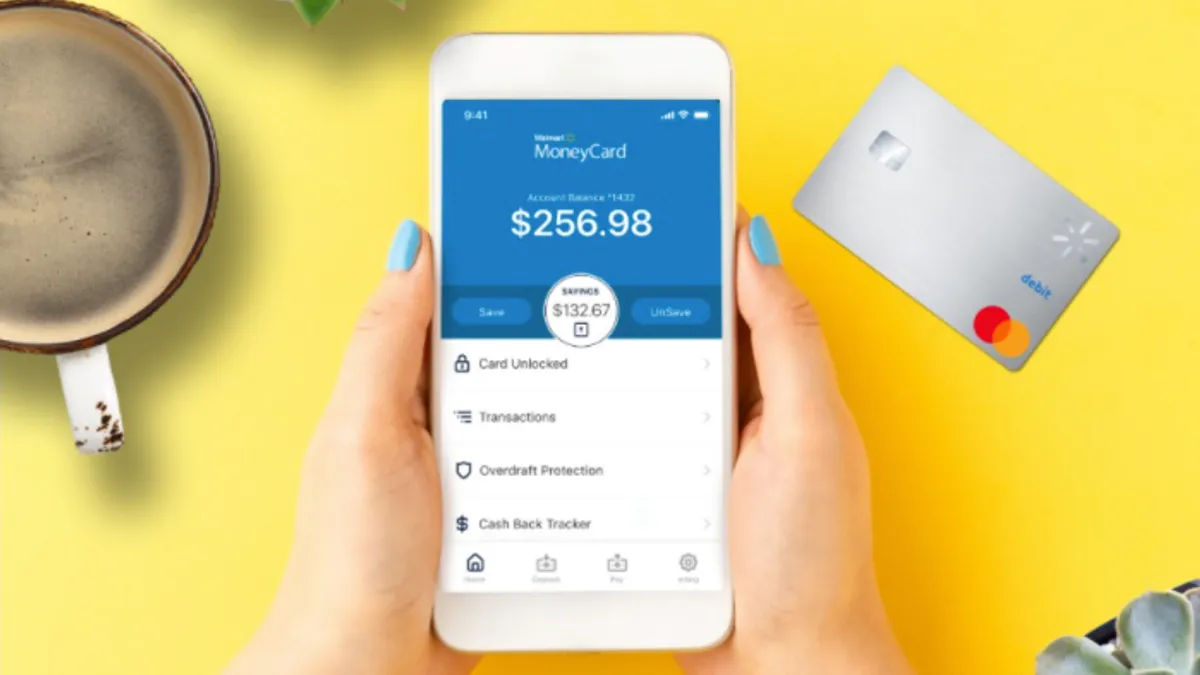

Retrieved from Walmart on June 25, 2021

Retrieved from Walmart on June 25, 2021

Walmart, Green Dot switch MoneyCard to demand deposit account

Consumers who convert their accounts can access perks such as overdraft protection and no monthly fee for a qualifying direct deposit of $500.

By Tatiana Walk-Morris • June 28, 2021 -

Column

BIS report shows growing divide on crypto

Central banks strike a second blow against digital tokens. Stablecoins, too, this time. The dissonance between market and government may come down to timing, or an age-old pattern concerning risk.

By Dan Ennis • June 24, 2021 -

Fiserv partners with NYDIG to offer Bitcoin services

The deal comes a month after NYDIG inked a Bitcoin services agreement with fellow payments processor FIS, and as big banks broaden their offerings surrounding cryptocurrency.

By Vaidik Trivedi • June 23, 2021