Payments: Page 27

-

PayPal expands its point-of-sale arsenal

The payments company is looking to wrest part of a burgeoning buy-now-pay-later market from the likes of Afterpay, Affirm and Klarna with a six-week installment plan for purchases between $30 and $600.

By Dan Ennis • Sept. 1, 2020 -

Ally partners with Mastercard's Vyze to enter retail point-of-sale lending

The bank will offer installment loans on retail purchases between $500 and $40,000 with interest rates ranging from 9.99% to 26.99%. Monthly fixed-rate installment loans will range from six to 60 months, the company said.

By Dan Ennis • Aug. 26, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

Advocacy groups urge CFPB, OCC to probe PayPal over school ties

The company said it had begun reviewing a list of 150 mostly unaccredited career training institutions the Student Borrower Protection Center said were offering high-interest PayPal Credit as a tuition payment option.

By Dan Ennis • Aug. 25, 2020 -

Citi sues Revlon creditors, wins temporary freezes on $412M after errant transfer

The court action comes after the bank made a more than 100-fold overpayment while serving as administrative agent on a 2016 loan.

By Dan Ennis • Updated Aug. 19, 2020 -

Sponsored by Accenture

10 ways COVID-19 is impacting payments

Payments organizations should now act urgently to moderate the damage it does to their customers, their people, their partners and their businesses.

By Sulabh Agarwal, Margaret Weichert, Graham Rothwell & Will Hay • Aug. 18, 2020 -

Retrieved from Facebook on June 02, 2020

Retrieved from Facebook on June 02, 2020

Facebook unveils payments umbrella

Facebook Financial, the social network's latest effort to lend brand consistency among its payment and commerce plans, will be overseen by Libra co-creator David Marcus.

By Dan Ennis • Aug. 11, 2020 -

Online payments provider Stripe hires GM CFO

"Stripe's mission to increase the [gross domestic product] of the internet is more important now than ever," Dhivya Suryadevara said. "I hope to use my skills to help accelerate Stripe's already steep growth trajectory."

By Jane Thier • Aug. 11, 2020 -

American Express makes Kabbage acquisition official

Not included in the deal is Kabbage's pre-existing loan portfolio. Kabbage and AmEx will establish an entity to manage and retain those loans once the acquisition is complete. Neither company disclosed the purchase price.

By Dan Ennis • Updated Aug. 18, 2020 -

Fed gives new details on its real-time payments system

One year after committing to FedNow, the central bank emphasized its effort to bolster 24/7/365 operability, the development of fraud deterrents, and a liquidity management tool that lets RTP participants help.

By Dan Ennis • Aug. 7, 2020 -

EBay partners with LendingPoint for merchant loans

The tie-up gives merchants an alternative to PayPal Working Capital, a financing solution eBay sellers have used in the past. PayPal's five-year operating agreement with eBay expired last month.

By Anna Hrushka • Aug. 6, 2020 -

Opinion

The digital transformation of payments reaches its next phase

In addition to providing the technology tools, banks must help educate clients and provide guidance to help ease client transformations from paper to electronic solutions, writes Carl Slabicki of BNY Mellon Treasury Services.

By Carl Slabicki • Aug. 4, 2020 -

Bank trade groups push back on OCC's payments charter plans

The regulator should take care not to introduce risks that would encourage regulatory arbitrage, the groups said, urging the OCC to be transparent when considering a new charter.

By Anna Hrushka • July 30, 2020 -

JPMorgan Chase, Marqeta partner to launch virtual corporate cards

The deal comes as payment networks have seen contactless transactions spike by as much as 150% since March 2019.

By Anna Hrushka • July 29, 2020 -

Bank of the West rolls out climate-conscious checking account

The bank will donate 1% of net revenues generated from the account to support environmental nonprofits. The account's tracking tool lets customers see the carbon impact of purchases made with the debit card.

By Dan Ennis • July 22, 2020 -

What US fintechs can learn from Wirecard's collapse

"Think about diversifying your supply chain and your partners," said Kim Muhota, vice president at SSA & Company. "It's really just a risk management play — the classic, don't have all your eggs in one basket."

By Anna Hrushka • July 22, 2020 -

Kabbage launches small-business checking account

The fintech said it plans to roll out several additional features connected to the account this year, including wire transfers and mobile remote deposits.

By Anna Hrushka • July 22, 2020 -

Chime, Apple debut credit score-boosting products

The challenger bank's entry into the credit card market comes a day after Goldman Sachs and Apple launched an initiative that gives rejected Apple Card applicants suggestions as to what they can do to be approved.

By Dan Ennis • July 2, 2020 -

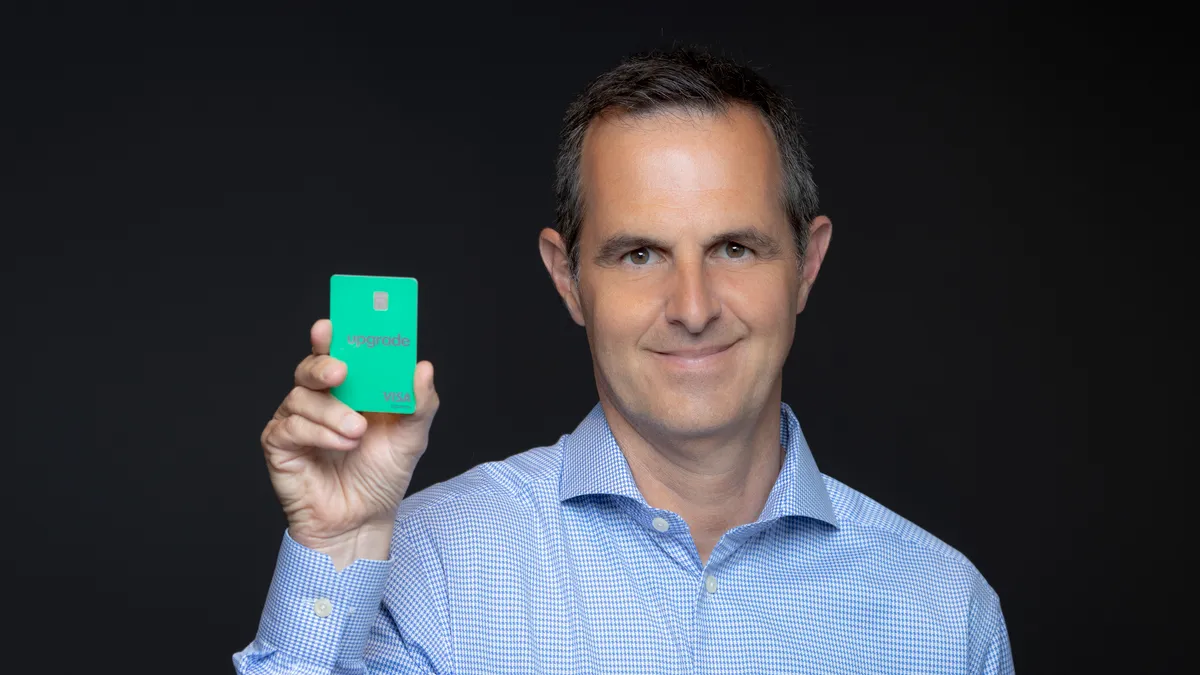

How Upgrade plans to use its latest $40M investment

Upgrade's latest funding round boosts the startup's valuation to $1 billion, giving it "unicorn" status alongside other neobanks such as Chime, Dave, Monzo, Revolut, N26 and NuBank.

By Anna Hrushka • June 25, 2020 -

Verizon, Synchrony launching consumer credit card

The mobile-phone provider joins Samsung among telecom giants offering cards this year. In a nod to pandemic spending, groceries net the card's richest reward — 4% back. But rewards are redeemable only on Verizon purchases.

By Dan Ennis • June 24, 2020 -

Andrew. (2011). "Los Angeles" [Photograph]. Retrieved from Flickr.

Andrew. (2011). "Los Angeles" [Photograph]. Retrieved from Flickr.

Welcome Technologies, Green Dot target Hispanic immigrants with bank account, card

Welcome is banking on the trust it says it's built to serve a community largely reluctant to use traditional financial institutions. But the company faces a twofold challenge, an analyst tells Banking Dive.

By Ken McCarthy • June 19, 2020 -

Kabbage rolls out simplified PPP process for Uber drivers, contractors

At least 40% of coronavirus relief applicants through the online lender are self-employed, said the company's co-founder, Kathryn Petralia, adding that Kabbage is the fourth-largest PPP provider.

By Kate Patrick Macri • June 16, 2020 -

Will COVID-19 push contactless payments into the mainstream?

Reports show contrasting figures on the adoption of touch-and-go tech, but the coronavirus — and perhaps a push from card issuers or retailers — may prove the catalyst to change consumer behavior.

By Tatiana Walk-Morris • June 11, 2020 -

Alibaba rolls out interest-free financing for small businesses

The program isn't a replacement for loans the conglomerate offers with Kabbage, an Alibaba executive said. But Kabbage stopped processing new loan requests through Alibaba in March in favor of financing PPP loans.

By Dan Ennis • June 5, 2020 -

Western Union offers to take over MoneyGram: Bloomberg

Traditional money-sending businesses have seen their model undercut by startups offering lower remittance fees — and by the coronavirus, as people lean away from cash-handling transactions in brick-and-mortar locations.

By Dan Ennis • June 2, 2020 -

Brex lays off 62 employees amid 'restructuring'

"Three months in, it's clear that the impact of COVID-19 won't be short-lived," Brex's co-founders wrote in a blog post. "We know that the pace of growth won't be what we expected for the foreseeable future."

By Anna Hrushka • June 1, 2020