Payments: Page 8

-

Fed seeks 8,000 financial institutions for FedNow

About 700 financial institutions have connected to the Fed’s instant payment network since last July, with at least 1,000 more in the pipeline, a FedNow official said this week.

By Lynne Marek , James Pothen • April 26, 2024 -

Q&A

Anchorage Digital CEO says custody, staking services poised for growth

Anchorage Digital's newly hired COO Aaron Schnarch will be key in scaling up to meet the increasing institutional demand for safe digital asset infrastructure, CEO Nathan McCauley said.

By Gabrielle Saulsbery • April 24, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Natalie Meepian via Getty Images

Natalie Meepian via Getty Images Trendline

TrendlineM&A

President Donald Trump’s reelection was predicted to yield loosened regulation. But tariff volatility and economic uncertainty has thrown a wrench into an expected boom in mergers and acquisitions.

By Banking Dive staff -

US seeks 3 years in prison for Changpeng Zhao, $5.3B fine for Do Kwon

The federal government is tying up loose ends to address high-profile crypto crimes of yesteryear.

By Gabrielle Saulsbery • April 24, 2024 -

First Internet Bank CEO talks M&A, BaaS work

After its acquisition of First Century Bank fell through in 2022, First Internet built its own banking-as-a-service team, CEO David Becker said. It now counts startup Ramp as a client.

By Caitlin Mullen • April 24, 2024 -

Fintech One offers BNPL at Walmart stores: report

The move presents competition for BNPL provider Affirm, which has partnered with the retail giant since 2019.

By Caitlin Mullen • April 23, 2024 -

Fed courts nonbanks for FedNow growth

Nonbanks "help us understand what is needed, what customers are demanding [and] not seeing, what's on the horizon that we should be thinking about," a Chicago Fed specialist said this month.

By Lynne Marek • April 23, 2024 -

For Capital One and Discover, the 4th time may have been the charm

Discover rebuffed three Capital One pitches before agreeing to a deal, and talks halted for seven weeks, an SEC filing indicates.

By Dan Ennis • April 22, 2024 -

Truist CIO, chief audit officer leave bank

The bank, meanwhile, has added new leaders in its payments business and logged $70 million in restructuring charges in the first quarter, CEO Bill Rogers said Monday.

By Caitlin Mullen • April 22, 2024 -

Pathward to pay refunds, penalty tied to NY AG investigation

The bank, a frequent partner to fintechs, froze customer accounts and transferred money to debt collectors, violating state law, the NY AG’s office said.

By Caitlin Mullen • April 17, 2024 -

Fed keeps up CBDC research

Despite political opposition to a potential U.S. central bank digital currency, research staff at the central bank continue to study the possibility.

By Lynne Marek • April 17, 2024 -

US, Europe lock arms on payments regulation

U.S. and European regulators have joined forces to monitor digital payment concerns, including those related to buy now, pay later financing and big tech market participation.

By Lynne Marek • April 15, 2024 -

Citi’s reorg job toll climbs to 7,000: Fraser

The bank boosted its expectation for annual savings to $1.5 billion. Meanwhile, Citi, Wells Fargo and JPMorgan Chase reported marked increases in FDIC special assessment costs.

By Caitlin Mullen • April 12, 2024 -

KeyBank scouts for fintech partners

The bank, which has yet to strike a fintech partnership this year, generally enters into one to two each year, said Ken Gavrity, president of Key Commercial Bank.

By Caitlin Mullen • April 10, 2024 -

Dimon blasts regulation, proxy advisers in annual letter

The JPMorgan Chase CEO also gave prominent space to AI, touting its potential impact in software engineering, customer service and operations, “as well as in general employee productivity."

By Caitlin Mullen • April 8, 2024 -

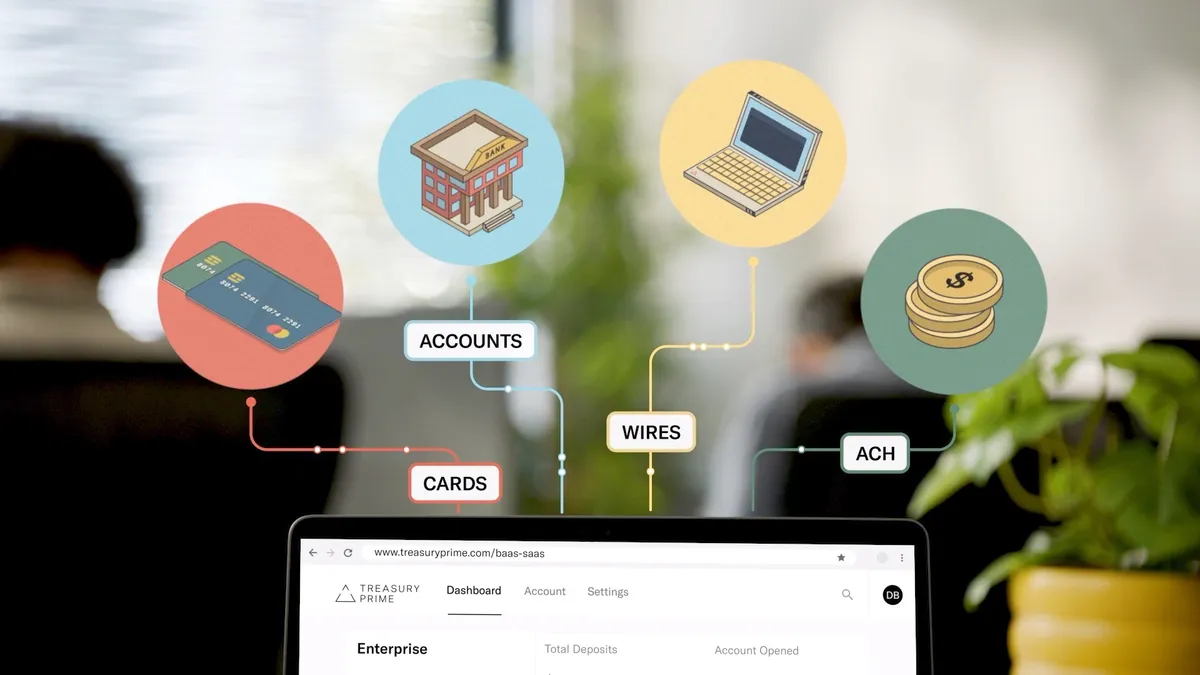

Treasury Prime, Narmi partner to offer customers FedNow service

The partnership aims to simplify and accelerate the adoption of FedNow by small and medium-sized financial institutions in Treasury Prime’s network.

By Rajashree Chakravarty • April 3, 2024 -

Citi asks judge to toss NY AG’s fraud reimbursement suit

The bank called Letitia James' lawsuit against the bank a "misguided attempt" to modify the Electronic Fund Transfer Act, when a different law covers wire transfers.

By Dan Ennis • April 3, 2024 -

Credit card complaints surpass bank account gripes at CFPB

The agency received 70,000 card-related complaints from consumers last year, but complaints regarding checking and savings accounts jumped 33% from 2022, according to a report last week.

By James Pothen • April 3, 2024 -

Warren reiterates call for gun MCC guidance

The senator and 32 other Democrats are stressing the need for federal guidance on the gun merchant category code as states take opposing sides.

By Caitlin Mullen • March 29, 2024 -

Ally names Discover CEO to its top post

A little over a month after starting as Discover's CEO, Michael G. Rhodes is leaving to take the same position at Ally.

By Caitlin Mullen • March 27, 2024 -

Fintech trade group sues to block Colorado interest-rate cap

A law set to take effect July 1 would bar state-chartered banks from offering Coloradans installment loans and BNPL products. But it may clear the market for federally chartered banks, plaintiffs say.

By Dan Ennis • March 27, 2024 -

Walmart can break off Capital One card partnership early, judge says

It won’t be easy for Walmart to find a new partner to replace Capital One, though, said Brian Riley, co-head of payments at Javelin Strategy & Research.

By Caitlin Mullen • March 27, 2024 -

Capital One pledges to give Discover’s network a boost

Dominated by Visa and Mastercard, card network markets “sorely need an injection of competitive rivalry,” Capital One argued in its application to regulators to purchase Discover.

By Caitlin Mullen • March 26, 2024 -

DOJ calls Apple card fees ‘significant expense’ for banks

The tech giant’s fees for credit card transactions “cut into funding for features and benefits that banks might otherwise offer smartphone users,” the Justice Department said in suing the company this month.

By James Pothen • March 26, 2024 -

JPMorgan seeks embedded payments niches

The biggest U.S. bank aims to offer embedded payments software solutions in more industries for its corporate clients.

By Lynne Marek • March 25, 2024 -

Robinhood co-founder steps down

Baiju Bhatt, who co-founded the fintech 11 years ago and was most recently chief creative officer, is moving on to “focus on his next enterprise.”

By Gabrielle Saulsbery • March 25, 2024