Regulations & Policy

-

Ex-Regions teller banned from banking after alleged theft

Markel O’Neal Calhoun stole nearly $18,000 from the bank last February, the Federal Reserve alleged.

By Gabrielle Saulsbery • Aug. 20, 2025 -

FDIC would give banks flexibility on digital signage in proposed rule

The proposal focuses display requirements toward screens and webpages most relevant to consumers, simplifying rules for signage on bank websites, mobile apps and ATMs.

By Caitlin Mullen • Aug. 20, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Permission granted by Frost Bank

Permission granted by Frost Bank Trendline

TrendlineTop 5 stories from Banking Dive

Since the approval of Capital One’s acquisition of Discover, banks have increasingly waded into new deals. Beyond that, they’ve doubled down on strategy, from organic growth to branch placement to app design.

By Banking Dive staff -

Truist settles web tracker lawsuit

California resident John Tasker sued the North Carolina lender in May for alleged privacy law violations. He filed a similar lawsuit against BMO that remains active.

By Gabrielle Saulsbery • Aug. 19, 2025 -

Fed nixes novel activities supervision program

The Federal Reserve’s oversight of banks’ crypto and fintech activities will be folded back into the normal supervisory process, the central bank said Friday.

By Gabrielle Saulsbery • Aug. 18, 2025 -

GOP lawmaker seeks probe into StanChart sanctions case

Rep. Elise Stefanik, R-NY, urged U.S. Attorney General Pam Bondi to launch an investigation into Standard Chartered Bank’s “illicit payments” and related “inaction” from New York’s attorney general.

By Caitlin Mullen • Aug. 18, 2025 -

DC Circuit reopens path to CFPB firings

The split ruling vacates a preliminary injunction that prevented Trump administration officials from cutting 95% of the bureau’s employees.

By Dan Ennis • Aug. 15, 2025 -

Trump scraps Biden order that toughened M&A standards

The revocation Wednesday undoes the previous administration’s “flawed philosophical underpinning” for “undue hostility” toward mergers and acquisitions, Trump’s FTC chair said.

By Caitlin Mullen • Aug. 15, 2025 -

FDIC oversight of large third parties needs clearer goals, OIG says

While the FDIC has “taken steps to establish goals and metrics” in its oversight of large third-parties, they were not “measurable or directly linked to program success factors.”

By Gabrielle Saulsbery • Aug. 15, 2025 -

Ethics questions cloud Bessent’s assets

The treasury secretary is delayed in complying with a conflict-of-interest agreement to divest certain investments, including farmland. He received an extension and pledged to comply, but that’s not enough for some.

By Dan Ennis • Aug. 14, 2025 -

Embezzlement cases engulf Alabama, Tennessee bankers

An Alabama banker made roughly 273 fraudulent ACH transactions totaling over $2.3 million, the DOJ said. Last week, the Fed banned an ex-First Horizon banker over embezzlement charges.

By Rajashree Chakravarty • Aug. 14, 2025 -

Do Kwon pleads guilty to fraud counts

Prosecutors plan to recommend a sentence of 12 years, and $19 million in penalties, as long as Kwon doesn’t commit any more crimes.

By Gabrielle Saulsbery • Aug. 13, 2025 -

Warren, Democrats ask Fed, FDIC, OCC to justify eSLR cuts

The lawmakers want more data and an extended comment deadline on a proposed reduction to big banks’ capital holdings – echoing Republican calls on the Fed’s ill-fated 2023 Basel III proposal.

By Dan Ennis • Aug. 12, 2025 -

CFPB moves to hold Synapse accountable for missing customer funds

The CFPB alleged the now-bankrupt Synapse failed to maintain adequate records of consumers’ funds and match them with its partner banks, leading to an unrecovered loss of $60 million to $90 million.

By Rajashree Chakravarty • Aug. 11, 2025 -

Warren urges Fed to activate countercyclical capital buffer

The Fed has never activated the framework, which would force banks to add a capital cushion. Sen. Elizabeth Warren thinks it’s time to do so – and is asking why the central bank has not voted on the measure in five years.

By Gabrielle Saulsbery • Aug. 11, 2025 -

Republican senators take aim at MRA process

Eleven GOP senators are urging banking agency heads to make changes to the process around matters requiring attention, which they argue lacks “structure, uniformity and legal basis.”

By Caitlin Mullen • Aug. 11, 2025 -

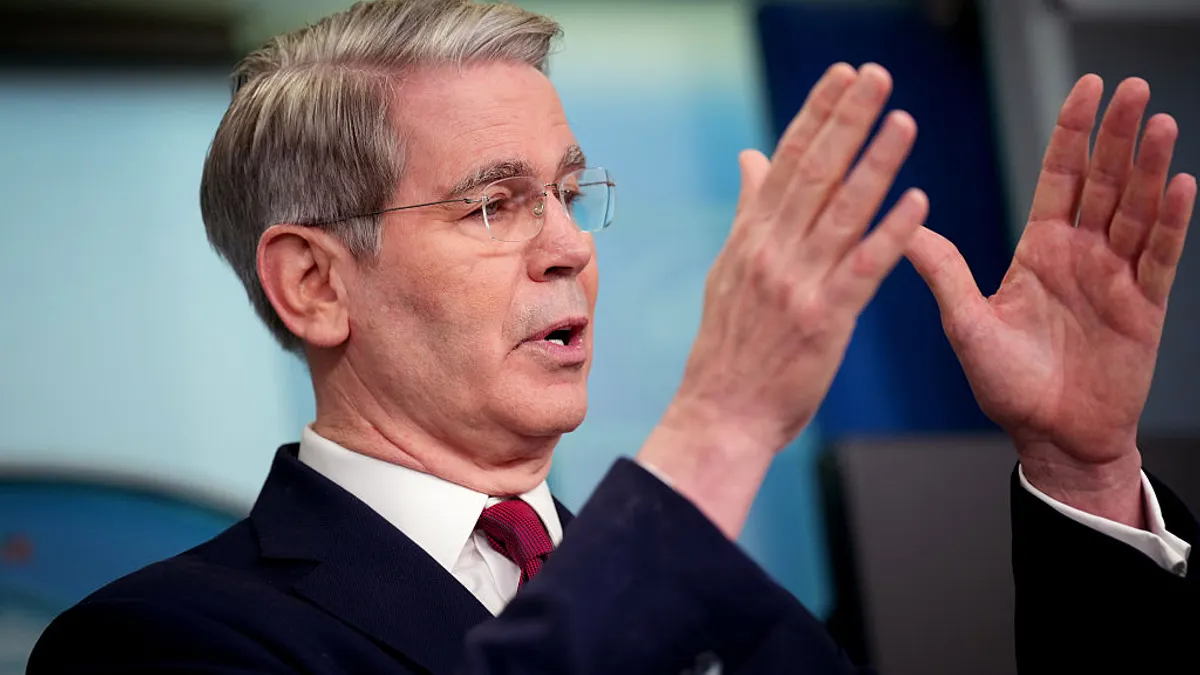

Trump taps economic adviser Stephen Miran for Fed post

Miran, an architect of Trump’s tariff policy, would be a temporary fix. He’d serve the remainder of outgoing Fed Gov. Adriana Kugler’s term, buying time for Trump to finalize his pick for central bank chair.

By Dan Ennis • Aug. 8, 2025 -

Trump takes aim at debanking

An executive order the president issued Thursday demands that regulators remove reputational risk from evaluations and to review complaint data for instances of religion-based debanking.

By Gabrielle Saulsbery • Aug. 8, 2025 -

UBS quits climate alliance amid global exodus

The Swiss lender said its “ambition to being a leader in sustainability is unchanged” and that it will continue to “progress [its] sustainability and impact strategy.”

By Zoya Mirza • Aug. 7, 2025 -

Wells Fargo won’t face class-action mortgage discrimination lawsuit

A federal judge denied class action certification in a mortgage redlining lawsuit against the lender, saying the plaintiffs “did not identify any ties that bind for purposes of commonality.”

By Rajashree Chakravarty • Aug. 7, 2025 -

Paxos to pay $48.5M over AML, due-diligence failures

Some of the charges stem from the stablecoin issuer’s relationship with Binance. The agreement includes a $22 million investment in Paxos’ compliance program and a $26.5 million payment to New York’s Department of Financial Services.

By Gabrielle Saulsbery • Aug. 7, 2025 -

CFTC, SEC make quick work on crypto movement

Both regulators announced plans last week to get going on crypto regulation that aligns with a report by the President’s Working Group on Digital Assets. They’ve already made waves this week.

By Gabrielle Saulsbery • Aug. 6, 2025 -

Florida’s BayFirst sheds 51 jobs, shutters SBA loan platform

The bank’s COO called out older, smaller loans as a trouble spot. BayFirst counted $1.5 million in first-half losses and expects to take a third-quarter restructuring charge. It’s also suspending dividend payouts.

By Dan Ennis • Aug. 6, 2025 -

Column

Dive Deposits: CFPB claps back at GAO

The bureau’s chief legal officer defended Acting Director Russ Vought’s decision to decline funding from the Federal Reserve, saying the move did not constitute an illegal withholding.

By Dan Ennis • Aug. 5, 2025 -

Column

Dive Deposits: The Fed may have out-Fridayed itself

Fed Gov. Adriana Kugler’s resignation may have overshadowed two dissents on the interest rate. But a single opening at the central bank may not carry as much impact as President Trump would hope.

By Dan Ennis • Aug. 4, 2025 -

UBS to pay $300M to settle Credit Suisse mortgage securities case

The Zurich-based lender’s agreement with the U.S. Justice Department will resolve the remaining consumer relief obligations from the 2017 settlement, UBS said Monday.

By Rajashree Chakravarty • Aug. 4, 2025