Regulations & Policy: Page 25

-

‘Polarizing’ state laws risk ‘fragmenting’ system: OCC’s Hsu

Banks are increasingly asked by state policies to “pick a side in service of performative politics rather than deliberative policy,” Acting Comptroller of the Currency Michael Hsu said.

By Lamar Johnson • July 22, 2024 -

Citi COO intended to deceive OCC, ex-employee says

In an amended lawsuit, former Citi data executive Kathleen Martin claims Anand Selva suggested twice that she fudge data to the bank’s primary regulator. She declined and lost her job two weeks later, she says.

By Gabrielle Saulsbery • July 19, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Permission granted by Frost Bank

Permission granted by Frost Bank Trendline

TrendlineTop 5 stories from Banking Dive

Since the approval of Capital One’s acquisition of Discover, banks have increasingly waded into new deals. Beyond that, they’ve doubled down on strategy, from organic growth to branch placement to app design.

By Banking Dive staff -

Capital One-Discover deal critics, supporters sound off

Executives with the two companies and a number of community groups spoke in favor of the $35.3 billion merger Friday, while a raft of critics urged regulators to block the deal.

By Caitlin Mullen • July 19, 2024 -

Retrieved from OCC.

Retrieved from OCC.

OCC bans 7 bankers in misappropriation, PPP cases

The bankers include former employees of JPMorgan, BofA, Wells Fargo and Varo. In one case, an ex-U.S. Bank employee received $29,375 in PPP funds and misrepresented payroll and business expenses.

By Dan Ennis • July 19, 2024 -

Hsu signals OCC to review preemption rules

In a speech Wednesday, the acting Comptroller of the Currency also pointed to the need for heightened regulation of bigger banks and the rising complexity of bank-nonbank ties.

By Caitlin Mullen • July 18, 2024 -

6 ways the CFPB wants to keep its eyes on fintech middlemen

Clearer guidance around “rent-a-bank,” open banking and buy now, pay later will ensure more consumers benefit, Director Rohit Chopra said in remarks last week.

By Suman Bhattacharyya • July 17, 2024 -

Discover to sell student loan portfolio to Carlyle, KKR in $10.8B deal

The student loan sale is the latest loose end Discover seeks to tie up since Capital One announced its intent to purchase the card company.

By Caitlin Mullen • July 17, 2024 -

First Republic ex-employees’ suit dismissed against FDIC

A federal district judge said his court “lacks jurisdiction” over the lawsuit, brought by 170 ex-First Republic employees who say the FDIC is blocking them from $150 million in retirement funds.

By Rajashree Chakravarty • July 15, 2024 -

Citi leans on tech modernization to fix data quality management failings

Days after federal regulators hit the bank with more than $135 million in fines, CEO Jane Fraser said Citi's transformation efforts addressed "decades of underinvestment."

By Matt Ashare • July 15, 2024 -

Column

Dive Deposits: It was Citi’s week and, arguably, everybody won

The bank shook off fresh penalties by reporting skyrocketing revenue in its banking unit. It’s no wonder Citi granted $41 million to its banking chief. But a rival for that job may be glad he left.

By Dan Ennis • July 12, 2024 -

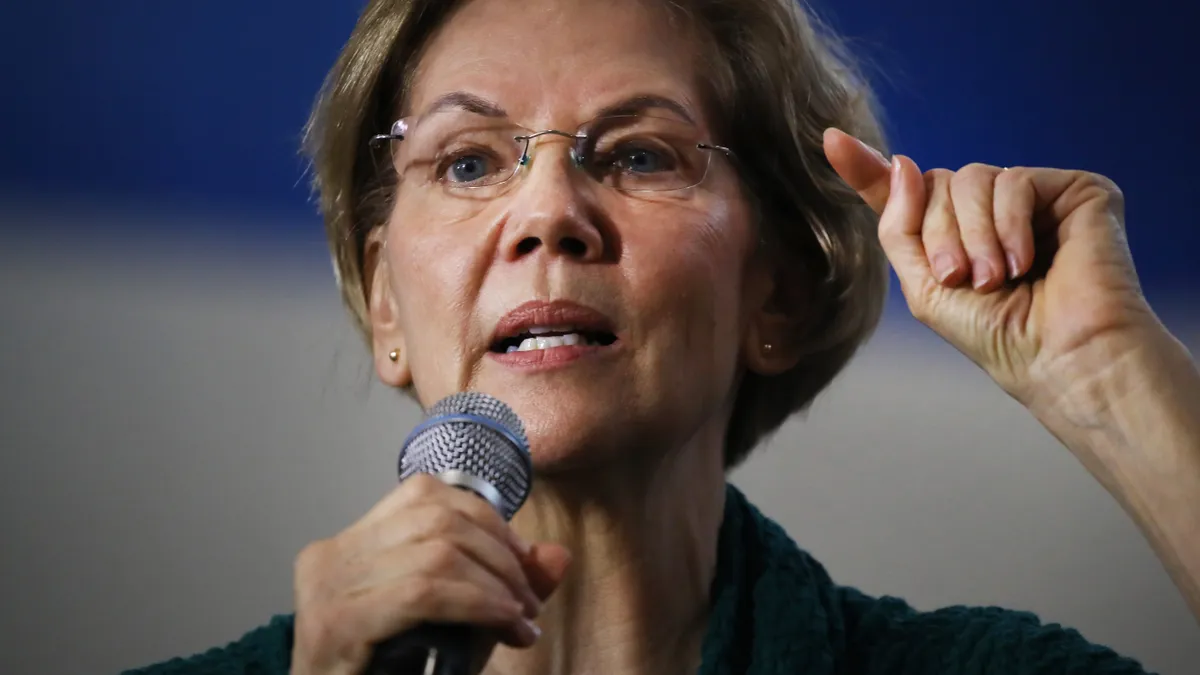

Senators press Jamie Dimon on alleged climate turnabout

The lawmakers, including Sen. Elizabeth Warren, D-MA, demanded answers from the JPMorgan Chase CEO on the bank's environmental "commitments" and "aspirations."

By Gabrielle Saulsbery • July 11, 2024 -

Senators grill FDIC chair nominee Goldsmith Romero

The CFTC commissioner aiming to replace Martin Gruenberg pledged Thursday during a Senate committee hearing to bring accountability to an agency reeling from toxic-culture allegations.

By Caitlin Mullen • July 11, 2024 -

Citi to pay $135.6M in new penalties over 2020 orders

The bank has made insufficient progress toward resolving nagging data quality, risk management and internal control issues, the OCC and Federal Reserve said Wednesday.

By Dan Ennis • July 11, 2024 -

Bank-fintech guidance needs more clarity, FDIC’s McKernan says

“Rules of the road” for bank-fintech tie-ups could help banks that partner with fintechs better manage third-party risks, he said.

By Suman Bhattacharyya • July 10, 2024 -

Former FTX execs Wang, Singh to be sentenced this fall

Both cooperated with the prosecution and testified against their former colleague, Sam Bankman-Fried. This will "very likely" reflect in their sentences, one attorney told Banking Dive.

By Gabrielle Saulsbery • July 10, 2024 -

First Citizens’ poaching claims against HSBC largely dismissed

A judge allowed claims alleging theft of trade secrets and breach of contract to proceed. First Citizens claimed an SVB alum hatched a plan to persuade more than 40 employees to follow him to HSBC.

By Dan Ennis • July 10, 2024 -

Warren presses Fed’s Powell on bank exec compensation

The central bank chair engaged in a heated back-and-forth with the senator, and also weighed in on CRE, Chevron deference and liquidity in hearings this week.

By Caitlin Mullen • July 10, 2024 -

FDIC downgrades Forbright Bank’s CRA score

The demerit stems from a relationship the bank had with a third party that ended more than two years ago, a source familiar with the evaluation said.

By Gabrielle Saulsbery • July 9, 2024 -

Fifth Third fined $20M over fake accounts, auto repossessions

The Cincinnati bank must compensate roughly 35,000 harmed consumers. The CFPB settlement resolves a March 2020 lawsuit that asserted the bank created fake accounts and used an aggressive “cross-sell” strategy.

By Rajashree Chakravarty • July 9, 2024 -

Powell: Capital requirements changes should face public comment

The Federal Reserve chair told senators Tuesday it’s his preference to seek public comment on a revised capital requirements proposal, and the Fed is working to get the FDIC and OCC on board.

By Caitlin Mullen • July 9, 2024 -

Warren blasts Powell’s ‘cozy relationship’ with bank execs

Since Powell assumed his role in February 2018, the Federal Reserve chair has had private conversations with JPMorgan CEO Jamie Dimon at least 19 times, according to the senator.

By Rajashree Chakravarty • July 8, 2024 -

TD names Citi vet next compliance chief

Erin Morrow replaces Monica Kowal, who left the bank July 2. Two of the three highest-ranking TD execs assigned to fix compliance management framework deficiencies have left in recent days.

By Dan Ennis • July 8, 2024 -

Discover to settle card misclassification class actions for $1.2B

The card company has warned it could face further financial toll related to the issue, in which it overcharged merchants for years.

By Caitlin Mullen • July 8, 2024 -

Potential BofA blind spot prompts court to revive $10B lawsuit

A U.S. appeals court nullified a ruling by a judge whose wife owned, then divested, Bank of America shares while he presided over an antitrust case in which BofA was a defendant.

By Rajashree Chakravarty • July 3, 2024 -

Silvergate pays $63M to settle with SEC, Fed, California regulator

The company and two of its executives settled allegations against them. Silvergate’s former CFO, however, did not, and eyes a civil trial.

By Gabrielle Saulsbery • July 2, 2024