Regulations & Policy: Page 7

-

Stablecoin bill falters in Senate

Democrats demanded fixes to the GENIUS Act – designed to create a framework for bringing stablecoins into the U.S. financial system – and raised concerns about Trump’s ties with crypto ventures.

By Rajashree Chakravarty • May 9, 2025 -

Lawmakers press Bessent on CDFI cuts

“If CDFIs follow their statutory obligations and do not digress into more ideological boundaries ... they can be important institutions,” the Treasury secretary told legislators Wednesday.

By Caitlin Mullen • May 8, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Permission granted by Frost Bank

Permission granted by Frost Bank Trendline

TrendlineTop 5 stories from Banking Dive

Since the approval of Capital One’s acquisition of Discover, banks have increasingly waded into new deals. Beyond that, they’ve doubled down on strategy, from organic growth to branch placement to app design.

By Banking Dive staff -

Senate votes to overturn OCC ban on expedited merger review

A similar resolution pending in the House would reverse a rule toughening the approval process – just as opponents of the Capital One-Discover deal say the green light came too easily.

By Dan Ennis • May 8, 2025 -

Maxine Waters walks out of digital asset hearing

House Democrats’ walkout blocked the hearing from taking place. They cited concerns over the president’s and his family’s ties to digital asset businesses.

By Rajashree Chakravarty • May 7, 2025 -

Senators re-up bill requiring independent Fed IG

Sens. Elizabeth Warren, D-MA, and Rick Scott, R-FL, faulted recently retired Fed IG Mark Bialek for failing to address central bank “corruption,” underscoring the need for “structural changes” to the role.

By Caitlin Mullen • May 7, 2025 -

(2024). [Photo]. Retrieved from Federal Reserve.

(2024). [Photo]. Retrieved from Federal Reserve.

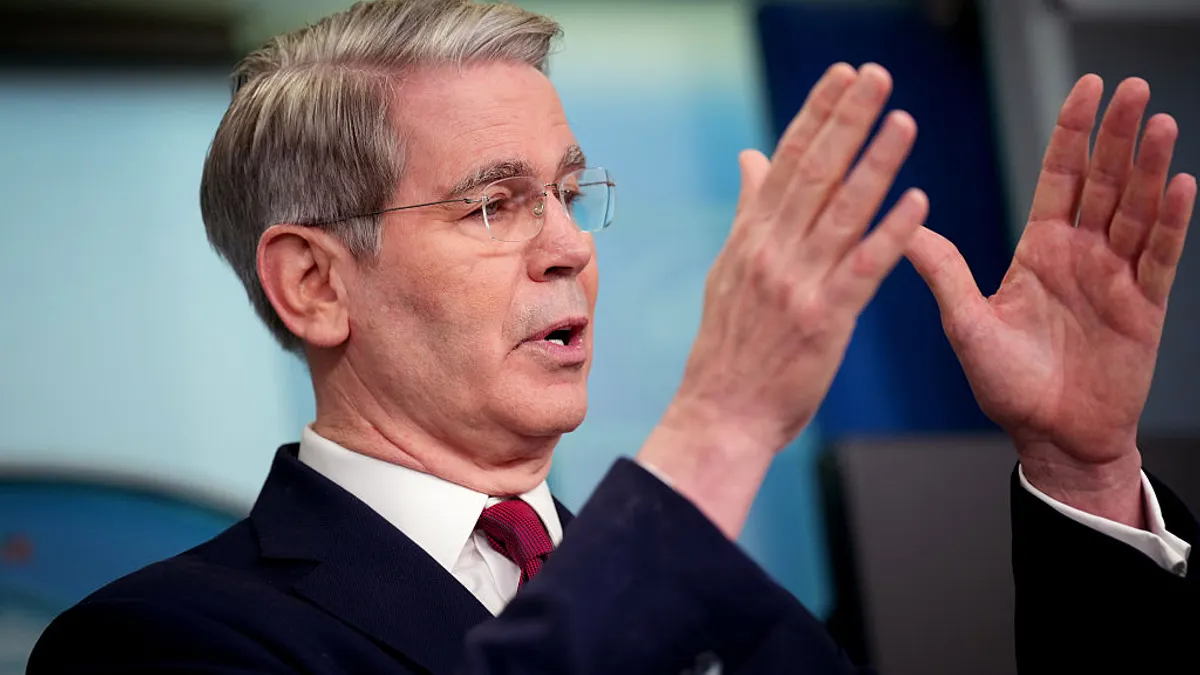

Bowman nod for Fed supervision czar advances to full Senate

The Senate Banking Committee voted 13-11 along party lines to pass the nomination to the full chamber. A key Democrat reiterated her concerns over Bowman’s stance on tariffs, mergers and climate.

By Dan Ennis • May 7, 2025 -

Credit Suisse pleads guilty to tax crimes, agrees to pay $511M

The lender now owned by UBS pleaded guilty to conspiring to hide more than $4 billion from the IRS in at least 475 offshore accounts.

By Rajashree Chakravarty • May 6, 2025 -

Treasury’s Bessent: Private credit surge underscores need for bank deregulation

“The growth of private credit tells me that the regulated banking system has been too tightly constrained,” Scott Bessent said Monday.

By Caitlin Mullen • May 6, 2025 -

HSBC pressed on net zero by $1.6 trillion investor group at annual meeting

Some 30 investors called on the bank to “urgently affirm” its commitment to its climate goals and prioritizing net-zero emissions across its operations.

By Zoya Mirza • May 6, 2025 -

CFPB agrees to dismiss appeal in UDAAP lawsuit

The CFPB and seven trade groups filed paperwork in the Fifth Circuit to end litigation related to an update the agency made to its exam manual in 2022.

By Rajashree Chakravarty • May 5, 2025 -

CFPB says it won’t enforce small-biz data collection rule

The bureau cited resource constraints and fairness, adding that it would focus on “pressing threats.” One opponent said the CFPB “can't simply gut rules by press releases on its whim.”

By Dan Ennis • May 2, 2025 -

NCUA’s Harper: Firings laying groundwork for Fed dismissals

“I think they’re chipping away, so that they can get to the Federal Reserve Board,” the former NCUA chair said Thursday of his and a fellow board member’s dismissal by the Trump administration.

By Caitlin Mullen • May 2, 2025 -

Column

Dive Deposits: 4 reminders that it’s not 2022 anymore

The closure of Citi’s we-hardly-knew-ye office in Málaga, Spain – combined with moves to preserve overdraft fees and toughen in-office requirements – make it clear that if 2025 threw a party, 2022 would not be invited.

By Dan Ennis • May 1, 2025 -

Relaxed regulatory oversight spurs bank-crypto activity

Since January, federal bank regulators have done an about-face on crypto guidance, inspiring banks to explore the space.

By Gabrielle Saulsbery • April 30, 2025 -

Warren, Chopra warn of ‘real price to pay’ on DOGE

The former CFPB director pointed to a rise in uninsured deposits amid recent market turmoil.

By Caitlin Mullen • April 29, 2025 -

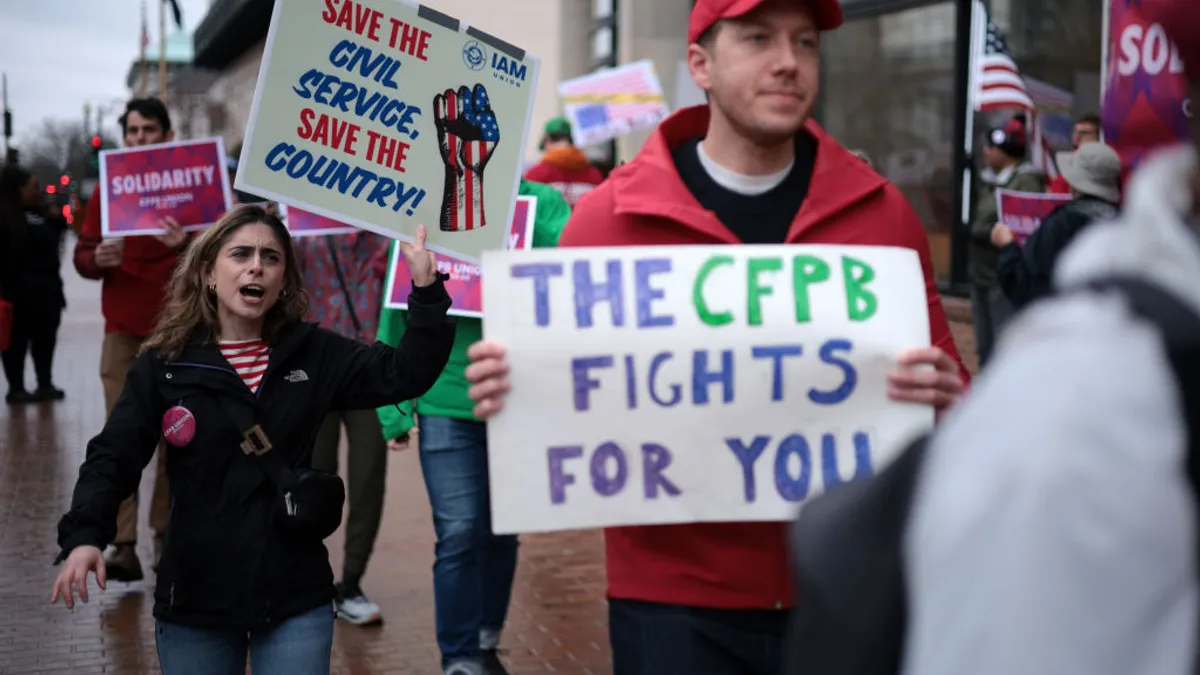

Appeals court backs injunction barring CFPB mass firing

The bureau’s 1,483-person reduction will remain halted through May 16. A three-judge panel walked back language concerning “particularized assessments” of employees’ necessity. One judge dissented.

By Dan Ennis • April 29, 2025 -

Wells Fargo clears 12th consent order; 2 remain

The 2018 consent order the CFPB lifted is the bank’s sixth to be resolved this year. The two remaining include the Federal Reserve’s asset cap.

By Rajashree Chakravarty • April 28, 2025 -

Nexo reenters US market

Co-founder Antoni Trenchev credited the regulatory shift under Trump for the firm’s reemergence in the U.S. Nexo’s exit was preceded by failed regulatory talks and followed by a $45 million SEC fine.

By Gabrielle Saulsbery • April 28, 2025 -

Sponsored by Arcesium

[Podcast] Comply to Compete: Better Banking Data Management Through 2025’s M&A Integrations

M&A is surging—are banks ready for the compliance challenges? Tune in to Arcesium’s podcast for expert insights.

By Banking Dive's studioID • April 28, 2025 -

Warren grills FDIC’s Hill over DOGE incursion

Four senators argued DOGE’s presence could threaten the $137 billion Deposit Insurance Fund, potentially undermining the FDIC's ability to oversee orderly bank resolutions.

By Rajashree Chakravarty • April 25, 2025 -

Fed joins FDIC, OCC in withdrawing crypto-skeptical guidance

The guidance withdrawals “ensure the Board's expectations remain aligned with evolving risks and further support innovation in the banking system,” the Federal Reserve said Thursday.

By Gabrielle Saulsbery • April 25, 2025 -

CFPB workers’ union rebuts bureau’s job-cut justification

Evidence indicates the bureau didn’t conduct a court-required assessment before attempting to cut about 90% of its staff, and the layoffs would have left CFPB data “irreparably lost,” plaintiffs said.

By Caitlin Mullen • April 24, 2025 -

Trump backs off his push to fire Fed’s Powell

Less than a week after saying the Federal Reserve chair’s “termination cannot come fast enough,” the president said Tuesday he has “no intention” of ousting the central bank chief.

By Dan Ennis • April 23, 2025 -

CFPB defends analysis behind 90% job cuts

A 200-person workforce would allow the bureau to fulfill statutory obligations “and better aligns with the new leadership’s priorities and management philosophy,” attorneys for the agency said.

By Caitlin Mullen • April 22, 2025 -

FDIC scraps some large bank living will requirements

Instead of requiring a bridge bank strategy, the FDIC wants large banks to describe one or more potential resolution strategies the regulator could execute, it said Friday.

By Caitlin Mullen • April 21, 2025