Risk: Page 2

-

Citi drops firearms restriction in a bow to conservative pressure

The bank updated a 7-year-old policy, enacted after the Parkland school shooting, over concerns about “fair access” months after Republicans accused some institutions of political de-banking.

By Dan Ennis • June 4, 2025 -

Fed lifts Wells Fargo’s asset cap

The regulator’s board lifted the $1.95 trillion asset cap the bank has operated under since 2018, but certain provisions of the consent order remain.

By Caitlin Mullen • June 3, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Permission granted by Frost Bank

Permission granted by Frost Bank Trendline

TrendlineTop 5 stories from Banking Dive

Since the approval of Capital One’s acquisition of Discover, banks have increasingly waded into new deals. Beyond that, they’ve doubled down on strategy, from organic growth to branch placement to app design.

By Banking Dive staff -

Citi exec tapped for Treasury terrorist financing role

Jonathan Burke has served as Citi’s global head of banking sanctions compliance since December 2023, according to his LinkedIn profile.

By Dan Ennis • June 3, 2025 -

Barclays mobilized over $687M in climate tech investments since 2020: report

The British bank’s climate investment arm has a mandate to invest £500 million into equity capital in climate tech startups between 2020 and 2027.

By Zoya Mirza • June 2, 2025 -

Wells Fargo’s Scharf assured over asset cap’s potential end

“We’re not done, but we’re a hell of a lot closer to the end than the beginning, at this point,” the CEO said Wednesday.

By Caitlin Mullen • May 28, 2025 -

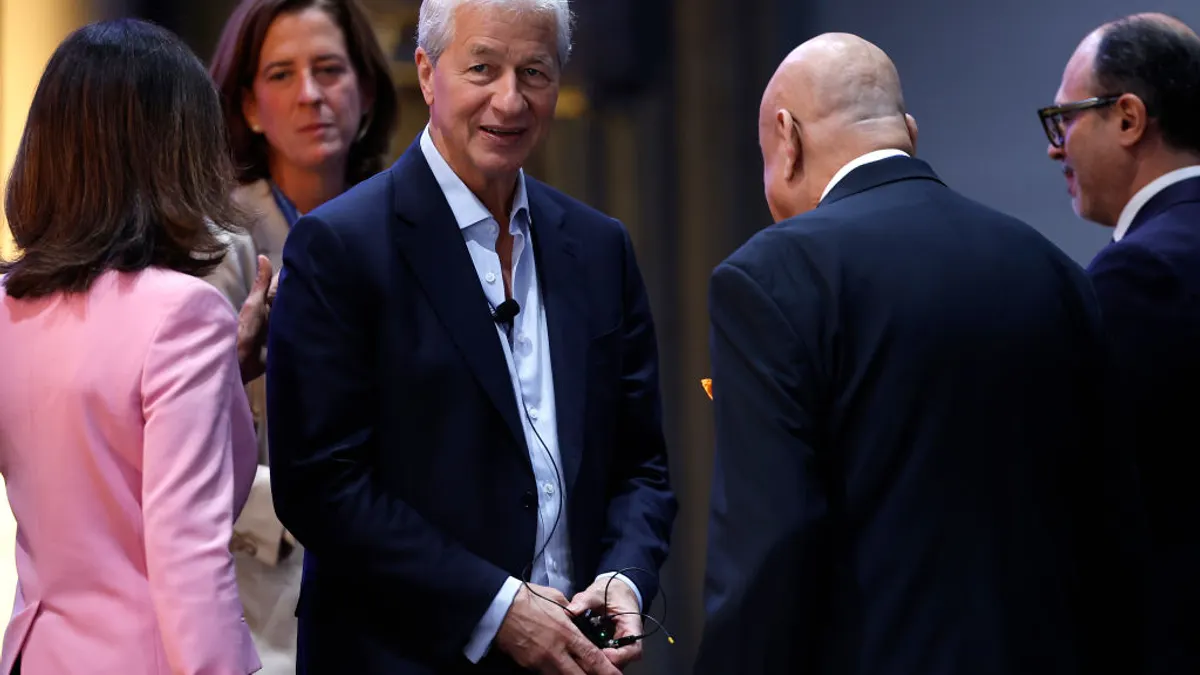

JPMorgan Chase launches geopolitics center

CEO Jamie Dimon has long beat the drum on geopolitical awareness. Now, his bank wants to help clients make sense of it all.

By Gabrielle Saulsbery • May 22, 2025 -

JPMorgan’s Dimon talks regulatory changes, crypto

The CEO didn’t mince words Monday on the bank regulatory approach over the last 15 years. Regulators “went so far beyond what was reasonable that they should be embarrassed.”

By Caitlin Mullen • May 20, 2025 -

Democrats press biggest US banks on climate alliance exits

“Leaving doesn’t eliminate climate-related financial risk; instead, it diminishes your capacity to monitor and address that risk collaboratively,” lawmakers told JPMorgan and 11 other institutions.

By Lamar Johnson • May 16, 2025 -

Comerica risk chief heads to USAA

Brian Goldman, who’s been Comerica’s chief risk officer for about a year and a half, will leave to take the same role at USAA, effective May 27.

By Caitlin Mullen • May 14, 2025 -

Morgan Stanley to see no SEC penalty on cash sweeps

The agency concluded its probe into the bank’s interest rate-related program. The bank still faces an investigation from a state regulator, though.

By Dan Ennis • May 7, 2025 -

Treasury’s Bessent: Private credit surge underscores need for bank deregulation

“The growth of private credit tells me that the regulated banking system has been too tightly constrained,” Scott Bessent said Monday.

By Caitlin Mullen • May 6, 2025 -

HSBC pressed on net zero by $1.6 trillion investor group at annual meeting

Some 30 investors called on the bank to “urgently affirm” its commitment to its climate goals and prioritizing net-zero emissions across its operations.

By Zoya Mirza • May 6, 2025 -

Zelle service unavailable for many users after Fiserv tech glitch

The P2P payments service experienced technical troubles Friday as Fiserv cited an "internal issue" in its disruption.

By Justin Bachman • May 5, 2025 -

NCUA liquidates NJ credit union

Unilever Federal Credit Union, with roughly $46.6 million in assets, was declared insolvent and asked to cease operations Wednesday.

By Rajashree Chakravarty • May 1, 2025 -

Safe Harbor’s new CEO: ‘The idea is: grow’

Terry Mendez, who replaced Sundie Seefried this year at the helm of the cannabis banking pioneer, has cut costs and seeks to rebound after the company’s loss nearly tripled last year.

By Caitlin Mullen • April 30, 2025 -

Warren, Chopra warn of ‘real price to pay’ on DOGE

The former CFPB director pointed to a rise in uninsured deposits amid recent market turmoil.

By Caitlin Mullen • April 29, 2025 -

Sponsored by Arcesium

[Podcast] Comply to Compete: Better Banking Data Management Through 2025’s M&A Integrations

M&A is surging—are banks ready for the compliance challenges? Tune in to Arcesium’s podcast for expert insights.

By Banking Dive's studioID • April 28, 2025 -

Bank of America ordered to pay FDIC $540M in risk lawsuit

A judge’s decision, made public Monday, marks the latest development in a yearslong legal fight between the bank and the regulatory agency over the unpaid deposit insurance assessments.

By Caitlin Mullen • April 15, 2025 -

TD acknowledges ‘darkest day’ in shareholder meeting

The bank’s chair called October’s $3.09 billion settlement “extraordinarily painful.” Investors voted in four new board members Thursday, including Morgan Stanley’s former deputy CFO.

By Dan Ennis • April 11, 2025 -

Dimon points to ‘turbulence,’ sees uncertainty persisting through July

The trade war poses certain risks to JPMorgan Chase, given its global reach. “Add that to the list of worries – we will be in the crosshairs,” CEO Jamie Dimon said Friday.

By Caitlin Mullen • April 11, 2025 -

Warren presses Fed’s Bowman on tariff stance

The senator grew exasperated when the nominee for vice chair for supervision suggested a wait-and-see approach on Trump policy.

By Caitlin Mullen • April 10, 2025 -

Lawmakers push House bill on reputational risk

Reps. Andy Barr, R-KY, and Ritchie Torres, D-NY, introduced companion legislation of the Senate’s FIRM Act to remove reputational risk as a component in bank supervision.

By Rajashree Chakravarty • April 10, 2025 -

Treasury eyes bigger regulatory role, Bessent says

The treasury secretary said he wants regulatory tailoring to ensure smaller community banks matter on a wider scale.

By Caitlin Mullen • April 9, 2025 -

Webster Bank risk chief to retire

Daniel Bley will leave his role after the Connecticut-based bank finds his replacement, the lender said last week.

By Rajashree Chakravarty • April 8, 2025 -

Dimon frets over tariff uncertainty in annual letter

The CEO of the biggest U.S. bank said he sees President Donald Trump’s tariff policy as "one large additional straw on the camel’s back."

By Caitlin Mullen • April 7, 2025