Technology: Page 10

-

How embedded payments are changing the way we pay

As payments technology advances, more companies are embedding the payments process in websites and apps. Here’s a primer on how this trend is advancing and changing the payments arena.

By Patrick Cooley • Aug. 14, 2024 -

Tracker

A running list of fintech layoffs in 2024

Thousands of fintech employees have been let go since the start of the year. Many firms cited cost cuts.

Aug. 9, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

FTX to pay $12.7B to fraud victims

An order by a New York judge resolves a lawsuit filed by the Commodity Futures Trading Commission in late 2022 and permanently bans FTX from trading digital assets.

By Gabrielle Saulsbery • Aug. 9, 2024 -

Ripple to pay $125M penalty in XRP case against SEC

The fine was not nearly the $2 billion the SEC sought. The judge in the case, though, issued an injunction requiring Ripple to register if it intends to sell securities in the future.

By Dan Ennis • Aug. 8, 2024 -

Truist names JPMorgan, Wells vet as next CIO

Steve Hagerman spent 17 years and five years at JPMorgan and Wells Fargo, respectively. He will replace interim CIO Brad Bender in October.

By Gabrielle Saulsbery • Aug. 8, 2024 -

JPMorgan fires up biometric payments processing

The biggest U.S. bank is piloting payments processing for biometric transactions, with plans to use it at the hamburger chain Whataburger, which lets customers pay with a face scan.

By Lynne Marek • Aug. 7, 2024 -

Genesis completes restructuring, begins payouts

The company filed for bankruptcy in January 2023. User funds had been frozen since November 2022 when the crypto lender ran into liquidity issues following the collapse of FTX.

By Gabrielle Saulsbery • Aug. 5, 2024 -

Outdated tech could slow instant payment adoption: survey

Financial institutions expect business clients to be a driver of instant payment revenue, but adopting the technology comes with hurdles, the results of a recent survey showed.

By Tatiana Walk-Morris • Aug. 2, 2024 -

Fifth Third’s Newline to expand Stripe’s embedded financial services

“Maybe we’re just a little too Midwest humble about it, but Newline isn’t new to this,” Newline GM Tom Bianco said. Working with Stripe, he said, reinforces that it is, and has been, “a real force.”

By Gabrielle Saulsbery • July 31, 2024 -

How Flushing Bank stays cyber-safe

CEO John Buran credits “measured” growth rate and solid teamwork for putting his $8.8 billion-asset institution atop Forbes’s cybersecurity list.

By Gabrielle Saulsbery • July 31, 2024 -

Wells Fargo hires BNY’s ex-CIO to serve as tech chief

Bridget Engle comes to Wells next month after seven years at BNY. Wells also tapped its previous tech chief, Tracy Kerrins, to lead a new generative AI team.

By Dan Ennis • July 31, 2024 -

Stripe buys software rival Lemon Squeezy

The San Francisco payments giant bought the 4-year-old Salt Lake City startup as it continues its global expansion.

By Patrick Cooley • July 30, 2024 -

Trump pledges to fire Gensler, support crypto

The Republican presidential nominee told Bitcoin 2024 attendees that, if elected, he will hire advisers who “want to see your industry thrive, not dive.”

By Gabrielle Saulsbery • July 29, 2024 -

Q&A

Citizens CIO: ‘Human in the loop’ still key for banks using genAI

The bank won’t employ direct-to-consumer applications of generative AI in 2024, the executive said, adding he envisions it happening in a year or so.

By Caitlin Mullen • July 26, 2024 -

Fed cites digital bank Jiko over capital planning woes

The central bank is requiring the startup, which bought a bank in 2020, to submit a liquidity risk management plan with steps to diversify its funding sources and enhanced stress test scenarios.

By Dan Ennis • July 24, 2024 -

Revolut faces more fraud claims than other UK banks: report

A spokesperson said the fintech investigates each fraud claim independently of other cases, and that it takes such claims “incredibly seriously.”

By Gabrielle Saulsbery • July 24, 2024 -

FTC demands pricing input from JPMorgan, Mastercard

The Federal Trade Commission demanded information from the megabank, card network and other companies to better understand how consumer data is being used in pricing.

By Lynne Marek • July 24, 2024 -

BlockFi prepares to make customers whole

The crypto firm’s bankruptcy plan was approved in September. It announced Monday the sale of its FTX claims, part of its plan to pay customers back, at a “substantial premium to the[ir] face value.”

By Gabrielle Saulsbery • July 23, 2024 -

Fed fines Green Dot $44M

The consent order has been expected since February, when Green Dot revealed that reasonable associated losses could total $50 million.

By Gabrielle Saulsbery • July 22, 2024 -

Sponsored by Huron

A regional U.S. bank’s path to digital excellence with Workday

A financial institution collaborated with a consulting firm to implement a suite of cloud-based applications.

July 22, 2024 -

JPMorgan, UBS and others see effects of IT outage

Trading was delayed at JPMorgan and Nomura, media outlets reported. UBS saw problems related to legacy systems inherited from Credit Suisse. Charles Schwab warned users not to place duplicate trades.

By Dan Ennis • July 19, 2024 -

Green Dot execs misled shareholders about declining business, lawsuit says

A former Green Dot employee alleged Monday that company leaders misrepresented how an important line of business was performing while also knowing about issues that would lead to an expensive Fed consent order.

By Gabrielle Saulsbery • July 17, 2024 -

SEC drops enforcement action against Paxos

The SEC dropping its enforcement action against Paxos a year after issuing the firm a Wells notice may have reignited the crypto regulation debate.

By Rajashree Chakravarty • July 17, 2024 -

6 ways the CFPB wants to keep its eyes on fintech middlemen

Clearer guidance around “rent-a-bank,” open banking and buy now, pay later will ensure more consumers benefit, Director Rohit Chopra said in remarks last week.

By Suman Bhattacharyya • July 17, 2024 -

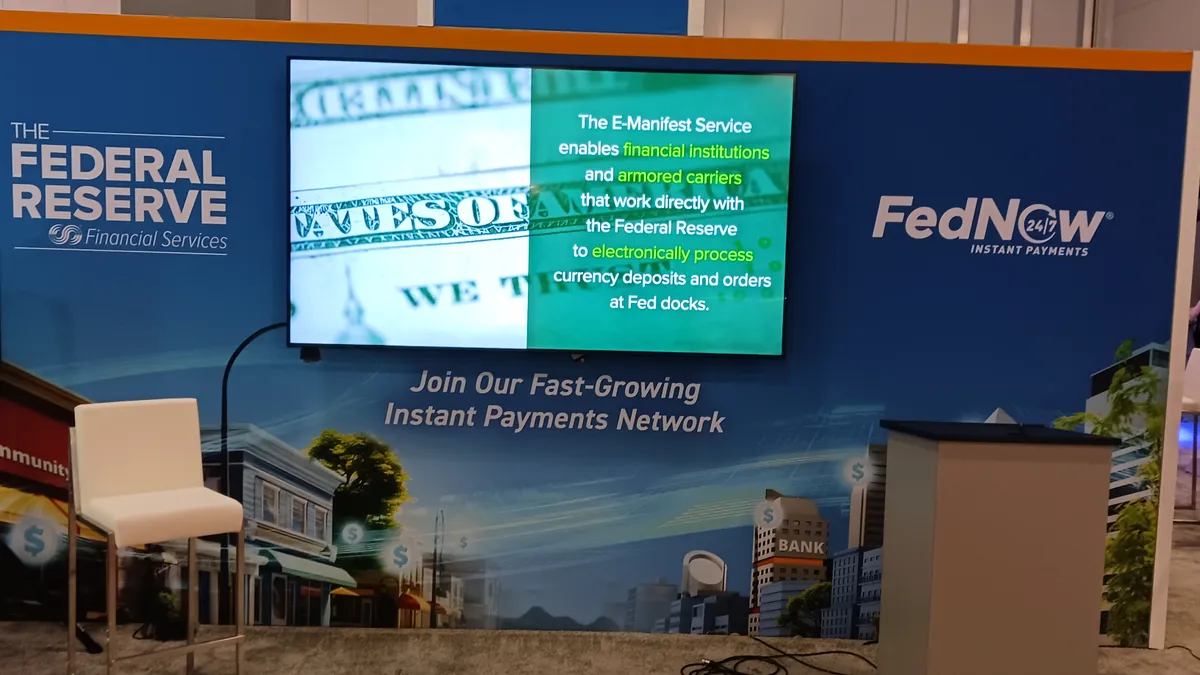

FedNow zooms past RTP participation in inaugural year

The Federal Reserve’s nascent instant payments system has collected hundreds of bank participants across the country in its first year of operations, although a few major banks are holdouts.

By Lynne Marek • July 17, 2024