Technology: Page 14

-

Two SEC attorneys resign after ‘gross abuse of power’ sanctions

A judge sanctioned the regulator in March for issues in its case against crypto platform DEBT Box. The lead attorneys on the case have resigned, according to Bloomberg.

By Gabrielle Saulsbery • April 23, 2024 -

Fintech One offers BNPL at Walmart stores: report

The move presents competition for BNPL provider Affirm, which has partnered with the retail giant since 2019.

By Caitlin Mullen • April 23, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Fed courts nonbanks for FedNow growth

Nonbanks "help us understand what is needed, what customers are demanding [and] not seeing, what's on the horizon that we should be thinking about," a Chicago Fed specialist said this month.

By Lynne Marek • April 23, 2024 -

Goldman sells Marcus Invest accounts to Betterment

When accounts transition in June, Goldman's three-year robo-advisory experiment will end, and the bank will shed another piece of its once-nascent consumer-banking business.

By Dan Ennis • April 23, 2024 -

Truist CIO, chief audit officer leave bank

The bank, meanwhile, has added new leaders in its payments business and logged $70 million in restructuring charges in the first quarter, CEO Bill Rogers said Monday.

By Caitlin Mullen • April 22, 2024 -

Neobank Mercury adds personal banking

The fintech, which has faced regulatory scrutiny, expanded into consumer banking with Mercury Personal, offering a banking option for founders and investors.

By Rajashree Chakravarty • April 17, 2024 -

Warren, Grassley want details on CFTC, Bankman-Fried meetings

FTX founder Sam Bankman-Fried and his team met with CFTC Chair Rostin Behnam 10 times in the 14 months preceding FTX's bankruptcy. Lawmakers are now asking questions.

By Gabrielle Saulsbery • April 16, 2024 -

Q&A

BofA evolves AI-powered assistant toward deeper digital integration

Six years into the Erica era, customers are taking advantage of the tool's insights as often as they're asking questions of it, said Nikki Katz, the bank's head of digital.

By Caitlin Mullen • April 15, 2024 -

US, Europe lock arms on payments regulation

U.S. and European regulators have joined forces to monitor digital payment concerns, including those related to buy now, pay later financing and big tech market participation.

By Lynne Marek • April 15, 2024 -

JPMorgan’s Dimon wants more cloud to fuel AI, analytics

The nation's biggest bank aims to have 75% of its data and 70% of its applications in the cloud this year, the CEO said in his letter to shareholders.

By Matt Ashare • April 15, 2024 -

Sponsored by Huron

Unleashing the synergy of generative AI and robotic process automation in financial services

The synergy of generative AI and RPA is revolutionizing financial services.

April 15, 2024 -

Bankman-Fried files to appeal conviction, sentence

In an email interview following his sentencing, the FTX founder told ABC News he’s “haunted, every day, by what was lost. I never intended to hurt anyone or take anyone’s money.”

By Gabrielle Saulsbery • April 12, 2024 -

Citi’s reorg job toll climbs to 7,000: Fraser

The bank boosted its expectation for annual savings to $1.5 billion. Meanwhile, Citi, Wells Fargo and JPMorgan Chase reported marked increases in FDIC special assessment costs.

By Caitlin Mullen • April 12, 2024 -

Adro raises $1.5M to bridge international students, banking services

Without a Social Security number or U.S. credit file, students coming from abroad face a lag in banking in their new home country. Adro aims to fix that.

By Gabrielle Saulsbery • April 10, 2024 -

KeyBank scouts for fintech partners

The bank, which has yet to strike a fintech partnership this year, generally enters into one to two each year, said Ken Gavrity, president of Key Commercial Bank.

By Caitlin Mullen • April 10, 2024 -

Varo’s new CFO aims for ‘path to profitability’

Zillow alum Allen Parker is focused on “ensuring finance can play a role in how we prioritize our investments,” he said.

By Grace Noto • April 9, 2024 -

Dimon blasts regulation, proxy advisers in annual letter

The JPMorgan Chase CEO also gave prominent space to AI, touting its potential impact in software engineering, customer service and operations, “as well as in general employee productivity."

By Caitlin Mullen • April 8, 2024 -

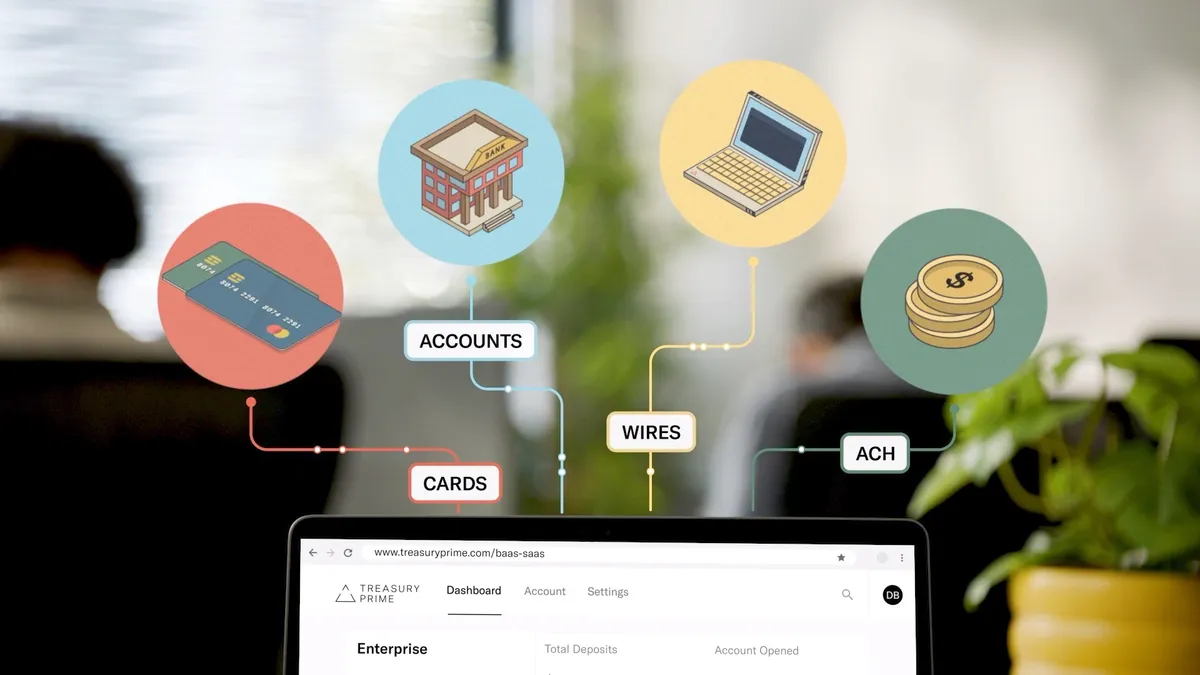

Treasury Prime, Narmi partner to offer customers FedNow service

The partnership aims to simplify and accelerate the adoption of FedNow by small and medium-sized financial institutions in Treasury Prime’s network.

By Rajashree Chakravarty • April 3, 2024 -

Goldman renewables spinoff MN8 Energy secures $325M investment

Ridgewood Infrastructure and Switzerland-based Mercuria Energy both secured observer seats on the renewable energy company’s board of directors.

By Lamar Johnson • April 2, 2024 -

Bank of America rolls out platform linking small businesses, CDFIs

The online platform, a partnership with the Community Reinvestment Fund, USA, provides access to around 150 local community development financial institutions and other business support organizations.

By Rajashree Chakravarty • March 28, 2024 -

FTX founder Sam Bankman-Fried gets 25 years in prison

The former crypto exchange CEO was convicted in November 2023 on seven counts of fraud and conspiracy.

By Gabrielle Saulsbery • March 28, 2024 -

SEC can continue its case against Coinbase

The agency “sufficiently pleaded that Coinbase operates as an exchange, as a broker, and as a clearing agency under the federal securities laws,” U.S. District Judge Katherine Polk Failla ruled.

By Gabrielle Saulsbery • March 27, 2024 -

SEC asks judge to green-light $2B penalty for Ripple

The crypto firm hasn’t accepted responsibility for the portion of XRP sales a judge ruled illegal in July, the SEC said. In a social post, Ripple’s CEO said the company would “expose the SEC for what they are” in a filing next month.

By Dan Ennis • March 26, 2024 -

Robinhood co-founder steps down

Baiju Bhatt, who co-founded the fintech 11 years ago and was most recently chief creative officer, is moving on to “focus on his next enterprise.”

By Gabrielle Saulsbery • March 25, 2024 -

Banks balance cloud, cyber priorities with AI eagerness

More than two-thirds of financial firms have made meaningful progress on core modernization, according to Broadridge data.

By Matt Ashare • March 25, 2024