Technology: Page 16

-

MoneyLion, EY partner to co-build ‘turnkey’ solutions for banks

The partnership will help to drive deposits for mid-sized banks and help diversify their existing revenue streams by implementing comprehensive digital marketplaces inside their ecosystems.

By Rajashree Chakravarty • Feb. 7, 2024 -

Fed ends enforcement action against Farmington State Bank

The small Washington state-based bank was heavily tied to FTX before the crypto exchange's implosion.

By Gabrielle Saulsbery • Feb. 7, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Fiserv CEO details special bank charter pursuit

The processing and acquiring company, which seeks a “very specific” special bank charter, doesn’t intend to compete with its financial institution partners, Fiserv CEO Frank Bisignano said Tuesday.

By Caitlin Mullen • Feb. 7, 2024 -

Fleet fintech ditches Visa for Mastercard

Fuel card startup AtoB, with $112 million in financial backing, plans to take on dominant fleet service rivals Wex and Fleetcor.

By Lynne Marek • Feb. 6, 2024 -

Vast Bank discontinues crypto mobile app

The Tulsa, Oklahoma-based lender told customers their digital assets would be liquidated and accounts would be closed. Customers will receive stranded assets via cashier’s check, the bank said.

By Rajashree Chakravarty • Feb. 5, 2024 -

Celsius emerges from bankruptcy after 18 months

As part of its bankruptcy exit, the crypto exchange is distributing $3 billion to creditors and launching a Bitcoin mining firm.

By Gabrielle Saulsbery • Feb. 2, 2024 -

Genesis Global settles SEC suit for $21M

The settlement will, among other things, "eliminate the risks, expenses, and uncertainty associated with protracted litigation against the SEC."

By Gabrielle Saulsbery • Feb. 2, 2024 -

FTX to repay customers, nixes reboot

“I’d like the court and stakeholders to understand this is not a guarantee. ... But we believe the objective is within reach and we have a strategy to achieve it,” said FTX attorney Andrew Dietderich.

By Gabrielle Saulsbery • Feb. 1, 2024 -

Nasdaq to cut jobs to streamline operations: report

The second-largest U.S. stock exchange is planning to cut its workforce as it integrates software provider Adenza into its business to improve efficiency, Bloomberg reported.

By Rajashree Chakravarty • Jan. 31, 2024 -

The banking industry outlook on 2024: The year of wait-and-see

A capital requirements proposal, fintech regulation and the CFPB itself hang in the balance as opinions (from the public and a court) and an ever-ticking clock loom large.

By Dan Ennis • Jan. 30, 2024 -

Trading platform EquiLend down following cyberattack

The prolific criminal group LockBit has reportedly claimed credit for the attack, raising further questions about the risks facing the securities and banking industries.

By David Jones • Jan. 24, 2024 -

Figure eyes SEC approval for interest-bearing stablecoin

The company’s token would be redeemable at 1 cent per certificate, rather than $1, and interest would accrue daily and be paid monthly to the user, according to paperwork filed with the agency.

By Dan Ennis • Jan. 23, 2024 -

Retrieved from LinkedIn on January 23, 2024

Jack Henry vaults COO to CEO seat

Greg Adelson, the company’s current president and chief operating officer, will take the reins from outgoing CEO David Foss in July.

By James Pothen • Jan. 23, 2024 -

Binance, SEC face off in court

For the second time in one week, the Securities and Exchange Commission sought to convince a judge that crypto is a security, and a crypto company sought to convince her of the opposite.

By Gabrielle Saulsbery • Jan. 23, 2024 -

BaaS to require strong commitment, investment in 2024, experts say

While demand for embedded banking services will continue to propel the BaaS space, experts say regulatory scrutiny will likely separate committed banks from those with a casual interest in the model.

By Anna Hrushka • Jan. 22, 2024 -

FedNow draws some banks, as others lag

The Federal Reserve is building up bank participation in FedNow, but big financial institutions such as Bank of America, Citi, PNC and Capital One, remain on the sidelines — for now.

By Lynne Marek • Jan. 19, 2024 -

Citi poured $12B into tech last year, retired nearly 400 legacy apps

While efforts to modernize are underway, the company is operating at a loss and plans to cut 20,000 positions by 2026 as part of a broader restructuring.

By Matt Ashare • Jan. 18, 2024 -

Bank of America CEO on digital transformation: ‘There’s always more to go’

The Charlotte, North Carolina-based lender has spent billions of dollars on data systems to support AI tools in the past decade and assisted 18 million unique users in Q4, CEO Brian Moynihan said.

By Matt Ashare • Jan. 18, 2024 -

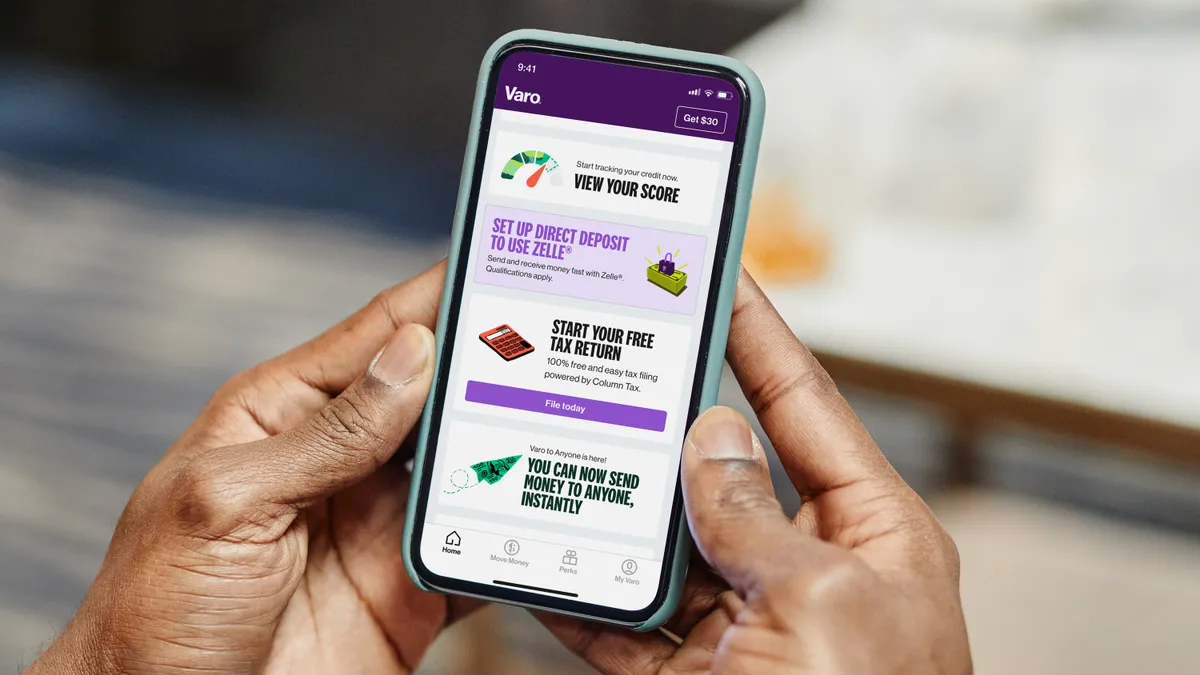

Varo rolls out free tax prep and filing tool with Column Tax

All Varo Bank customers can access the tax filing service, which uses pre-filled data based on user information and helps to file taxes in less than 15 minutes, the lender said.

By Rajashree Chakravarty • Jan. 17, 2024 -

Genesis Global Trading to pay $8M fine, surrender BitLicense

The Digital Currency Group subsidiary has been winding down since September. New York's crypto czar penalized it Friday for failing to comply with regulations while in operation.

By Gabrielle Saulsbery • Jan. 16, 2024 -

First Citizens can move forward with $1.2B poaching suit against HSBC

The judge in the case called the suit “confusing," and gave First Citizens 28 days to file an amended complaint. The bank alleges an ex-SVB executive masterminded a plan to bring 42 colleagues to HSBC.

By Gabrielle Saulsbery • Jan. 12, 2024 -

Stablecoin issuer Circle files for IPO

Circle, which issues the USDC stablecoin, said Thursday it filed confidential paperwork with the Securities and Exchange Commission — one day after the SEC's approval of 11 spot bitcoin ETFs.

By Gabrielle Saulsbery • Jan. 11, 2024 -

FTC slaps $3M penalty on fintech FloatMe

The federal agency alleged the cash advance app company charged users without consent and misled consumers on eligibility requirements.

By Rajashree Chakravarty • Jan. 10, 2024 -

Remitly taps ads to woo new clients

The cross-border payments company has boosted marketing to build up its remittance clientele.

By Lynne Marek • Jan. 10, 2024 -

The image by Gareth Milner is licensed under CC BY-SA 2.0

The image by Gareth Milner is licensed under CC BY-SA 2.0

Barclays slashes 5,000 jobs in cost-cutting effort

The London-based bank said it cut 5,000 roles from its global workforce of 84,000 last year in a bid to "simplify and reshape the business.”

By Anna Hrushka • Jan. 9, 2024