Technology: Page 35

-

Column

Citi's 7,000 new-hire push should come as no surprise

The bank warned investors in March that expenses could jump 10% to 12% over first-quarter levels. And it said it would pour some of its retail-exit windfall back into wealth management.

By Dan Ennis • June 8, 2022 -

Crypto framework would define SEC, CFTC oversight purview

A bipartisan Senate measure introduced Tuesday tackles regulatory requirements on stablecoin issuers, taxes on crypto transactions and delineates commodities and securities. But its chances of passing appear low.

By Robin Bradley • June 7, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Sponsored by West Monroe

Why a digital operating model is necessary for banks to reach their goals

To meet demands from inside and out, banks need a digitally forward operating model to power the entire enterprise.

June 6, 2022 -

Sponsored by Statflo

What you need to know about maintaining compliance with SMS regulations

SMS Regulations: How do you keep your company in compliance?

June 6, 2022 -

Deep Dive

Banks eye first-mover advantage to embracing the metaverse

Banks are carving out their own spaces in the metaverse, a virtual world estimated to represent a $1 trillion market opportunity.

By Anna Hrushka • June 2, 2022 -

Varo Bank could run out of funds by year-end, filing shows

The bank reported $263 million in equity and a burn rate of $84 million in 2022's first quarter. It has cut 65 employees since the previous quarter. However, the bank doesn't need to raise more capital, its CEO said.

By Anna Hrushka • May 31, 2022 -

CBDC, stablecoins and commercial bank money can coexist, Brainard says

The Federal Reserve vice chair, at a House Financial Services Committee hearing Thursday, also called for stricter regulation in the stablecoin space.

By Robin Bradley • May 27, 2022 -

CFPB won't let lenders hide behind algorithms

Lenders that use "black-box" models to determine creditworthiness must still give denied applicants detailed reasoning under ECOA, the bureau said Thursday.

By Dan Ennis • May 27, 2022 -

JPMorgan Chase taps PayPal exec Peggy Mangot to head fintech partnerships

The Wells Fargo and Google veteran, who joined the bank this month, leads a team responsible for designing, developing and driving fintech partnership strategy at JPMorgan's commercial bank.

By Anna Hrushka • May 26, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB recasts innovation office to emphasize competition

The bureau walked back its no-action letter and sandbox policies in favor of "incubation events" meant to troubleshoot barriers to innovation and help customers switch providers more easily.

By Dan Ennis • May 25, 2022 -

CBDC would pull deposits away from banks, trade groups tell Fed

A U.S. digital dollar would take $720 billion in deposits out of banks even if the central bank were to cap accounts at $5,000 per "end user," the American Bankers Association wrote in a letter.

By Robin Bradley • May 24, 2022 -

VyStar outage leaves members without digital banking access for 10 days

The credit union had planned to take down its systems May 13-15 for upgrades but discovered persistent issues and "decided to invest the time ... to make sure we get this right for our members," its CEO said.

By Robin Bradley • May 24, 2022 -

Neobank Stretch wants to bank individuals with a conviction history

Stretch is zeroing in on the struggles the formerly incarcerated face, pain points that are not adequately addressed in the mainstream banking system, Founder Yasaman Hadjibashi said.

By Anna Hrushka • May 19, 2022 -

Wells Fargo taps former JPMorgan exec to head financial advisory unit

The firm selected Sol Gindi, a former C-suite executive for JPMorgan's wealth management and consumer banking businesses, to replace Jim Hays as the head of Wells Fargo Advisors.

By Robin Bradley • May 17, 2022 -

PNC ordered to pay $218M to USAA in patent infringement case

“This verdict further validates our position that we created mobile deposit capture technology,” USAA Vice President of Corporate Development Nathan McKinley said in a statement.

By Anna Hrushka • May 16, 2022 -

Breaking the mainframe habit: Banks consider a cloud future

Banks are bullish on cloud migration, but challenges remain.

By Matt Ashare • May 13, 2022 -

Connecticut issues cease-and-desist order over fintech’s ‘tip’ structure

Including tips, the annual percentage rates on loans made to SoLo Funds borrowers in Connecticut ranged from 43% to 4,280% between June 2018 and August 2021, the state's banking commissioner said.

By Robin Bradley • May 12, 2022 -

Yellen urges stricter stablecoin regulation this year, amid TerraUSD crash

The coin, which relies on an algorithm rather than being backed by dollar reserves, plummeted to 23 cents Wednesday, according to CoinDesk.

By Robin Bradley • May 11, 2022 -

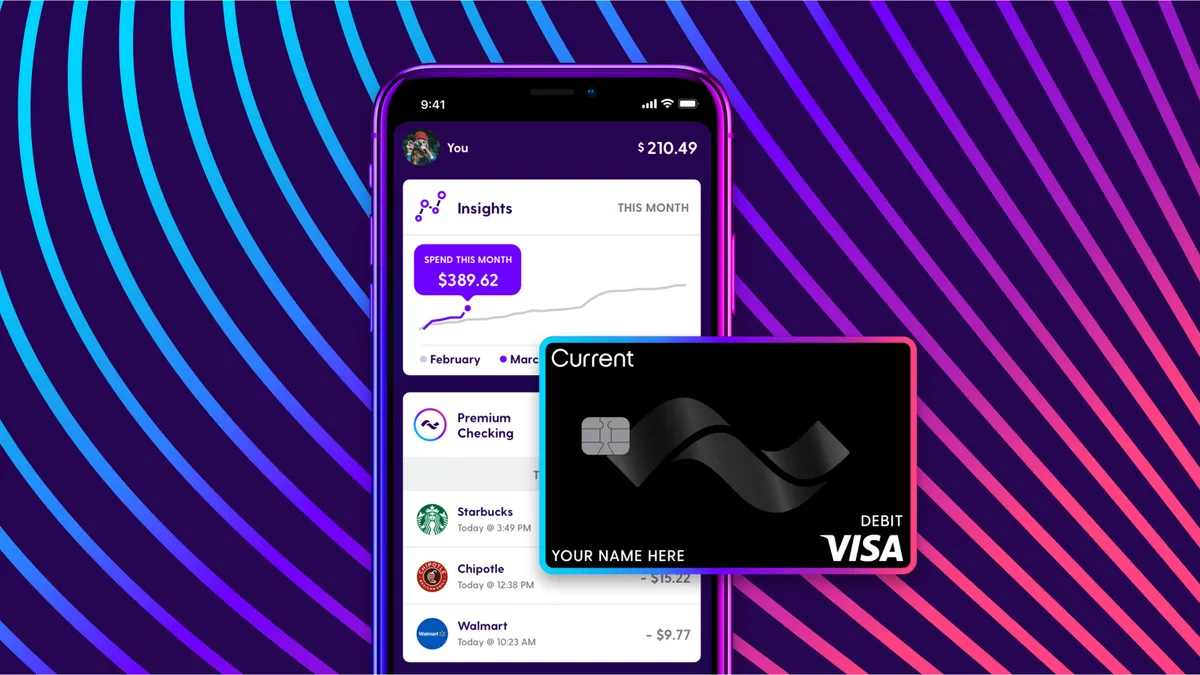

Current wades into embedded banking with launch of API platform

The neobank announced Plaid as its first partner, a tie-up the two firms said will enable Current’s customers to access more than 6,000 apps and services powered by the data aggregator’s network.

By Anna Hrushka • May 11, 2022 -

SEC to nearly double crypto enforcement unit

The agency is adding 20 supervisors, investigative staff attorneys, trial counsels and fraud analysts to an already 30-strong team.

By Robin Bradley • May 3, 2022 -

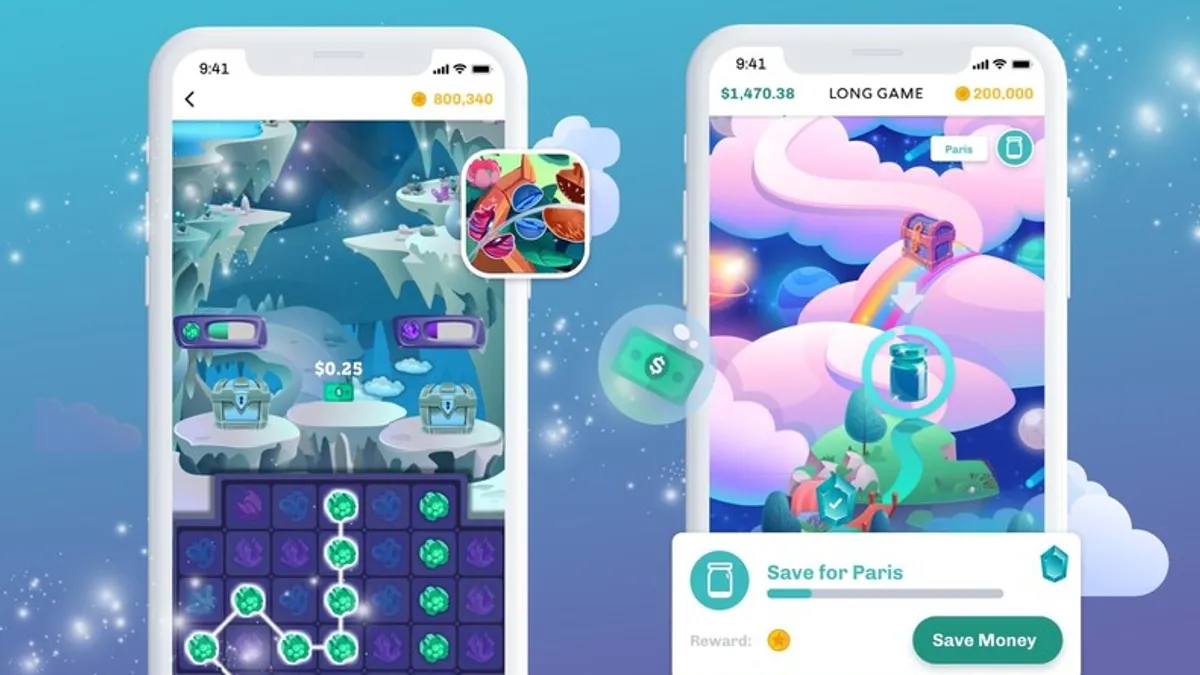

Truist buys gamified finance app Long Game

Long Game, which uses prize-linked games to encourage smart financial habits, aims to help banks and credit unions with client retention and account growth, particularly among Gen Z and millennial customers.

By Anna Hrushka • May 3, 2022 -

Column

Citi's role in 'flash crash' reinforces perils of manual transactions

Nasdaq said it won't cancel any trades from Monday that pushed European indexes down as much as 8% in five minutes. Unlike in 2020, the damage from a Citi employee's hands wasn't contained to the bank.

By Dan Ennis • May 3, 2022 -

U.S. Bank rolls out Spanish-language voice assistant for mobile app

The Minneapolis lender cites a study indicating 25% of Hispanic Americans are "smartphone-only" internet users — double the proportion of White adults.

By Robin Bradley • May 2, 2022 -

TD Bank targets South Florida tech talent pool

The Toronto-based lender on Tuesday announced the launch of a hub in Fort Lauderdale, adding it intends to hire 200 tech workers in the area over the next two years.

By Anna Hrushka • April 26, 2022 -

Bank trade groups want more clarity on Fed master accounts

The groups want further detail on how the central bank will review and scrutinize applications. The authors also want the Fed to explain how the country's reserve banks will monitor institutions in the proposed tiered system.

By Anna Hrushka • April 25, 2022