Technology: Page 40

-

4 credit unions launch neobank aimed at LMI users

Dora's checking account doesn't have a minimum balance requirement or monthly maintenance fees. Its app functions in both English and Spanish, and the platform offers early paycheck access with direct deposit.

By Robin Bradley • Sept. 30, 2021 -

Column

Robinhood, Revolut and PayPal play business-model musical chairs

New products have Revolut trying its hand at Robinhood's game, Robinhood looking to Coinbase, and PayPal seeing if high-yield savings a la Marcus would be a good fit.

By Dan Ennis • Sept. 24, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Inside Wells Fargo's multicloud strategy

Companies often use multiple cloud providers in practice, but high-profile work is aligned with one. The first five years will focus on migrating most existing applications into the public cloud, a bank executive said.

By Naomi Eide • Sept. 22, 2021 -

Coinbase scraps crypto lending product under fire from SEC

The company is also discontinuing its waitlist for Lend, a product that would have let users earn 4% interest by lending their holdings of a stablecoin to other customers.

By Dan Ennis • Sept. 21, 2021 -

Varo's latest $510M funding round validates bank charter decision, exec says

The bank, now reportedly valued at $2.5 billion, plans to use the new funding on account growth, brand building, its product roadmap and operational and risk management infrastructure.

By Anna Hrushka • Sept. 17, 2021 -

Business failure helped Chime CFO build resilience

Having a business that didn't succeed past its venture stage gave Matt Newcomb a big-picture view that informs his strategic mindset at the fast-growing fintech.

By Robert Freedman • Sept. 15, 2021 -

How BankMobile pivoted its business model in the face of competition

"Our pillar of being able to have a profitable, sustainable model — and as fast as possible — wasn't happening," CEO Luvleen Sidhu said. "It's challenging when you have other challenger banks spending half a billion dollars on marketing."

By Anna Hrushka • Sept. 15, 2021 -

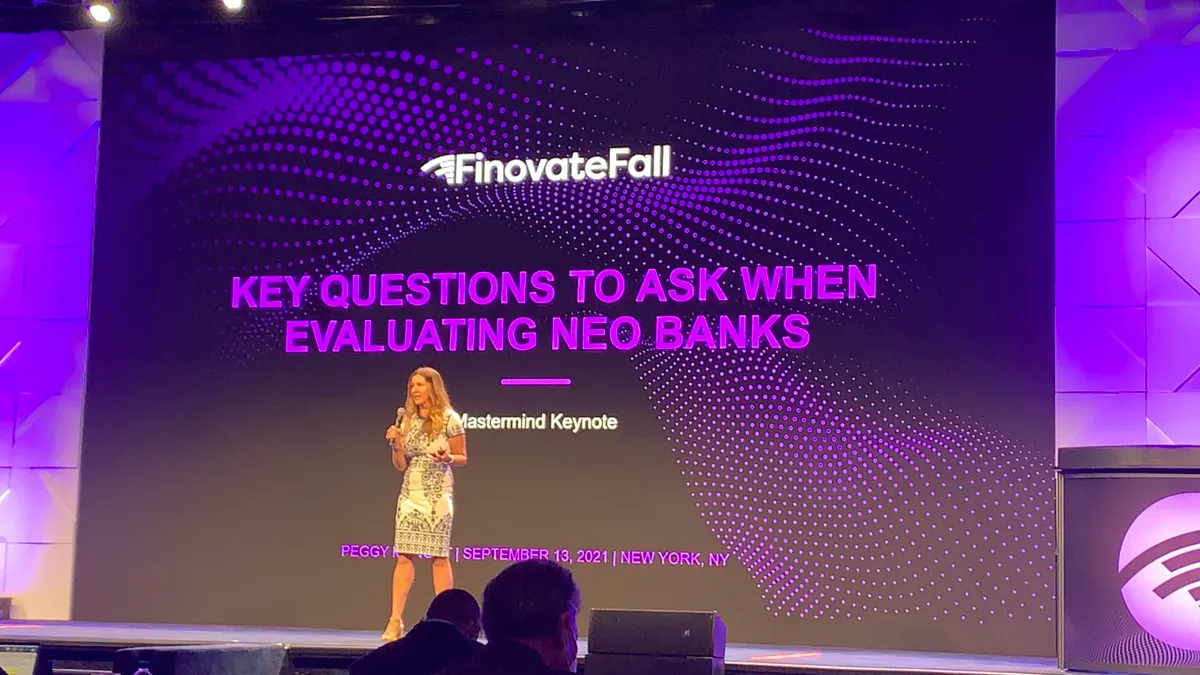

Why PayPal Ventures' Peggy Mangot thinks vertical neobanks are poised for growth

While mass-market neobanks continue to turn heads with user numbers and funding rounds, affinity neobanks are poised to experience their own market expansion soon, the executive told the Finovate Fall conference.

By Anna Hrushka • Sept. 14, 2021 -

Sponsored by West Monroe

Why banks need a data-driven sales methodology to grow in 2021

The conditions of 2021 require a next generation model of sales effectiveness, backed by data and analytics.

By Tom Collins and Dean Konick • Sept. 13, 2021 -

Georgia bank's new owners eye a digital makeover without losing the personal touch

ST Hldgs acquired Rochelle State Bank with the aim to bolster the single-branch institution's web portal and mobile options, while keeping the bank's close-knit model intact.

By Anna Hrushka • Sept. 9, 2021 -

Coinbase reveals SEC plan to sue over lending product

Company execs ask for more clarity from the regulator amid plans to delay the interest-bearing offering until at least next month.

By Dan Ennis • Sept. 8, 2021 -

JPMorgan to buy majority stake in Volkswagen's payments business

The deal is the latest in a series of investments the bank has made in the past year, following CEO Jamie Dimon's 2020 promise that it would be "much more aggressive with acquisitions across the board."

By Anna Hrushka • Sept. 8, 2021 -

Sponsored by MX

Prioritization is the new innovation: 3 ways the financial industry can decide on digital initiatives

Financial data has become the center of every experience, so prioritization of strategies and technologies is key.

Sept. 7, 2021 -

Citizens Bank of Edmond to launch national digital bank with partner Moven

The platform is meant to target an underserved affinity group, Citizens CEO Jill Castilla said, adding she would share more details about the customer base in the next 60 days.

By Anna Hrushka • Aug. 31, 2021 -

Fintech veteran gears neobank toward musicians

Kasasa executive John Waupsh decided to launch Nerve after noticing musicians, struggling to access business accounts, often rely on personal checking accounts for business deposits and expenses.

By Anna Hrushka • Aug. 25, 2021 -

JPMorgan Chase glitch let customers see other users' data

The breach, which lasted from May 24 to July 14, appears to have limited reach — seven customers in Montana, for example — although no details were available regarding potential impact in other states, or elsewhere.

By Dan Ennis • Aug. 23, 2021 -

Bank of America nets record 227 patents in first half of 2021

That figure represents a 23% increase from the first six months of last year. About 40% of the 227 patents are connected to artificial intelligence or machine learning.

By Robin Bradley • Aug. 20, 2021 -

How Square's Afterpay deal plays into its SMB, consumer banking goals

The $29 billion deal will bring the Australian firm's point-of-sale financing technology and large merchant portfolio under Square's umbrella, further enabling the fintech to continue its push into banking services.

By Anna Hrushka • Aug. 18, 2021 -

PPP loans through fintechs much more likely to be suspicious, study finds

Fintech and traditional lenders both started the program with suspicious loan rates of around 10%, but fintechs' suspicious loan rates grew to 40% when PPP ended, University of Texas, Austin, researchers found.

By Anna Hrushka • Aug. 17, 2021 -

Column

Walmart, NYCB show 2 ways to angle for blockchain expertise

The retailer posted a job description for a crypto product lead, while New York Community Bank partnered with fintech Figure.

By Dan Ennis • Aug. 17, 2021 -

Bipartisan bill would expand SBA loan program to include fintech lenders

"You shouldn’t need a big bank to get an SBA loan," said Sen. John Hickenlooper, D-CO, who introduced the legislation alongside Sen. Tim Scott, R-SC, on Wednesday.

By Anna Hrushka • Aug. 13, 2021 -

Citi seeks to pair banks and small businesses

Citi aims to strengthen relationships with smaller banking institutions and improve access to capital for businesses.

By Robin Bradley • Aug. 12, 2021 -

Revolut readies for US growth with marketing push, product expansions

Since launching quietly stateside last year, the fintech has rolled out a small-business banking product, applied for a bank charter, and has begun offering remittances between the U.S. and Mexico.

By Anna Hrushka • Aug. 11, 2021 -

Ex-OCC chief Brooks resigns as Binance.US CEO

The former regulator, who had led the company just three months, cited "differences in strategic direction" in a Twitter post. Binance faces scrutiny from several U.S. bodies, including the CFTC, Justice Department and IRS.

By Robin Bradley • Aug. 9, 2021 -

Chase study highlights growing popularity of digital banking

The COVID-19 pandemic has increased consumers' reliance on mobile banking tools to manage their savings.

By Robin Bradley • Aug. 5, 2021