Technology: Page 5

-

FDIC eases crypto rules for banks

Banks can engage in crypto-related activities, but must still exercise proper caution, the agency said.

By Gabrielle Saulsbery • April 1, 2025 -

Why banks are all-in on open source

Morgan Stanley, JPMorgan Chase and other industry giants are reaping efficiency rewards and attracting tech talent simply by sharing code.

By Matt Ashare • March 31, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Sponsored by Catchpoint

Beyond APM: How banks are improving digital resilience with Internet Performance Monitoring

Read on to learn how your bank or credit union can benefit from an IPM-based strategy.

March 31, 2025 -

CFPB withdraws ‘inappropriate’ filing in NY AG’s suit against Citi

The bureau’s brief was withdrawn because it “advances an interpretation of the Electronic Funds Transfer Act that has never been embraced by any federal court prior.”

By Gabrielle Saulsbery • March 27, 2025 -

Chime adds instant loans

The San Francisco-based fintech has debuted an instant loans product that offers three-month installment funds of up to $500 to Chime members.

By Rajashree Chakravarty • March 26, 2025 -

Kraken to buy futures platform NinjaTrader for $1.5B

The tie-up marks the largest deal to date between the traditional finance and crypto sectors.

By Gabrielle Saulsbery • March 24, 2025 -

Coastal Community Bank self-identifies material weakness

The Everett, Washington-based company restated its financial reports for 2023 and the first three quarters of 2024. The lender recently inked a partnership with neobank Dave.

By Rajashree Chakravarty • March 20, 2025 -

SEC to drop Ripple case

“I'm heartened that we have paved the way for other industry players to see the value in not backing down ... We are now closing a chapter in crypto history,” CEO Brad Garlinghouse said.

By Gabrielle Saulsbery • March 20, 2025 -

Bank customers want clearer communication on cybersecurity: survey

Static, bare-bones website text about information security is “not enough anymore,” an Accenture executive said. A survey by the company found that customers trust banks – but not third-party partners – with their data.

By Caitlin Mullen • March 20, 2025 -

Grasshopper lines up new executives amid lending push

The $867.5 million-asset digital bank added a slew of new lending executives this week, as the lender seeks to jump off loan growth that's come in part from its embedded finance business.

By Gabrielle Saulsbery • March 19, 2025 -

Citi shrinks execs’ bonuses over tech revamp

Senior leaders were paid just 68% of 2024’s target, the bank said in a proxy filing, citing slower progress on regulatory issues.

By Caitlin Mullen • March 19, 2025 -

Crypto firm Gemini hires Affirm veteran as CFO

Dan Chen’s appointment could signal momentum in Gemini’s reported plans to conduct an IPO, coming as the crypto exchange closes the books on several regulatory actions.

By Grace Noto • March 18, 2025 -

Northern Trust exec: Crypto rule changes may ease tokenization

Biden-era anti-crypto regulations didn’t just affect volatile digital assets. They also affected firms offering traditional assets, like bonds, on the blockchain.

By Gabrielle Saulsbery • March 17, 2025 -

Klarna whittled workforce via AI ahead of IPO

The Swedish buy now, pay later juggernaut cut its headcount in each of the past two years, and expects to keep shrinking it.

By Justin Bachman , Lynne Marek • March 17, 2025 -

Mercury to pivot from partner bank Evolve

The decision to sever ties with Evolve follows neobank Dave’s decision to line up Coastal Community Bank as its new partner.

By Rajashree Chakravarty • March 17, 2025 -

Citi revamps tech leadership in its wealth division

Dipendra Malhotra, former head of analytics, AI and data at Morgan Stanley's wealth unit, will help drive technology modernization at Citi, CIO Jonathan Lofthouse said.

By Matt Ashare • March 14, 2025 -

Webster eyes $100B threshold, invests in hiring and tech

The Connecticut-based bank aims to hire about 200 people this year, including adding about two dozen technology and cybersecurity employees, Webster’s CIO said.

By Caitlin Mullen • March 14, 2025 -

Wells Fargo taps Discover, JPMorgan vet to lead branch, ATM tech unit

Heather Blair served as senior vice president of consumer banking technology at Discover for more than a year. She also spent 17 years at JPMorgan Chase, including as head of technology.

By Matt Ashare • March 13, 2025 -

Airwallex taps into multibillion-dollar creator economy

By embedding finance tools into creator platforms, Airwallex aims to help creators get paid more easily, said Ravi Adusumilli, the company's Americas president.

By Gabrielle Saulsbery • March 12, 2025 -

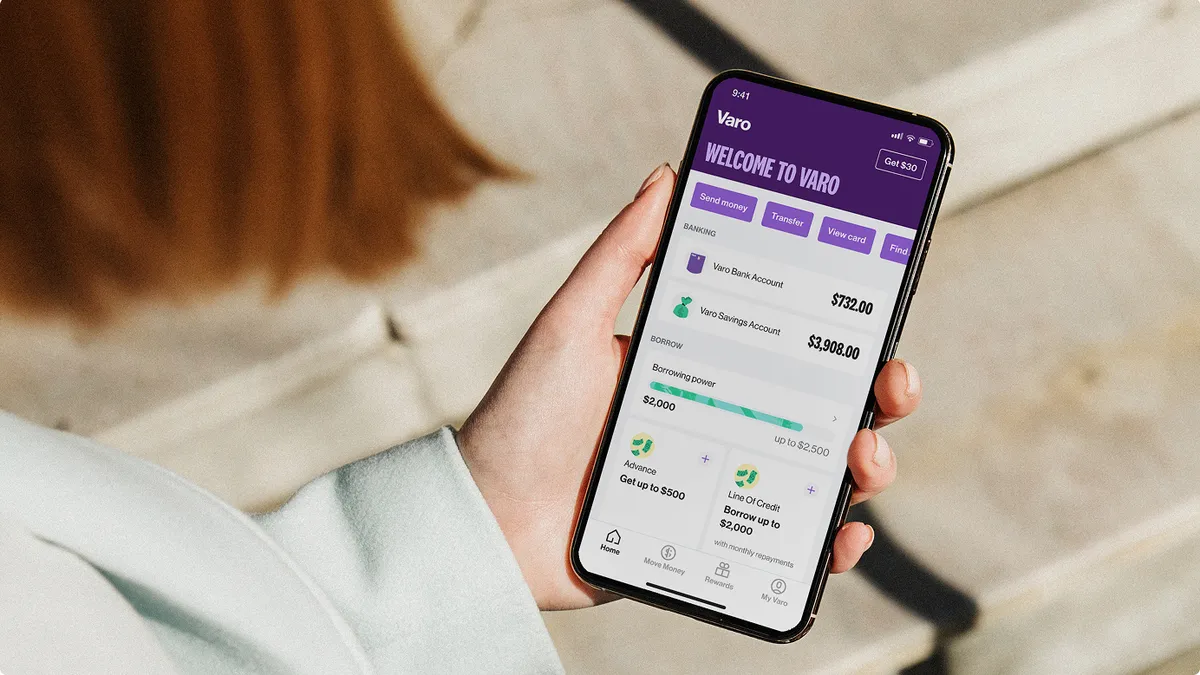

Varo to leverage AI, machine learning in profitability push

Incoming Varo Bank CEO Gavin Michael said he plans to achieve profitability by capitalizing on technology for underwriting and fraud prevention.

By Rajashree Chakravarty • March 12, 2025 -

Q&A

Pathward CEO: Regulatory scrutiny of BaaS ‘just getting started’

Regulators will keep BaaS under the microscope, continuing to put pressure on the space and contributing to fewer banks in the space, expects Brett Pharr, the bank’s CEO.

By Caitlin Mullen • March 12, 2025 -

OCC shifts gears on crypto

The interpretive letter issued Friday, advising banks on engaging in certain crypto-asset activities, rescinded Biden-era guidance issued in 2021.

By Rajashree Chakravarty • March 10, 2025 -

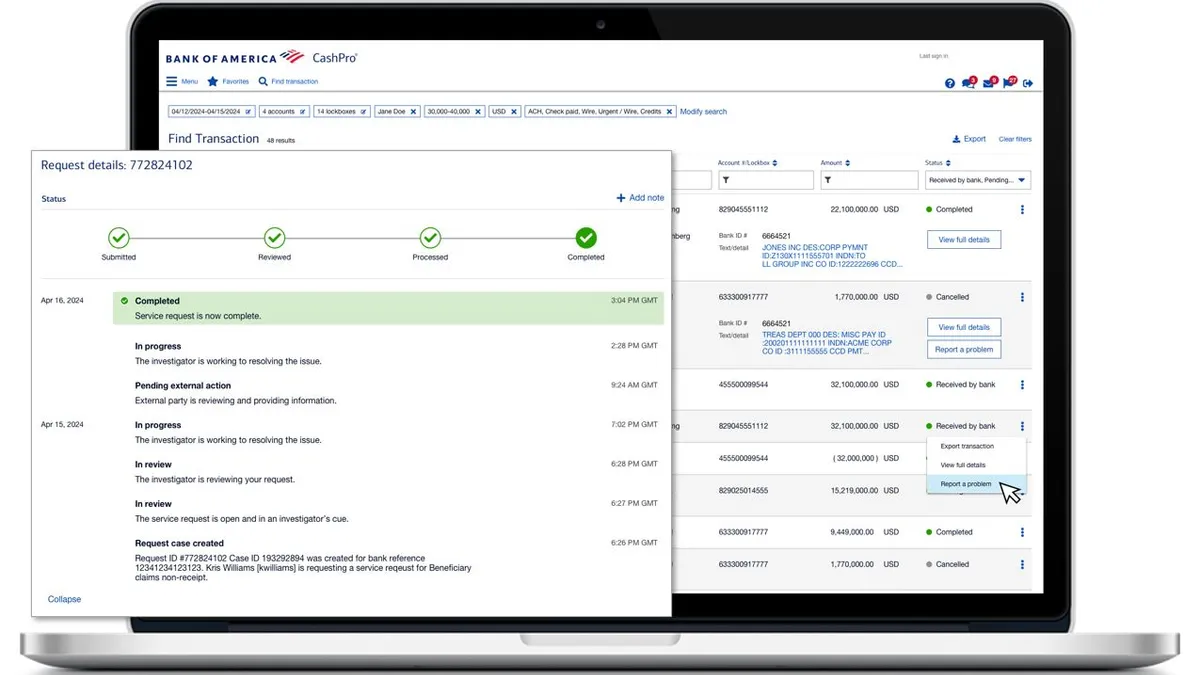

BofA eyes personalization, speedier onboarding for business clients

The team behind the bank’s CashPro platform is making tweaks and enhancements to bring more of the consumer experience to the digital business banking space, a CashPro product executive said.

By Caitlin Mullen • March 6, 2025 -

Dave, Coastal Community Bank team up in pivot away from Evolve

The Los Angeles-based fintech will start onboarding customers to Coastal Community Bank as soon as the second quarter of 2025, Dave said Monday.

By Rajashree Chakravarty • March 5, 2025 -

Golden 1 CFO sees culture fit as crucial in hiring

Keeping credit union membership at top of mind sometimes means tweaking the "pure math" approach to solutions, Golden 1 CFO Allyson Hill said.

By Grace Noto • March 5, 2025