Commercial: Page 39

-

JPMorgan Chase sees 42% drop in Q1 profit

The bank reported a $902 million net build in credit reserves tied to potential Russia losses and trepidation over inflation. It also took $524 million in losses related to commodities trading and further Russia exposure.

By Dan Ennis • April 13, 2022 -

Fifth Third CEO Greg Carmichael to step down in July

Carmichael, who joined the bank in 2003 as executive vice president and chief information officer, will be replaced by Fifth Third President Tim Spence.

By Anna Hrushka • April 12, 2022 -

Explore the Trendline➔

Explore the Trendline➔

da-kuk via Getty Images

da-kuk via Getty Images Trendline

TrendlineArtificial intelligence

Banks are enthusiastic about AI’s promises. But can they get customers on board, and will regulators let the innovation happen?

By Banking Dive staff -

Bank deposits could decrease for the first time in 80 years

Businesses and consumers alike have been depositing at a greater clip since the COVID-19 pandemic began. And, according to a Barclays analysis, the banking industry has $8.5 trillion more in deposits than loans.

By Robin Bradley • April 12, 2022 -

Needham Bank sees ‘cross sell’ opportunity in cast-off cannabis unit

After learning that Eastern Bank was looking to offload the cannabis business it inherited from Century Bank in November, Needham found its market opening.

By Anna Hrushka • April 11, 2022 -

NYC halts new account openings with Wells Fargo, citing mortgage race gap

The city removed Wells from its designated banking list in 2017 over concerns about the bank's lending practices but re-added it last year after its CRA rating improved.

By Robin Bradley • April 11, 2022 -

Ex-Goldman banker Ng found guilty in 1MDB scandal

He faces 30 years in prison on charges of conspiracy to commit both bribery and money laundering. His attorney has indicated he would challenge the conviction before appealing to a higher court.

By Dan Ennis • April 11, 2022 -

Citizens Bank offers on-demand pay product for corporate clients

The bank said the service can be up and running within 30 days. Citizens is working with an unnamed third-party vendor to provide the offering, an executive said.

By Anna Hrushka • April 1, 2022 -

Column

Jamie Dimon, U.S. Bank and BMO show value is a buyer-led construct

JPMorgan Chase reported it gave its CEO a stock award worth more than double what it estimated in 2018. But as M&A has shown, value isn't always one-for-one.

By Dan Ennis • March 31, 2022 -

FDIC unveils guidance for banks to navigate climate-related risks

The agency asked banks with $100 billion or more in assets to measure and mitigate climate change's financial risks, echoing a December move by the Office of the Comptroller of the Currency (OCC).

By Robin Bradley • March 31, 2022 -

Cross River hits $3B valuation, eyes global expansion — but still defies labels

"Besides the technology ... we also are a regulated financial institution, and the combination of the two really is the secret sauce that allows us to work" with heavy-hitting partner companies, executive Hillel Olivestone said.

By Anna Hrushka • March 31, 2022 -

Goldman to buy retirement plan robo-adviser NextCapital

Details of the transaction were not disclosed. But Goldman isn't the only big bank to make a play in the robo-advising space this year. UBS in January agreed to acquire Wealthfront in a deal worth $1.4 billion.

By Robin Bradley • March 30, 2022 -

Serial acquirer Seacoast moves on Miami with $168.3M buy of Apollo Bank

The deal, set to close in the fourth quarter, would add five Miami-Dade County branches to Seacoast's footprint and take Apollo off the market. A credit union's bid for Apollo was terminated in the COVID-19 pandemic's early days.

By Dan Ennis • March 30, 2022 -

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps." [Video]. Retrieved from https://financialservices.house.gov/videos/?VideoID=Sf5D9BprcXg.

(2020). "Holding Wells Fargo Accountable: CEO Perspectives on Next Steps." [Video]. Retrieved from https://financialservices.house.gov/videos/?VideoID=Sf5D9BprcXg.

House panel wants deeper details of banks' business activities in Russia

Rep. Maxine Waters, D-CA, asked 31 trade groups to survey their members to find out what they are doing to exit or phase out business with Russia or, conversely, defend why they would continue those ties.

By Robin Bradley • March 25, 2022 -

Wall Street securities bonuses jump 20% to $257,500 in 2021, NY official says

The bonuses — the highest since 2006 — trumped the 15.7% figure the state comptroller's office projected.

By Robin Bradley • March 24, 2022 -

Fed approves Citizens' $3.5B acquisition of Investors Bancorp

The deal, expected to give Citizens an additional 154 branches — mostly in the New York City area — marks the second big new revenue stream for the bank in a little over a month.

By Robin Bradley • March 23, 2022 -

JPMorgan mines Wells Fargo for next diversity chief

The move is part of an executive shuffle that shifts the bank's current diversity leader to a role as Northeast segment head for middle-market banking and specialized industries.

By Dan Ennis • March 23, 2022 -

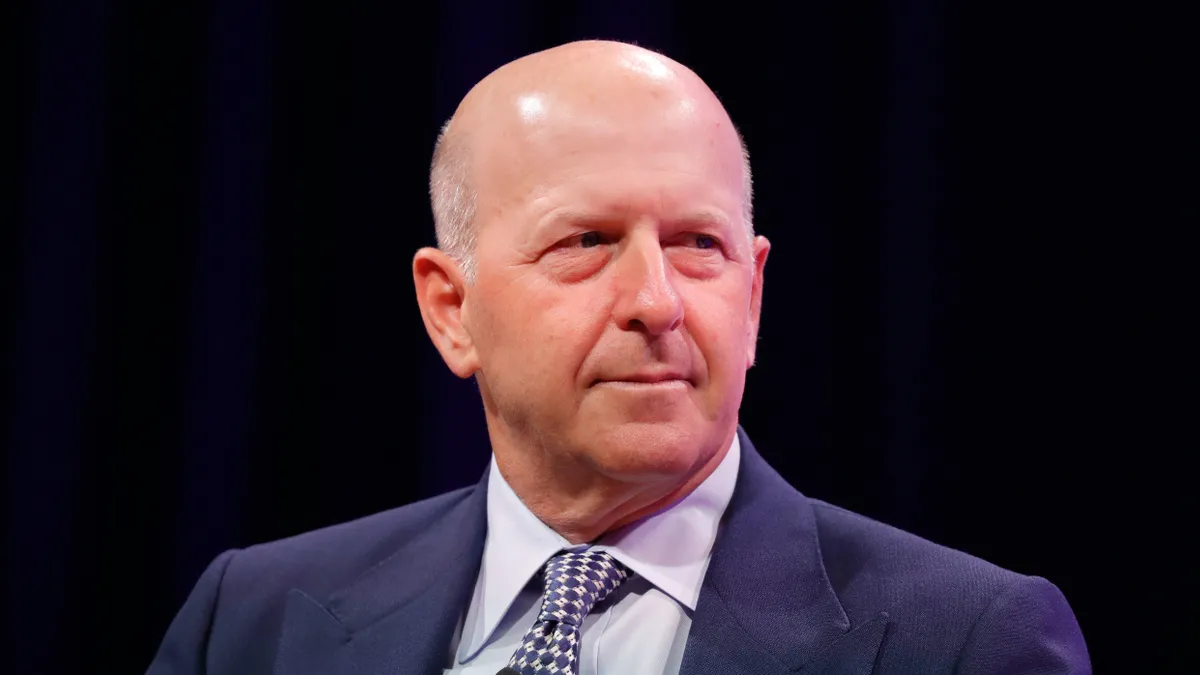

Goldman's general counsel gets a 75% raise over her predecessor

$7.5 million is a popular pay boost for the bank. That's the amount by which CEO David Solomon, President John Waldron and General Counsel Kathy Ruemmler saw their compensation jump last year.

By Robin Bradley • March 21, 2022 -

Huntington poaches Truist retail banking chief

Truist, meanwhile, promoted its chief digital officer to lead the Charlotte, North Carolina-based bank's retail and community banking and marketing efforts.

By Robin Bradley • March 18, 2022 -

JPMorgan Chase continues overseas acquisition streak

The bank on Tuesday bought an Irish software provider that helps businesses manage employee share plans in a deal reportedly valued at $730 million.

By Robin Bradley • March 16, 2022 -

JPMorgan Chase drops ban on unvaccinated new hires

The bank, in a memo Monday, said it will stop mandatory twice-weekly testing of unvaccinated employees April 4, and no longer require unvaccinated workers to wear face masks, effective immediately.

By Robin Bradley • March 15, 2022 -

Arizona deal marks 5th credit union purchase of bank in 2022

At the current pace, 26 credit union-bank tie-ups could be in the works by the end of the year, far surpassing 2019's record.

By Robin Bradley • March 14, 2022 -

Capital One's general counsel wears 2 new hats

The McLean, Virginia-based bank has seen two other high-profile exits from its legal department in the past two weeks.

By Robin Bradley • March 11, 2022 -

BNY Mellon CEO Todd Gibbons to retire Aug. 31

Robin Vince, a 26-year Goldman Sachs veteran who joined BNY Mellon in 2020, will take the bank's top role.

By Robin Bradley • March 10, 2022 -

Citi names next chief compliance officer

Tom Anderson, who now serves as chief compliance officer for the bank's personal banking and wealth management division, returned to Citi last year after stints at American Express and JPMorgan Chase.

By Robin Bradley • Updated May 12, 2022 -

Judge may rule soon on Wells Fargo commercial real estate 'time bomb'

The bank has moved to dismiss a class-action lawsuit that alleges it improperly inflated underwriting metrics ahead of the pandemic, leaving the company vulnerable to losses in 2020.

By Maura Webber Sadovi • March 7, 2022