Fintech: Page 14

The latest fintech news for banking professionals.

-

US, Europe lock arms on payments regulation

U.S. and European regulators have joined forces to monitor digital payment concerns, including those related to buy now, pay later financing and big tech market participation.

By Lynne Marek • April 15, 2024 -

Adro raises $1.5M to bridge international students, banking services

Without a Social Security number or U.S. credit file, students coming from abroad face a lag in banking in their new home country. Adro aims to fix that.

By Gabrielle Saulsbery • April 10, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Funding Circle gets final nod for SBA 7(a) loans amid pushback

The London-based company received final approval to proceed with the 7(a) lending program around four months after the SBA announced it would grant three new licenses.

By Rajashree Chakravarty • April 10, 2024 -

KeyBank scouts for fintech partners

The bank, which has yet to strike a fintech partnership this year, generally enters into one to two each year, said Ken Gavrity, president of Key Commercial Bank.

By Caitlin Mullen • April 10, 2024 -

Wyoming bank sheds fintech program

The Kansas City Fed hit Mode Eleven Bancorp with a cease-and-desist following an inspection in September.

By Gabrielle Saulsbery • April 5, 2024 -

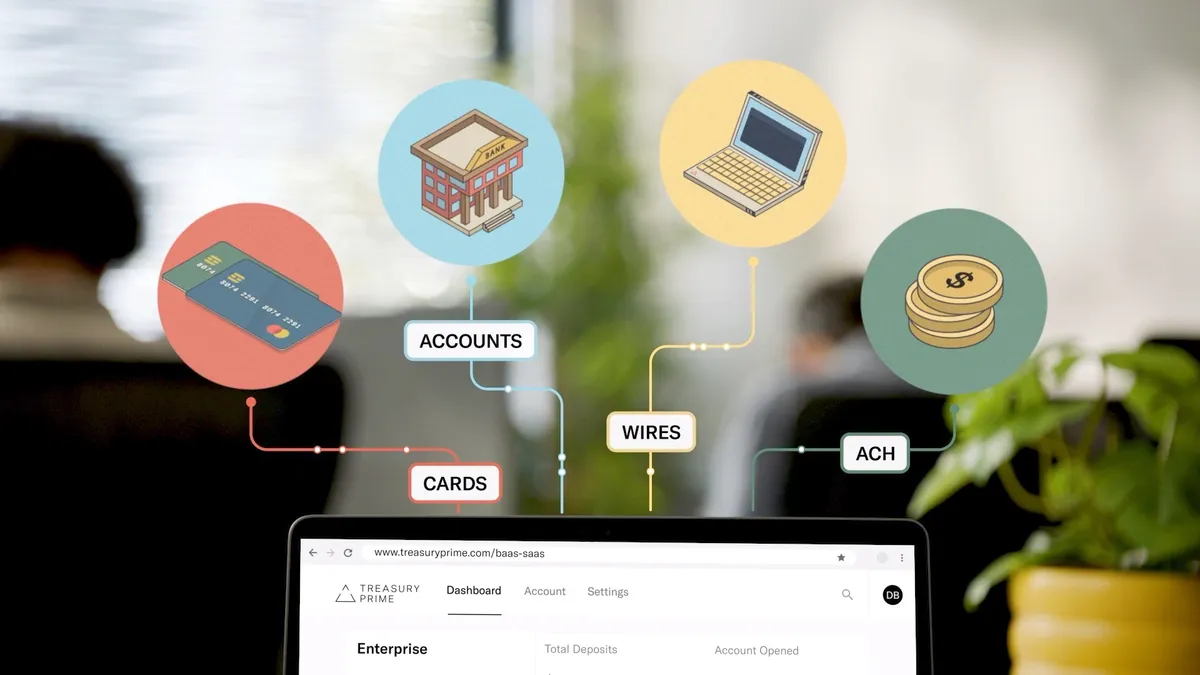

Treasury Prime, Narmi partner to offer customers FedNow service

The partnership aims to simplify and accelerate the adoption of FedNow by small and medium-sized financial institutions in Treasury Prime’s network.

By Rajashree Chakravarty • April 3, 2024 -

JPMorgan Chase to let brands target customers based on spending data

Chase Media Solutions connects customers to retail deals, tailored to their spending, directly through their bank app.

By Gabrielle Saulsbery • April 3, 2024 -

Piermont, Sutton banks hit with FDIC consent orders over BaaS

The FDIC ordered Piermont to review all transactions since September 2022 to ensure all suspicious activity was reported. Sutton, meanwhile, must compile an inventory of its third-party relationships.

By Caitlin Mullen • April 1, 2024 -

Fintech trade group sues to block Colorado interest-rate cap

A law set to take effect July 1 would bar state-chartered banks from offering Coloradans installment loans and BNPL products. But it may clear the market for federally chartered banks, plaintiffs say.

By Dan Ennis • March 27, 2024 -

SBA critics push back on fintechs making 7(a) loans

During a hearing last week, Sen. Joni Ernst, R-IA, challenged SBA Administrator Isabel Guzman over her push for direct lending by nonbank entities, highlighting the license Funding Circle received last year.

By Rajashree Chakravarty • March 27, 2024 -

Fintech Wise swipes Delivery Hero alum for finance chief

Emmanuel Thomassin will leave for the London-based money transfer provider after a decade in Delivery Hero’s top financial seat.

By Grace Noto • March 26, 2024 -

JPMorgan seeks embedded payments niches

The biggest U.S. bank aims to offer embedded payments software solutions in more industries for its corporate clients.

By Lynne Marek • March 25, 2024 -

Robinhood co-founder steps down

Baiju Bhatt, who co-founded the fintech 11 years ago and was most recently chief creative officer, is moving on to “focus on his next enterprise.”

By Gabrielle Saulsbery • March 25, 2024 -

FTX CEO says Bankman-Fried lives ‘life of delusion’

In his victim impact statement, John Ray III told Judge Lewis Kaplan that FTX’s estate was “a metaphorical dumpster fire” when he joined the firm at bankruptcy.

By Gabrielle Saulsbery • March 21, 2024 -

Varo hires Zillow, Amazon alum as next CFO

The fintech will tap Allen Parker’s financial acumen as it looks to return its path to profitability following a rocky 2023.

By Grace Noto • March 20, 2024 -

Bakkt names Andy Main as new CEO in leadership shuffle

The switch comes after the New York Stock Exchange threatened to delist the crypto platform over its share price. Bakkt’s next chief executive will detail his vision for the company March 25 in an earnings call.

By Rajashree Chakravarty • March 20, 2024 -

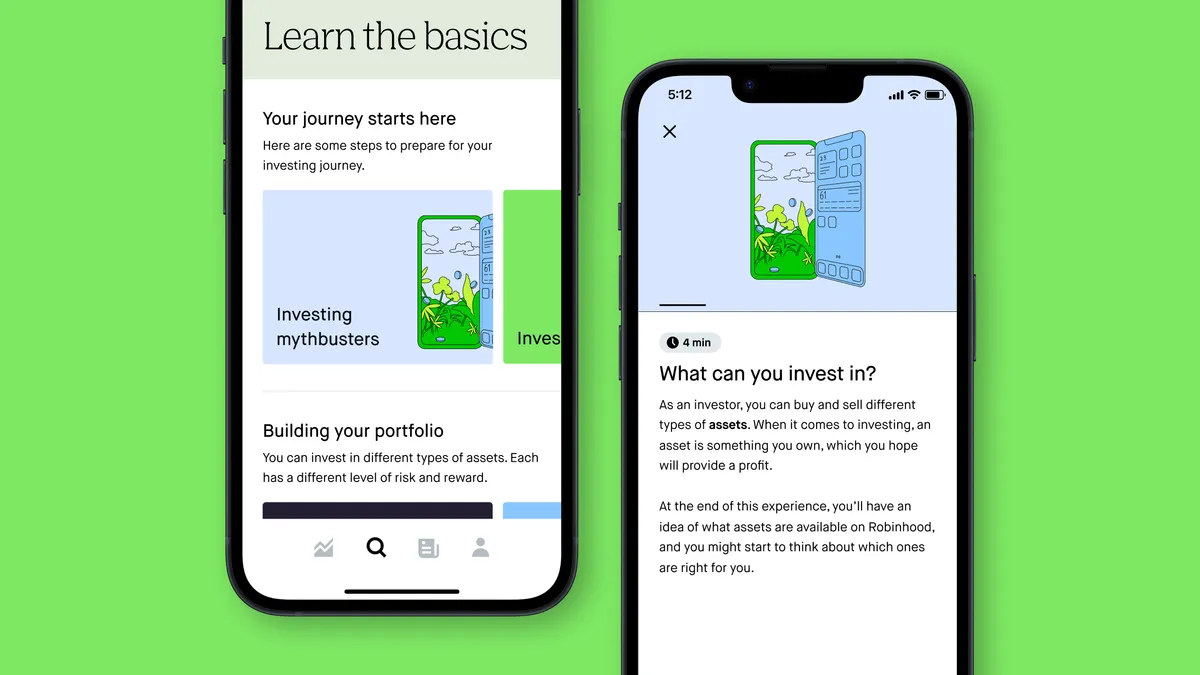

Robinhood goes live in the UK

The company indefinitely postponed its U.K. launch in 2020 over technical issues but rolled out a waitlist in November. It did, however, pause margin investing for U.K. users.

By Gabrielle Saulsbery • March 20, 2024 -

FTC fines fintechs Biz2Credit, Womply $59M over PPP actions

The agency claimed Biz2Credit misrepresented the timeline for application processing, and Womply had inadequate customer service in the COVID-era crunch for small-business loans.

By Dan Ennis • March 19, 2024 -

Goldman’s Cohen heads for exit as GreenSky deal closes

GreenSky is now owned by an investor group led by Sixth Street. Stephanie Cohen, Goldman’s global head of platform solutions, is leaving the bank for IT firm Cloudflare.

By Gabrielle Saulsbery • March 18, 2024 -

Marqeta CFO touts EWA expansion

The card-issuing fintech has seen adoption of its debit card-linked EWA product increase as hourly workers at Walmart and Uber have been added, CFO Mike Milotich said.

By James Pothen • March 18, 2024 -

A year later: SVB’s impact on fintech

Fintechs like Mercury and MoneyLion showed their resilience, offering innovative products and assisting their customers through difficult times.

By Rajashree Chakravarty • March 13, 2024 -

Klarna’s IPO prospects grab spotlight

The BNPL provider’s CEO has suggested the company could IPO “quite soon,” but fintech investors expect the market will first want to see a stronger track record of profitability.

By Caitlin Mullen • March 13, 2024 -

Stripe reports payments volume increase

The digital payments company processed $1 trillion in total payments volume last year, according to its annual letter released Wednesday.

By James Pothen • March 13, 2024 -

Starling taps HSBC alum as next CEO

The digital bank's founder, Anne Boden, said she believes Raman Bhatia can move Starling “into its next phase of growth while cherishing the culture and values” her team had worked hard to create.

By Gabrielle Saulsbery • March 13, 2024 -

Ansa cuts fees for merchants with white-labeled wallets

With an Ansa wallet, a merchant “doesn’t have to maintain ... what is at its core really tricky and regulated payments infrastructure,” co-founder Sophia Goldberg said.

By Gabrielle Saulsbery • March 6, 2024