Fintech: Page 15

The latest fintech news for banking professionals.

-

Q&A

How banks, fintechs can navigate regulatory challenges in BaaS space

Banks have a responsibility to treat their customers fairly because they deal with people’s money, said the CEO of Synctera, a partner of Lineage Bank, which was recently hit with an FDIC consent order over BaaS.

By Rajashree Chakravarty • March 6, 2024 -

i2c pursues bank clients abroad

The issuing-processing fintech sees a bigger opportunity in regions outside the U.S. to sell its core banking services, founder and CEO Amir Wain said.

By Caitlin Mullen • March 6, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Metropolitan Commercial Bank exits BaaS

“The decision to terminate these financial service partnerships will reduce the Company’s exposure to the heightened, and evolving, regulatory standards related to these activities,” the bank said in its 10-K filing last week.

By Gabrielle Saulsbery • March 4, 2024 -

Cross River draws Morgan Stanley, SVB vets to lead investment banking launch

Henry Pinnell and Benjamin Samuels will team up to lead an effort that includes advising clients on mergers and acquisitions, capital markets transactions and other corporate finance matters, the bank said.

By Dan Ennis • March 4, 2024 -

Gemini to return more than $1.1B to Earn customers

The crypto exchange and New York's Department of Financial Services reached an agreement Wednesday that included a $37 million penalty for compliance failures.

By Gabrielle Saulsbery • Feb. 29, 2024 -

Tennessee bank hit with FDIC consent order over BaaS business

Under the consent order, Lineage Bank must implement an enhanced risk management program overseen by its board of directors, increase capital levels, and let go of some fintech partners.

By Rajashree Chakravarty • Feb. 28, 2024 -

Smaller credit unions face hurdles despite NCUA’s fintech rule

The financial innovation rule may open the door to more partnerships, but larger institutions still have advantages on tech, budget and risk management, experts say.

By Ken McCarthy • Feb. 28, 2024 -

Green Dot faces Fed’s proposed consent order

The digital bank set aside $20 million to cover a potential penalty stemming from compliance risk management issues predating the company’s current management.

By Gabrielle Saulsbery • Feb. 28, 2024 -

Treasury Prime has laid off half its staff

The banking-as-a-service platform is shedding its fintech-bank liaison duties — and about 40 to 50 employees — to focus exclusively on providing software to banks.

By Gabrielle Saulsbery • Feb. 28, 2024 -

Chime to pay California regulator $2.5M over customer service flaws

The agency investigated accuracy and responsiveness to customer complaints. The consent order offered few details but the time frame aligns with COVID-era account closures.

By Dan Ennis • Feb. 28, 2024 -

AI could spark change in the SMB lending space: white paper

Financial institutions, including fintechs, can leverage artificial intelligence technology like machine learning to automate lending decisions, a white paper commissioned by Uplinq said.

By Rajashree Chakravarty • Feb. 21, 2024 -

Neon Money Club launches dating app for those with good credit

Score, which is only available for those with a score of 675 or better, highlights the importance of discussing finances in relationships — even in new ones.

By Gabrielle Saulsbery • Feb. 21, 2024 -

Cross-border payments remain focus for Fed

Tools that “automate processes, reduce costs and promote effective safeguards across jurisdictions” may help improve cross-border payments, a Federal Reserve official said last week.

By Lynne Marek • Feb. 20, 2024 -

PayPal invests in AI startup Rasa

The investment is the first that the digital payments pioneer is making from its new artificial intelligence venture fund.

By Tatiana Walk-Morris • Feb. 20, 2024 -

Viva Wallet CEO sues JPMorgan, claiming bank is limiting growth

Haris Karonis alleges JPMorgan, which owns 48.5% of Viva, is seizing on "perverse incentives" that allow the bank to take full control of the fintech if its value falls below €5 billion next year.

By Gabrielle Saulsbery • Feb. 15, 2024 -

Plaid names Cloudflare vet as its first president ahead of ‘eventual’ IPO

The fintech's hiring of Jen Taylor, Cloudflare's ex-chief product officer, comes months after Plaid appointed its first CFO and named another executive as head of Europe.

By Dan Ennis • Feb. 14, 2024 -

Q&A

Adyen eyes growth in North America

Davi Strazza, North America president at Adyen, pointed to the Dutch processor’s single technology platform as setting it apart in a crowded field of payments players.

By Caitlin Mullen • Feb. 14, 2024 -

Citi moves deeper into e-commerce through digital couponing

The bank recently launched a browser extension that searches for coupons on merchant checkout pages, suggests applicable codes and can activate cash-back offers.

By Suman Bhattacharyya • Feb. 12, 2024 -

Dutch neobank Bunq withdraws application for US banking charter

Bunq is the latest in a line of European neobanks to back out of pursuing a U.S. banking charter, though it stated plans to reapply, American Banker reported.

By Rajashree Chakravarty • Feb. 8, 2024 -

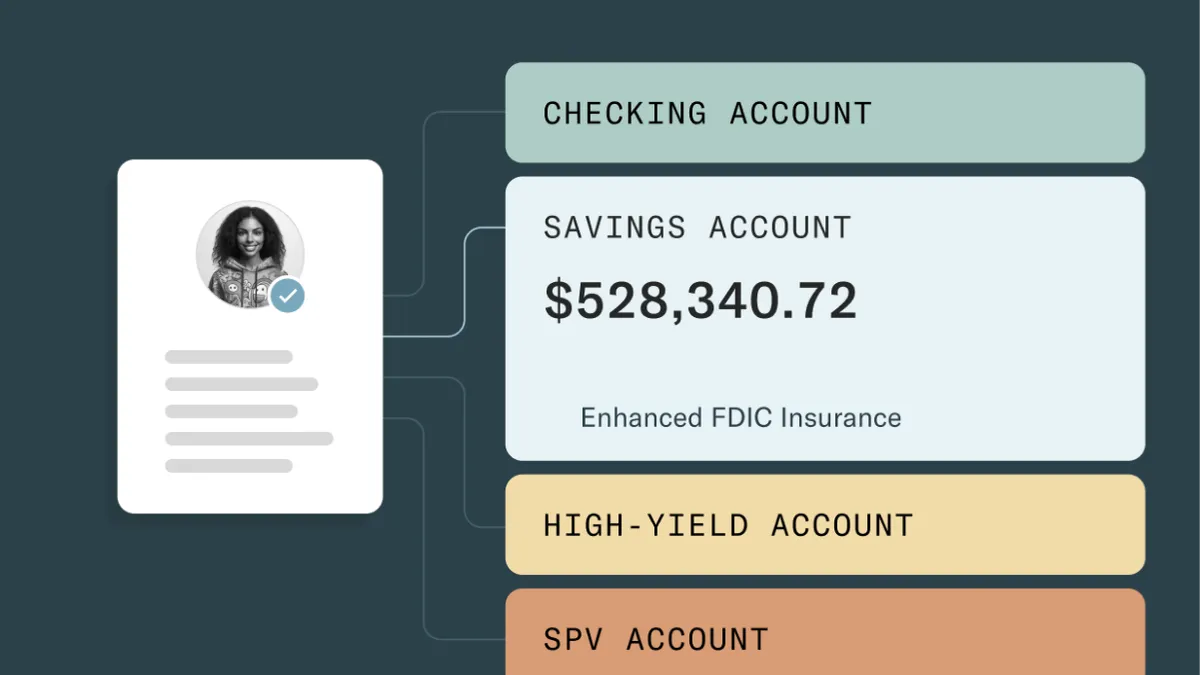

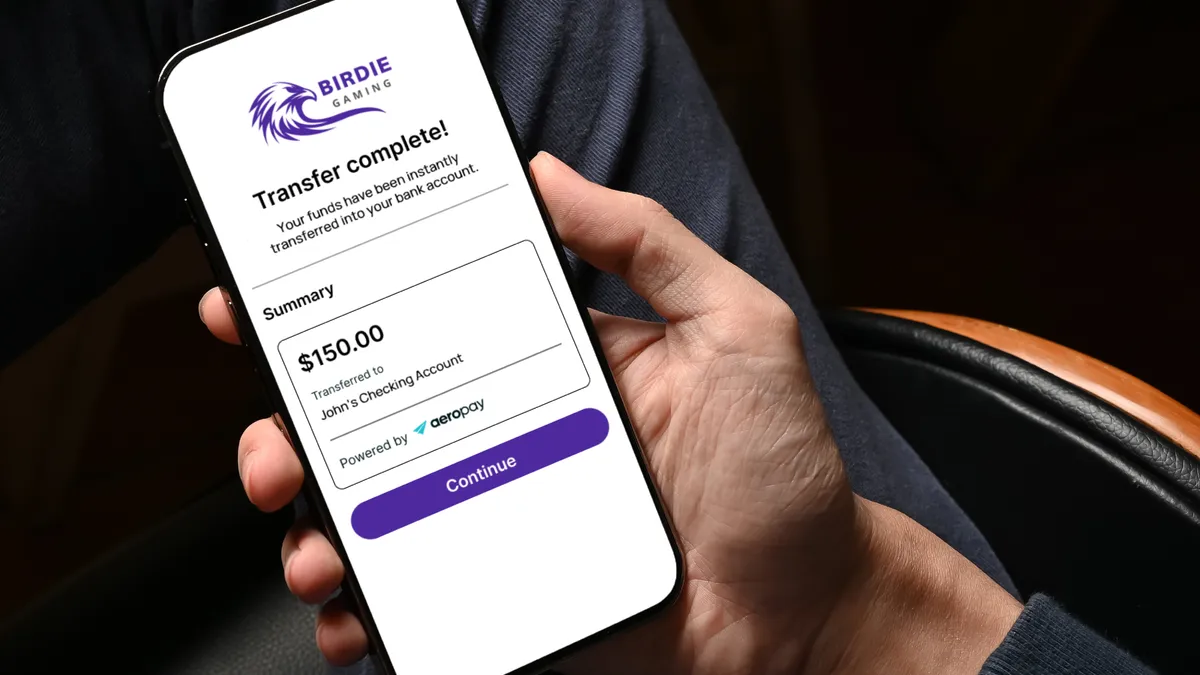

Aeropay partners with Cross River, UBank on gaming payouts

A record 67.8 million people are expected to place bets on this year’s Super Bowl, the American Gaming Association said Tuesday. Aeropay aims to get winnings paid out as fast as possible.

By Gabrielle Saulsbery • Feb. 7, 2024 -

MoneyLion, EY partner to co-build ‘turnkey’ solutions for banks

The partnership will help to drive deposits for mid-sized banks and help diversify their existing revenue streams by implementing comprehensive digital marketplaces inside their ecosystems.

By Rajashree Chakravarty • Feb. 7, 2024 -

Fiserv CEO details special bank charter pursuit

The processing and acquiring company, which seeks a “very specific” special bank charter, doesn’t intend to compete with its financial institution partners, Fiserv CEO Frank Bisignano said Tuesday.

By Caitlin Mullen • Feb. 7, 2024 -

Fleet fintech ditches Visa for Mastercard

Fuel card startup AtoB, with $112 million in financial backing, plans to take on dominant fleet service rivals Wex and Fleetcor.

By Lynne Marek • Feb. 6, 2024 -

Republican lawmakers raise concerns over FDITech

“[D]uring your tenure, the FDIC has moved innovation backwards,” the GOP lawmakers noted in the letter to the Federal Deposit Insurance Corp. Chair Martin Gruenberg.

By Rajashree Chakravarty • Feb. 5, 2024 -

Genesis Global settles SEC suit for $21M

The settlement will, among other things, "eliminate the risks, expenses, and uncertainty associated with protracted litigation against the SEC."

By Gabrielle Saulsbery • Feb. 2, 2024