Payments: Page 5

-

Underbanked US population grows to 14.2%, FDIC finds

Separately, the unbanked proportion of U.S. households dropped to 4.2% last year, the regulator said in its biennial survey. But racial disparity persists: 32.3% of unbanked households are Black and 33.4% are Hispanic, the FDIC found.

By Caitlin Mullen • Nov. 13, 2024 -

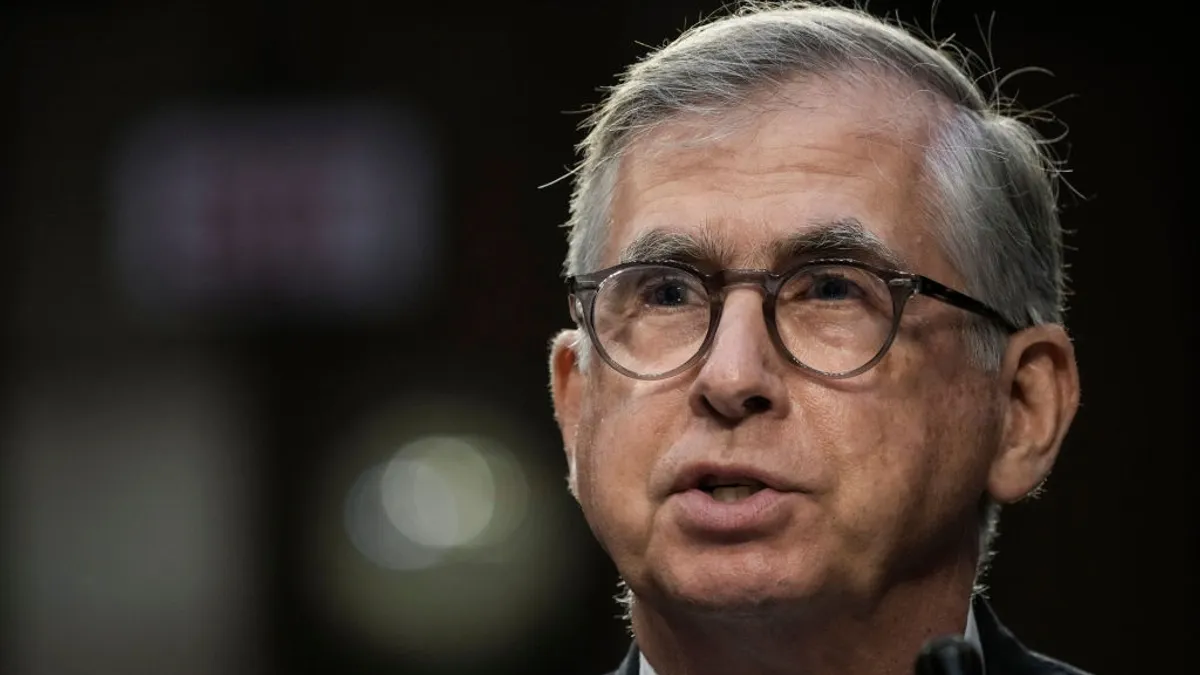

Fed’s Waller: Payments industry needs public-private balance

The Federal Reserve must consider when to make up for private sector shortcomings in payments, while keeping its role limited, board governor Christopher Waller said Tuesday.

By Tatiana Walk-Morris • Nov. 13, 2024 -

Explore the Trendline➔

Explore the Trendline➔

wildpixel via Getty Images

wildpixel via Getty Images Trendline

TrendlineThe Banking Dive Outlook on 2022

Some narratives in 2022, such as office returns, will seem like a logical progression from the year before. Others, such as the regulatory sphere and shift toward smaller M&A, may mark a big shift from the previous 12 months.

By Banking Dive staff -

Klarna files for IPO

The buy now, pay later company announced Tuesday it had filed confidentially with the Securities and Exchange Commission for an initial public offering.

By Patrick Cooley • Nov. 13, 2024 -

Comerica sues CFPB over ‘costly’ prepaid card probe

The agency “failed to acknowledge” that Comerica “generally acted with the oversight … or approval of the federal government” in handling a Treasury Department program, the bank said.

By Caitlin Mullen • Nov. 12, 2024 -

FTX suing Binance, founder for $1.76B

The FTX estate is looking to recoup funds it alleged were “fraudulently” transferred to Binance in 2021.

By Gabrielle Saulsbery • Nov. 11, 2024 -

Paze gets new leader amid slow start

Early Warning Services, the bank-owned company that operates Paze, tapped a new leader last month for the digital wallet operation after slow progress in launching the new service.

By Patrick Cooley • Nov. 7, 2024 -

Cross River drops lawsuit against Fiserv subsidiary

The Fort Lee, New Jersey-based lender dismissed its lawsuit against First Data Merchant Services, which was filed in October 2023, without disclosing a reason.

By Rajashree Chakravarty • Nov. 6, 2024 -

Fed aims to make instant payments the norm

“It's going to be up to us to move instant payments from being novel to being normal,” Federal Reserve Financial Services’ chief payments executive told attendees at an industry conference last week.

By Lynne Marek and Patrick Cooley • Nov. 5, 2024 -

Stablecoins face obstacles to widespread adoption

The digital currencies could simplify cross-border payments, but consumers are wary of using them, payments and fintech executives say.

By Patrick Cooley • Nov. 4, 2024 -

AI increases fraud risk, fintechs say

Financial firms monitor for fraud by looking for unusual activity, but an artificial intelligence model can be trained to transact like a real person.

By Patrick Cooley • Oct. 31, 2024 -

BofA discloses Zelle probe, says it may result in litigation

The bank also said it’s in contact with regulators over its Bank Secrecy Act/anti-money laundering and sanctions compliance programs, and a regulatory order could stem from those discussions.

By Caitlin Mullen • Oct. 30, 2024 -

How open banking will shape the future of payments

The Consumer Financial Protection Bureau released its open banking final rule last week, leading the payments and financial services industries to begin preparing for a new era in data sharing.

By Patrick Cooley • Oct. 29, 2024 -

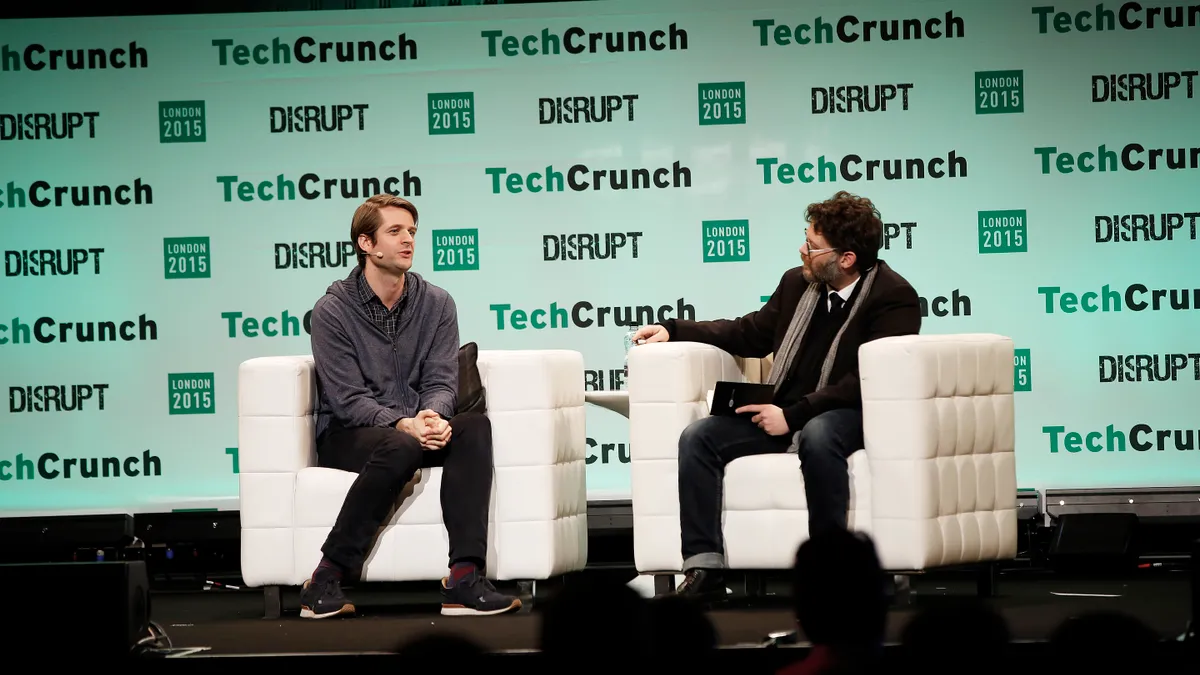

Pay-by-bank to be used for bills, Plaid CEO predicts

Plaid CEO Zach Perret expects consumers to use pay-by-bank services for mortgage and utility payments, but is skeptical they will be used to pay at restaurants or for groceries any time soon, he said.

By Patrick Cooley • Oct. 28, 2024 -

Industry balks at FDX standard-setting monopoly

Regulators and industry participants worry that FDX will have an unfair monopoly and will advantage its own members if no other organization applies.

By Patrick Cooley • Oct. 24, 2024 -

Goldman, Apple to pay CFPB $89.8M over Apple Card issues

The bank and tech firm failed to address disputed transactions from their joint Apple Card program, the bureau alleged, and misled cardholders about interest-bearing products.

By Gabrielle Saulsbery • Oct. 23, 2024 -

CFPB issues final rule on open banking

Payment apps are included in the data-control rule, in a change from last year’s proposal. Banks and credit unions with less than $850 million in assets are exempt.

By Dan Ennis • Oct. 22, 2024 -

Fiserv may grab competitive edge with new bank charter

The payments processor can undercut rivals on price because it won’t be paying bank fees, industry consultants say.

By Patrick Cooley • Oct. 21, 2024 -

Truist CEO: No ‘merger hangover’ with expenses

As the bank approaches five years since the completion of the SunTrust-BB&T merger, Truist CEO Bill Rogers sought to assure analysts Thursday that it’s on offense rather than defense.

By Caitlin Mullen • Oct. 17, 2024 -

Discover discloses SEC accounting criticism

The agency disagrees with the way the company is allocating card misclassification charges, Discover said in its third-quarter earnings report.

By Patrick Cooley • Oct. 17, 2024 -

Payments players tap M&A to build tech stacks

The Fed’s recent interest rate cut could spur even more deal-making in the remaining months of the year and into 2025. Mastercard, Global Payments and Payoneer are among the companies that have bought businesses this year.

By Shefali Kapadia • Oct. 16, 2024 -

Harris tries to court Black men voters with forgivable loans, crypto

Vice President Kamala Harris’ plans are part of her Opportunity Economy pledge, “an economy where people don't just get by, but get ahead,” and come as polls show she could stand to gain more support from Black men voters.

By Gabrielle Saulsbery • Oct. 14, 2024 -

Barclays replaces Goldman Sachs as GM card issuer

The London-based bank will issue two credit cards for the automaker in the U.S., beginning next summer.

By Patrick Cooley • Oct. 14, 2024 -

LendingClub, Pagaya acquire tech assets of defunct Tally

Tally’s assets will be integrated into the existing products of both firms, according to company spokespeople. Tally shuttered in August this year over failure to raise funds.

By Rajashree Chakravarty • Oct. 10, 2024 -

Citi urges judge again to dump NY AG’s fraud suit

Lawyers for the bank argue the state is trying to rewrite the Electronic Fund Transfer Act through “litigation” and that when consumers are deceived into sending money to criminals, it’s “not a Citi issue.”

By Dan Ennis • Oct. 9, 2024 -

Tech costs, regulatory demands among community bankers’ top worries

A recent survey of community bankers also cited cost of funds as a top risk, amid the higher rate environment. “Right now, our motto is ‘Survive until 2025,’” a Pennsylvania community bank CEO said.

By Caitlin Mullen • Oct. 8, 2024