Payments: Page 6

-

Tech costs, regulatory demands among community bankers’ top worries

A recent survey of community bankers also cited cost of funds as a top risk, amid the higher rate environment. “Right now, our motto is ‘Survive until 2025,’” a Pennsylvania community bank CEO said.

By Caitlin Mullen • Oct. 8, 2024 -

Fiserv teams with Canadian company on open banking

Fiserv has allowed Zūm Rails to use its embedded finance system to bring open banking and instant payments to Fiserv’s U.S. business customers.

By Patrick Cooley • Oct. 4, 2024 -

Explore the Trendline➔

Explore the Trendline➔

wildpixel via Getty Images

wildpixel via Getty Images Trendline

TrendlineThe Banking Dive Outlook on 2022

Some narratives in 2022, such as office returns, will seem like a logical progression from the year before. Others, such as the regulatory sphere and shift toward smaller M&A, may mark a big shift from the previous 12 months.

By Banking Dive staff -

Retrieved from OCC.

Retrieved from OCC.

OCC seeks to halt Illinois card interchange fee law

The Office of the Comptroller of the Currency blasted an Illinois law that prohibits credit and debit card interchange fees on tips and excise taxes.

By Lynne Marek • Oct. 3, 2024 -

Hurricane Helene aftermath prompts card, cash troubles

After the storm ripped through the southeastern U.S., consumers and merchants have been left grappling with card network outages and cash shortages.

By Lynne Marek • Oct. 3, 2024 -

Oportun inks deal to sell credit card portfolio

The deal, expected to close in November, is a push by the online lender to pursue profitability by simplifying its business and focusing on its core products.

By Rajashree Chakravarty • Oct. 2, 2024 -

Kansas City Fed dissects consumer use of digital payments

About 95.5% of U.S. households have a bank account, and 46.4% use a nonbank payment service, a new report says. Meanwhile, the Boston Fed found more consumers are using credit cards to make ends meet.

By Tatiana Walk-Morris • Sept. 30, 2024 -

Wells Fargo, Fiserv to end joint venture

Fiserv will receive an unspecified cash payment from the bank. The payments processor will also take a $400 million to $600 million impairment charge this year related to the joint venture.

By Patrick Cooley • Sept. 30, 2024 -

How Visa stymied big tech rivals

The U.S. lawsuit paints a picture of the dominant card network using lures and threats to stifle competition from Apple, PayPal and others.

By Lynne Marek • Sept. 25, 2024 -

Q&A

Sezzle evolves alongside BNPL industry

The company now offers more products but also faces more regulatory pressure, Sezzle CEO Charlie Youakim said.

By Patrick Cooley • Sept. 25, 2024 -

Fed payments proposal pits big banks against small rivals

Large institutions welcome the move to extend the operating hours of two interbank payments systems, but smaller ones may feel the squeeze of increased workload, staffing and competition.

By Lynne Marek • Sept. 18, 2024 -

U.S. Bank reaches its proving ground

The super-regional is at an “inflection point” after recent acquisitions and tech updates, CEO Andy Cecere said at the bank’s investor day. One analyst, however, is calling for “a new set of eyes at the top.”

By Caitlin Mullen • Sept. 13, 2024 -

U.S. Bank rolls out access to Paze digital wallet

The bank began offering the payments option from Early Warning Services to its credit and debit cards customers this week.

By Patrick Cooley • Sept. 13, 2024 -

FIS draws fintech startups into accelerator

Fidelity National Information Services this week continued an annual program backing young fintechs that are striving to disrupt the financial services landscape.

By Lynne Marek • Sept. 11, 2024 -

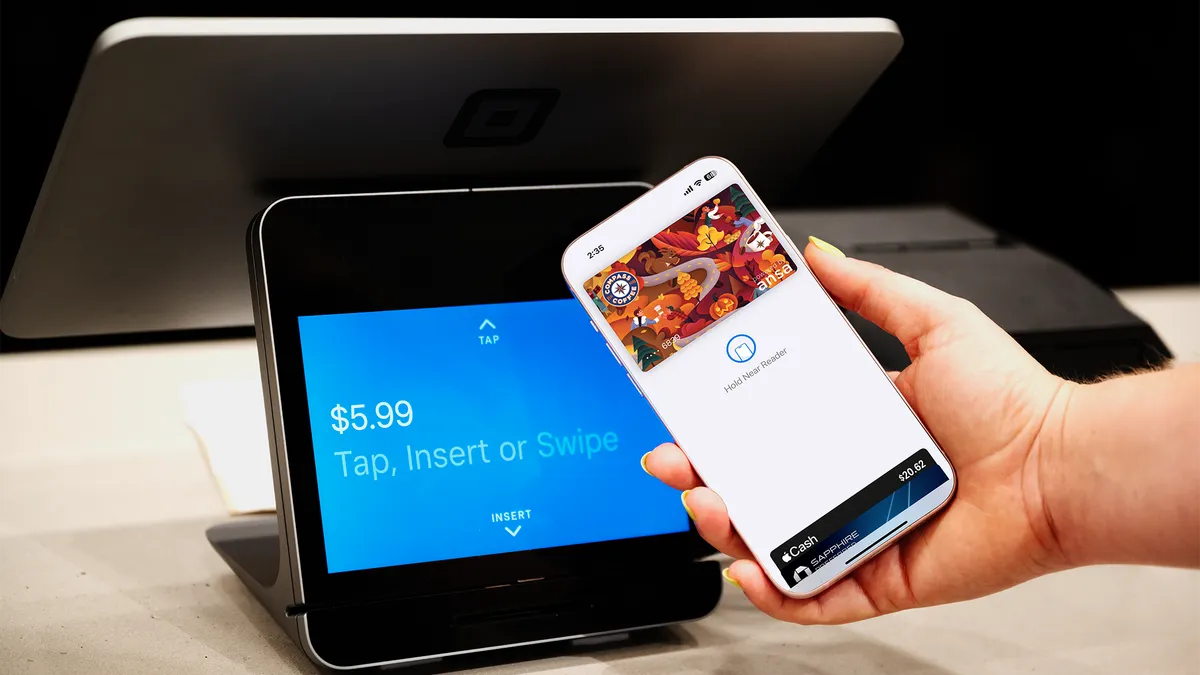

Ansa debuts in-store digital wallet capabilities

Ansa last week launched a software development kit, which can be integrated into a brand’s mobile app. “The pain’s on our side to make sure all their systems talk,” co-founder Sophia Goldberg said.

By Gabrielle Saulsbery • Sept. 11, 2024 -

Airwallex eyes embedded payments in globalization push

Headcount increases in Brazil and Mexico are among the “immediate bets” the company is making, executive GM Ravi Adusumilli said.

By Grace Noto • Sept. 10, 2024 -

Retrieved from Polaris Dawn on September 06, 2024

Retrieved from Polaris Dawn on September 06, 2024

The fintech CEO who is becoming a frequent flier with SpaceX

On Jared Isaacman’s second trip to space, the billionaire plans to become the first private spacewalker. Shift4 investors will need to follow space news to learn about it.

By Justin Bachman • Sept. 9, 2024 -

Visa to upgrade pay-by-bank service in UK next year

The card network plans to make the account-to-account service available to consumers for paying bills, like rent, but eventually for other uses too, such as digital streaming.

By Patrick Cooley , Lynne Marek • Sept. 6, 2024 -

CFPB slammed with EWA commentary

The Consumer Financial Protection Bureau asked for public feedback on its earned wage access rule proposal and it got an earful.

By Lynne Marek • Sept. 4, 2024 -

U.S. Bank works to simplify SMB banking, payments

To stand out from competitors, the Minneapolis-based lender has also expanded its SBA loan program over the last year, said Shruti Patel, chief product officer for business banking.

By Caitlin Mullen • Aug. 29, 2024 -

Fed’s Waller questions faster cross-border payments ties

There could be more fraud and money laundering if countries move too quickly to link their faster payments systems, the central bank governor said Wednesday at a conference.

By Lynne Marek • Aug. 29, 2024 -

MoneyGram, Adyen add chief technology officers

The payments companies are bolstering their tech leadership as big changes roil the industry and stoke competition.

By Lynne Marek • Aug. 28, 2024 -

Aeropay targets pay-by-bank evolution in US

The Chicago fintech has moved from servicing small merchants to handling cannabis payments, and now it’s catering to gaming clients.

By Lynne Marek • Aug. 27, 2024 -

Partner of former FTX exec hit with campaign finance charges

Now, Ryan Salame has asked a New York judge to void his guilty plea, which he attests was made following a verbal agreement with prosecutors that they would drop their probe into his partner Michelle Bond.

By Gabrielle Saulsbery • Aug. 23, 2024 -

U.S. Bank buys healthcare payments firm

The bank’s acquisition of Tempe, Arizona-based Salucro Healthcare Solutions allows its Elavon unit to dig deeper into healthcare payments and billing services.

By Lynne Marek • Aug. 22, 2024 -

Q&A

Marqeta CEO says his platform is no ‘single-trick pony’

Simon Khalaf cites the need for banks to change their behavior to focus on customer service. He also says upcoming underwriting tech could put the banking sector “on steroids.”

By Rajashree Chakravarty • Aug. 21, 2024