Technology: Page 2

-

CFTC, SEC make quick work on crypto movement

Both regulators announced plans last week to get going on crypto regulation that aligns with a report by the President’s Working Group on Digital Assets. They’ve already made waves this week.

By Gabrielle Saulsbery • Aug. 6, 2025 -

Small businesses turn to financial advice, data for growth: Citizens survey

Small business owners who rely on cash flow tools tend to have “higher confidence” and make informed decisions, according to Citizens’ head of business banking, Mark Valentino.

By Rajashree Chakravarty • Aug. 6, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Why Capital One’s software division created its own data security tool

When the bank couldn’t find a commercially available tokenization software tool, it tapped its engineering team to build one.

By Matt Ashare • Aug. 6, 2025 -

Will JPMorgan take a bigger bite of Apple?

If the bank makes a play for the tech company's credit card portfolio, it may also make a broader bid for more business.

By Patrick Cooley • Aug. 5, 2025 -

JPMorgan teams up with Coinbase

The U.S.’s biggest bank will partner with the crypto exchange to link Chase bank accounts and Coinbase crypto wallets.

By Rajashree Chakravarty • July 30, 2025 -

Q&A

TD exec keeps sight of customer trust amid AI rush

Consumers are more comfortable with AI but still want human connection when it comes to certain services, making it crucial for banks to meet customers where they are, said TD Bank’s head of analytics, intelligence and AI.

By Caitlin Mullen • July 30, 2025 -

BofA taps next tech chief

Aditya Bhasin, the lender’s chief technology and information officer since 2021, is leaving the bank and will be replaced by Hari Gopalkrishnan, who’s been at BofA since 2011.

By Caitlin Mullen • July 29, 2025 -

Post-asset cap, Wells chases government banking growth

In government banking, “we have felt it, reputationally,” a Wells executive said of the bank’s growth restraint and the issues that prompted it. Now, “our limitations are behind us.”

By Caitlin Mullen • July 29, 2025 -

Trade groups push back on crypto firms’ bank charter pursuit

The ABA and other trade groups have urged the OCC to delay approving national trust bank charter applications from Ripple, Circle and other crypto firms, citing “substantial concerns.”

By Rajashree Chakravarty • July 23, 2025 -

Discover costs mount for Capital One

Integration costs will surpass the original $2.8 billion estimate, CEO Richard Fairbank said Tuesday. Capital One reported a $4.3 billion second-quarter loss.

By Caitlin Mullen • July 23, 2025 -

Ally makes AI platform available companywide

The bank’s proprietary artificial intelligence platform, Ally.ai, has been tested with 2,200 employees in marketing, audit and technology over the past 18 months, its CIO said.

By Caitlin Mullen • July 23, 2025 -

OpenAI’s Altman didn’t expect banks to take to AI so soon

Financial institutions have been surprise early adopters of ChatGPT, and the AI industry is on the advent of "intelligence too cheap to meter," OpenAI's CEO and co-founder said at a Fed event Tuesday.

By Gabrielle Saulsbery • July 22, 2025 -

Banks diversify cloud portfolios to bolster resilience

Financial firms are leaning on cloud to improve customer service and power long-term growth, London Stock Exchange Group found.

By Matt Ashare • July 18, 2025 -

Big bank CEOs talk stablecoin plans

The prospect of a more favorable regulatory environment for digital assets has large lenders exploring or plotting stablecoin plans, JPMorgan, BofA, Citi and U.S. Bank executives indicated last week.

By Caitlin Mullen • July 17, 2025 -

Bank of America touts AI gains amid industrywide adoption push

The company deployed automated coding tools to its 17,000 software developers, CEO Brian Moynihan said Wednesday.

By Matt Ashare • July 17, 2025 -

Anthropic rolls out financial AI tools to target large clients

Claude for financial services can “turbocharge” the work analysts or fund managers are already doing by serving as their research analyst assistant, said Jonathan Pelosi, global head of industry for financial services at Anthropic.

By Rajashree Chakravarty • July 16, 2025 -

6 takeaways from the Senate’s crypto market structure hearing

Senators largely agreed on the need for regulation, but differed on the potential focus and framing of such a bill.

By Gabrielle Saulsbery • July 11, 2025 -

Community banks view embedded finance as key to longevity: report

Despite increased regulatory scrutiny of banking-as-a-service, over half of the surveyed community bank respondents are considering implementing BaaS or embedded banking solutions.

By Rajashree Chakravarty • July 9, 2025 -

BNY to custody Ripple USD

BNY custodies two other stablecoins – Circle’s USDC, since 2022, and SocGen’s USD CoinVertible, since June.

By Gabrielle Saulsbery • July 9, 2025 -

Early Warning Services pitches Zelle to Treasury

The company that owns the peer-to-peer service Zelle suggested the U.S. Treasury Department use that tool to replace checks with digital payments.

By Patrick Cooley • July 1, 2025 -

Banking conferences yet to come in 2025

Gatherings can be idea generators, or crucial chances to network — especially amid an environment where political change can yield previously unexpected possibilities and partnerships.

By Dan Ennis • June 27, 2025 -

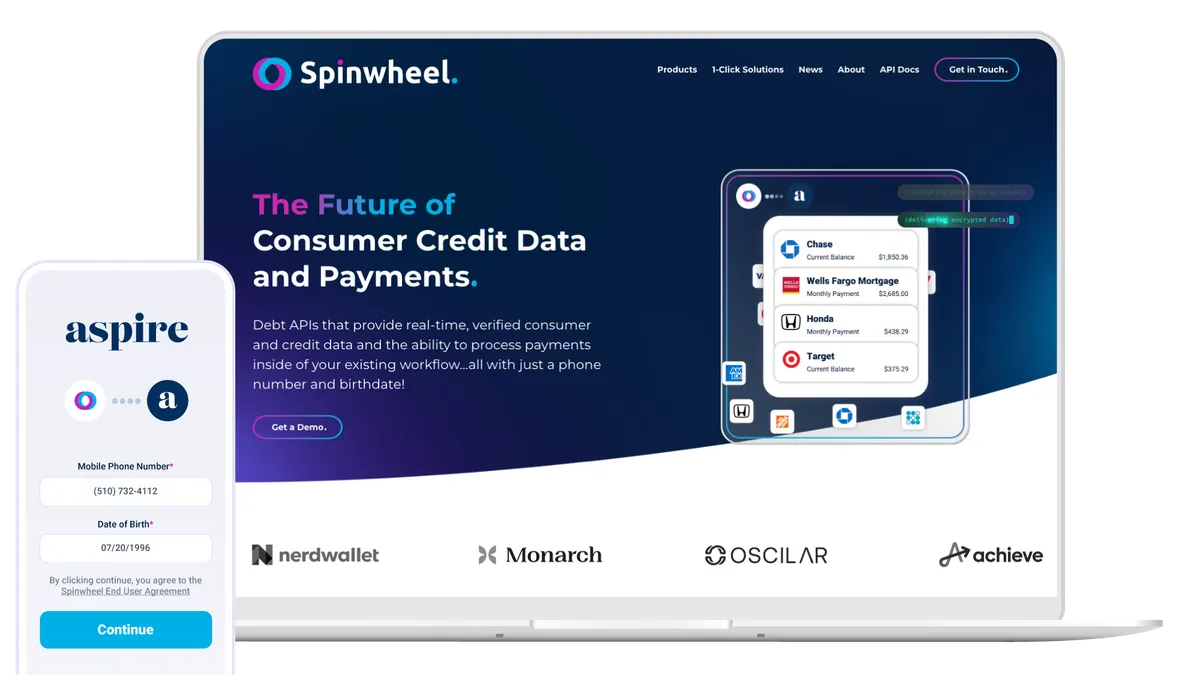

Spinwheel raises $30M in series A to boost agentic AI platform

The latest fundraise will help to develop its product stack that would reduce implementation time frames from over a year to just a few months, CEO and co-founder Tomás Campos said.

By Rajashree Chakravarty • June 25, 2025 -

Q&A

Anchorage CEO: Stablecoins to become ‘core plumbing’ in finance

“What we’re witnessing now is the early formation of a new financial standard — one that’s faster, more transparent, and natively digital,” Nathan McCauley said.

By Gabrielle Saulsbery • June 25, 2025 -

Klarna, Google join forces

The Swedish buy now, pay later business integrated its payments tool into the search giant’s digital wallet, making its services more widely available.

By Patrick Cooley • June 24, 2025 -

Banking industry, big tech unite to forge AI adoption guidelines

Citi and Morgan Stanley joined forces with AWS, Microsoft and Google Cloud to set open-source controls for secure AI adoption in the financial industry.

By Matt Ashare • June 24, 2025