Technology: Page 44

-

Niche banking could safeguard challengers, incumbents from big tech, retail threat

In his annual shareholder letter, JPMorgan CEO Jamie Dimon said the strengths of Amazon, Apple, Facebook, Google and Walmart are "extraordinary, with ubiquitous platforms and endless data."

By Anna Hrushka • April 9, 2021 -

State Street leans ever so slightly into crypto

Through a partnership with U.K.-based Pure Digital, the infrastructure the bank’s Currenex unit uses in foreign exchange will be transposed to the crypto space for a trading platform set to launch in mid-2021.

By Dan Ennis • April 9, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Membership-based neobank Fair would target immigrants, unbanked

Houston entrepreneur Khalid Parekh, who founded the tech firm Amsys Group, said the platform's portfolio of services will help differentiate it from neobanks already serving the space.

By Anna Hrushka • April 8, 2021 -

Walmart's trademark filing may offer clues to fintech startup

The litany of services "Hazel by Walmart" intends to provide ranges from credit and debit card payment processing services to financial portfolio analysis, credit repair and restoration and virtual currency transaction processing.

By Dan Ennis • April 8, 2021 -

Chance for early feedback spurs banks to join FedNow pilot program

More than 110 organizations are participating in the real-time payment effort, which is still slated for a 2023 debut.

By Anna Hrushka • April 6, 2021 -

SoFi to offer auto loan refinancing through MotoRefi partnership

The deal with the Arlington, Virginia-based startup represents the latest product expansion by SoFi as it continues its push to become more than a student loan fintech.

By Anna Hrushka • April 5, 2021 -

Robinhood axes its signature celebratory confetti displays

"If the focus of a conversation is around confetti and not around these people taking these first steps … then we've done something that's just off base," the company's senior director of product management said.

By Dan Ennis • March 31, 2021 -

KeyBank's digital bank for doctors gets national launch

The bank expects to add checking and retail investments to the platform this year, and to expand digital banking services to a market that includes pharmacists, physician assistants, nurses and therapists.

By Anna Hrushka • March 30, 2021 -

Greenwood raises $40M in funding with investments from 6 major banks

Led by Truist Ventures, the digital bank's funding round includes investments from JPMorgan Chase, Bank of America, Wells Fargo and PNC, in addition to payments giants Mastercard and Visa.

By Anna Hrushka • March 25, 2021 -

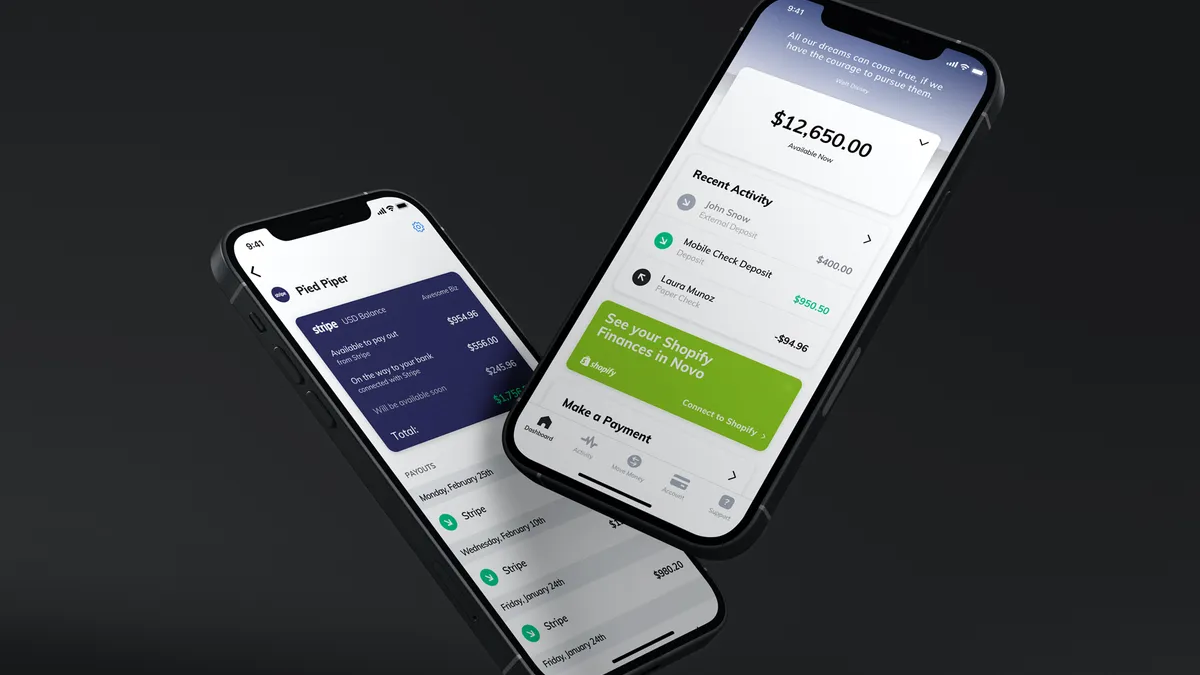

Novo expands products, welcomes surge in users from Azlo

Novo said it gained 20,000 former Azlo customers in the 2½ months since Spanish lender BBVA said it planned to shutter the entrepreneur-focused startup.

By Anna Hrushka • March 23, 2021 -

Powell reiterates 'no-rush' stance on Fed's digital dollar

Powell insists on Congress's approval before proceeding with a CBDC, but researchers are hoping to unveil prototypes as early as July. Meanwhile, the Senate's new banking panel chair is calling for faster action.

By Dan Ennis • March 23, 2021 -

Stripe faces building pressure for a go-public strategy

Stripe's Irish co-founder brothers will be balancing the views of management, investors and bankers in deciding the best path to fund the company's future.

By Lynne Marek • March 22, 2021 -

Coinbase settles CFTC 'wash trading' probe for $6.5M

The settlement comes as the cryptocurrency exchange is delaying until next month its hotly anticipated IPO, but a CFTC commissioner said the enforcement action is a poor reflection of the regulator's priorities.

By Dan Ennis • March 22, 2021 -

Digital bank for immigrants opens meet-up space in Miami

It's not typical for a digital bank to open a physical location in an effort to connect with customers, but Majority's CEO said it's important to have a presence in the communities they serve.

By Anna Hrushka • March 18, 2021 -

Column

Crypto, ESG and office returns: Banks show when they would — and would not — rather be first

As Morgan Stanley and BNY Mellon look to one-up each other on digital assets, JPMorgan and Bank of America find themselves in opposing camps over how they will host summer internships.

By Dan Ennis • March 18, 2021 -

How U.S. Bank tripled its digital account openings

"It was taking customers 10 minutes to get through this application, and that's just way too long," said Jonathan Burns, the bank's senior vice president and head of digital sales experience.

By Anna Hrushka • March 17, 2021 -

BofA banks on virtual reality to train workers for the 'moments of truth'

Immersive learning technology complements existing training resources, a company executive said, but it is not a replacement for all training.

By Ryan Golden • March 17, 2021 -

Brian Brooks, former OCC acting chief, joins blockchain startup

The new role places Brooks in a position where he can continue his push for the inclusion of blockchain and cryptocurrency in the financial sector, actions he took during his tenure at the helm of the bank regulator.

By Anna Hrushka • March 15, 2021 -

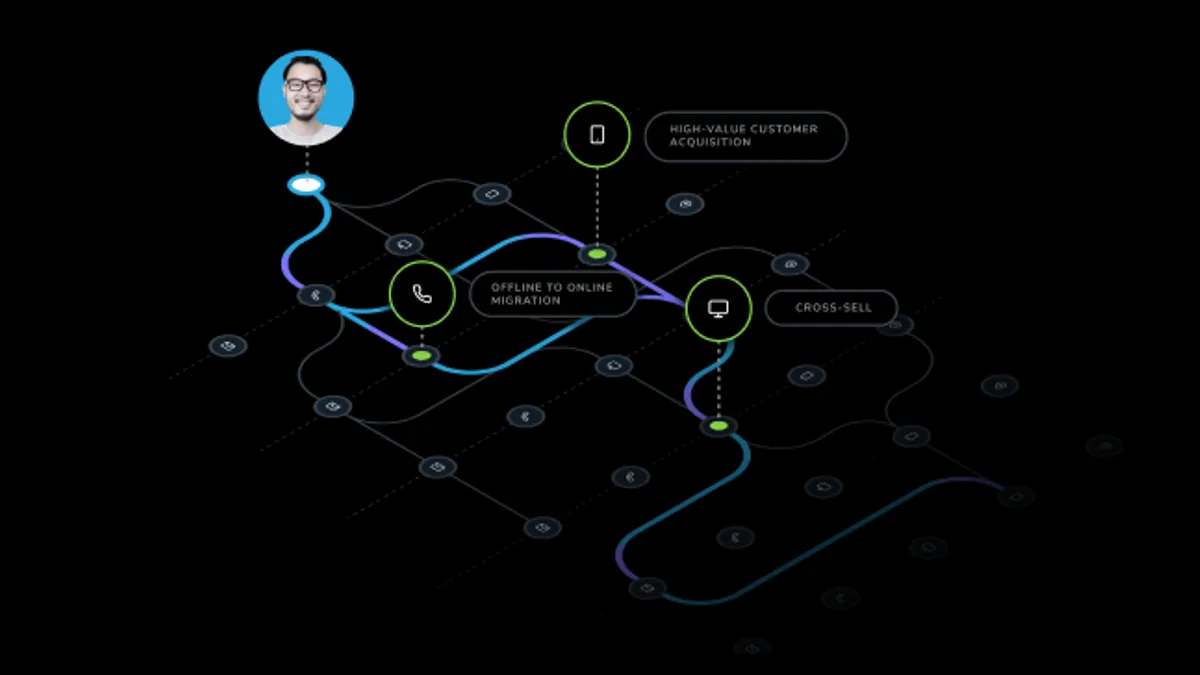

Sponsored by ActionIQ

Banking in the age of disruption: Can traditional banks take on Finserv innovators?

The rise of fintech has reenergized the innovation agenda and digital transformation of many traditional institutions. Can traditional banks take on Finserv innovators?

By George Phipps, Director of Product Marketing • March 15, 2021 -

Challenger Cheese aims to fill banking gap in US's Asian, immigrant communities

The platform supports social causes by allowing users to donate to Asian and immigrant-owned businesses, at-risk communities and charitable organizations with each purchase.

By Anna Hrushka • March 10, 2021 -

JPMorgan to pull Chase Pay from merchant apps, sites March 31

The bank announced in 2019 it would shut down the platform's stand-alone app. Merchant acceptance — about 1% in 2019 — has paled in comparison to competitor Apple Pay's 40%.

By Robert Freedman • March 10, 2021 -

Plaid payroll product streamlines income verification

Plaid Income is the second product the company has launched since the termination of a proposed $5.3 billion tie-up with Visa, signaling the scrapped deal is not slowing the expansion of the fintech's suite.

By Anna Hrushka • March 8, 2021 -

Inside Marqeta's plans to grow its 'card-as-a-service' offering

The card issuer and processor is differentiating through a flexible, API-based platform that helps clients launch card offerings in months instead of years.

By Suman Bhattacharyya • March 3, 2021 -

Column

Goldman crypto trading desk relaunch portends softer industry stance on Bitcoin

The bank follows BNY Mellon and JPMorgan in greater crypto acceptance, in a reversal from a May report in which Goldman called Bitcoin an "unsuitable investment." Citi this week said the currency is at a "tipping point."

By Dan Ennis • March 3, 2021 -

Deep Dive

Can banks win in the booming buy-now-pay-later space?

While BNPL represents a relatively small niche of the payments ecosystem, banks should take note of what the growth of that silo says about the next generation of consumers, one consultant said.

By Anna Hrushka • March 2, 2021