Technology: Page 45

-

:Weatherman1126. (2007). "Logo of The Goldman Sachs Group, Inc." [Image]. Retrieved from Wikipedia Commons.

:Weatherman1126. (2007). "Logo of The Goldman Sachs Group, Inc." [Image]. Retrieved from Wikipedia Commons.

Goldman loses 4 executives in 3 days as Walmart fintech poaches Marcus chief

The bank's general counsel and asset-management co-head are also reported to be leaving.

By Dan Ennis • Updated March 3, 2021 -

Column

JPMorgan finds balance between aiming for the stars, down-to-earth giving

The bank recently partnered with Danish satellite manufacturer GOMspace to see how blockchain technology could power transactions between satellites orbiting the earth.

By Dan Ennis • Feb. 25, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Alex Wong via Getty Images

Alex Wong via Getty Images Trendline

TrendlineFintech disruption in the banking industry

There are as many schools of thought on how to disrupt the banking space as there are disruptors.

By Banking Dive staff -

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Tether, crypto exchange Bitfinex to pay $18.5M to settle NY probe

Tether will give officials quarterly reports on its reserves and end trading with the state's residents in an agreement that ends a two-year investigation into allegations it hid the loss of $850 million in client and corporate money.

By Dan Ennis • Feb. 24, 2021 -

New FDIC CIO: 'Technology is the best enabler of banking the unbanked'

"I think the vectors of success for dealing with the unbanked are going to be digital in nature," said Sultan Meghji, who worked on an aid mission to help implement digital banking in Kenya, Tanzania and Uganda.

By Anna Hrushka • Feb. 23, 2021 -

Yes? No? Investment platform Kalshi will let users bet on event outcomes

Co-founder Tarek Mansour imagined the concept while interning at Goldman Sachs ahead of the Brexit vote. The company completed a $30 million funding round, aims to launch in March and has earned CFTC approval.

By Dan Ennis • Feb. 18, 2021 -

Greenwood taps fintech veteran to head compliance, risk

Lynn Tillman-Cherry said she expects the digital bank to adopt a regtech solution for its compliance program, with a focus on emerging technologies such as artificial intelligence.

By Anna Hrushka • Feb. 16, 2021 -

U.S. Bank partners with construction software firm amid booming homebuilders market

Built’s technology streamlines the sector's labor-intensive lending process by bringing all relevant parties onto one digital platform.

By Anna Hrushka • Feb. 11, 2021 -

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

BNY Mellon commits to holding, transferring and issuing crypto

The New York-based bank said Thursday it is developing a client-facing prototype for a multi-asset digital custody and administration platform set to roll out this year.

By Dan Ennis • Feb. 11, 2021 -

OCC conditionally approves second crypto firm for trust charter

Seattle-based Protego intends to provide custody services for its clients' digital assets — and, eventually, a client-to-client lending and trading platform. The company has 18 months to meet the regulator's terms.

By Dan Ennis • Feb. 8, 2021 -

'PPP fatigue' sends lenders to Customers Bank's white-label service

"It's very difficult to build what we built," said Sam Sidhu, the bank's vice chair and COO. "We thought that this would resonate well with other banks and we were right."

By Anna Hrushka • Feb. 4, 2021 -

Startup Paybby buys neobank Wicket to fast-track Black banking

Founder Hassan Miah said he plans to add overdraft protection, free retailer cash deposits, payments, transfers, check cashing, payday loan advances and consumer lending to the platform.

By Anna Hrushka • Feb. 1, 2021 -

SBA outlines steps to improve PPP, reports $35B in approved loans

The agency said a review of first-draw loans identified data mismatches and eligibility concerns in about 4.7% of the lender-submitted data.

By Anna Hrushka • Jan. 27, 2021 -

Black- and Latinx-focused digital bank Greenwood hits 500K signups in 100 days

"We see that there is definitely an appetite for what we're doing," said Ryan Glover, who founded the startup with civil rights leader Andrew Young and rapper Killer Mike. Glover said the platform could launch in May or June.

By Anna Hrushka • Jan. 26, 2021 -

Deep Dive

What’s in store for challenger banks in 2021?

As the challenger bank market continues to attract venture capital, new users and even celebrity endorsements, how will the momentum and hype surrounding this new way to bank continue into 2021?

By Anna Hrushka • Jan. 25, 2021 -

KeyBank aims to launch digital bank for doctors in March

"Think about a digital company that refinances student loans for doctors and dentists that are accredited, employed, have an average salary of about $200,000 per year," CEO Chris Gorman said. "These are great clients to get."

By Anna Hrushka • Jan. 22, 2021 -

Truist reports Q4 profit, continues merger-related job cuts, branch closures

The bank eliminated 1,307 positions during the fourth quarter. It said it closed 149 branches in 2020 and plans to shutter more than 400 this year.

By Anna Hrushka • Jan. 21, 2021 -

Deep Dive

4 banking trends to watch in 2021

Banking Dive expects M&A to pivot toward niches, race to be a continuing focus of ESG, and crypto to have a make-or-break year in 2021.

By Dan Ennis , Anna Hrushka • Jan. 20, 2021 -

Aggregator MX to expand reach of 'money experiences' as it angles toward IPO

The company has quadrupled its value in the past year in a field that, amid the Visa-Plaid deal's disintegration, has room for "co-opetition," one analyst said, as some banks use multiple data aggregators.

By Suman Bhattacharyya • Jan. 20, 2021 -

Plaid sees 'opportunity' after $5.3B Visa deal ends

The data aggregator's biggest priority now is getting 75% of its traffic dedicated to application programming interfaces by the end of 2021 — a prospect John Pitts, Plaid's head of policy, calls an "immense challenge."

By Anna Hrushka • Jan. 19, 2021 -

Sponsored by Oracle

Research shows that over half of Gen Z and Millennial's banking relationships are at risk

Gen Z, Millennials are looking to banks to help guide financial decisions for life's biggest moments.

By Parvez Ahmad, Oracle Financial Services • Jan. 19, 2021 -

JPMorgan net income jumps 42% YoY over trading revenue, lower credit reserves

The bank said it plans to add an extra $900 million to its $11 billion technology budget in 2021 and to expand its branch presence to 48 states by midyear.

By Anna Hrushka • Jan. 15, 2021 -

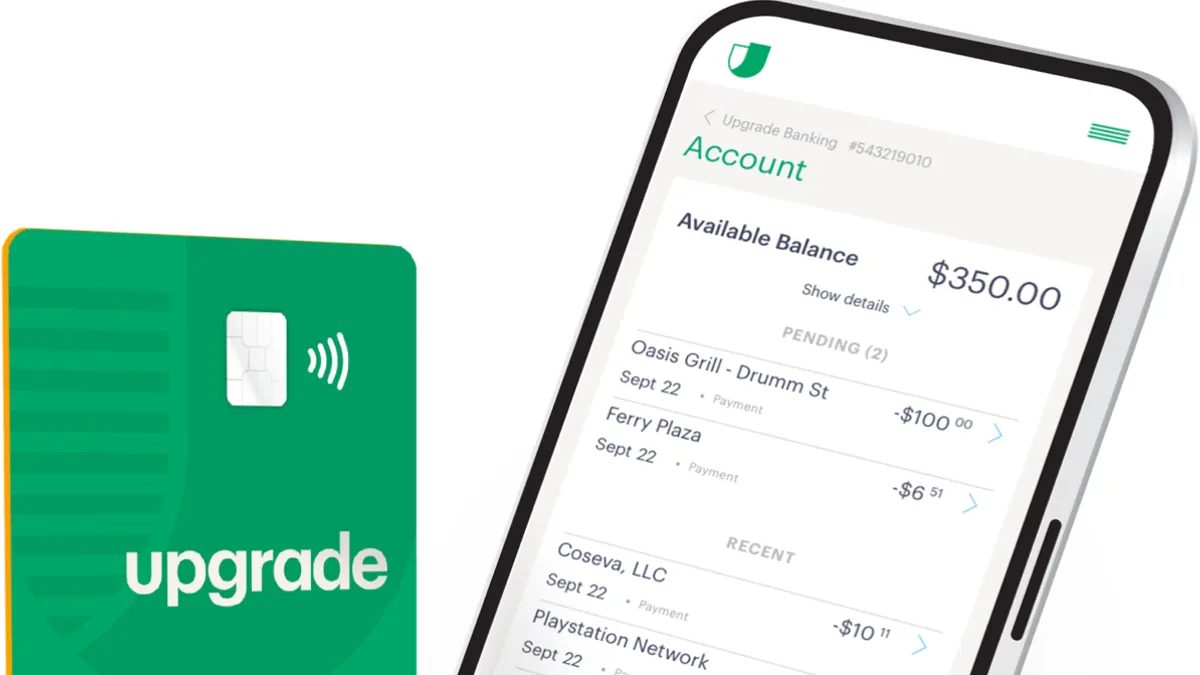

Upgrade adds mobile banking to credit, lending platform

The checking account's debit card lets users earn 2% cash back on gas, groceries and recurring payments. The company also is offering up to 20% lower rates on loans to qualified customers who open a bank account.

By Anna Hrushka • Jan. 14, 2021 -

Crypto firm Anchorage receives trust bank charter from OCC

The company must maintain $7 million in Tier 1 capital and must set aside at least $3 million in liquidity, or the equivalent of 180 days’ worth of operating expenses, under its agreement with the regulator.

By Dan Ennis • Jan. 14, 2021 -

Walmart to launch fintech startup with partner Ribbit Capital

Ribbit Capital's past investments include fintechs such as Affirm, Credit Karma and Robinhood.

By Anna Hrushka • Jan. 12, 2021 -

Banks embrace automation, white-label options ahead of PPP relaunch

"It's going to be the coming-out party for commercial digital loan applications," Numerated CEO Dan O'Malley said of the $284 billion round of Paycheck Protection Program funding.

By Anna Hrushka • Jan. 8, 2021